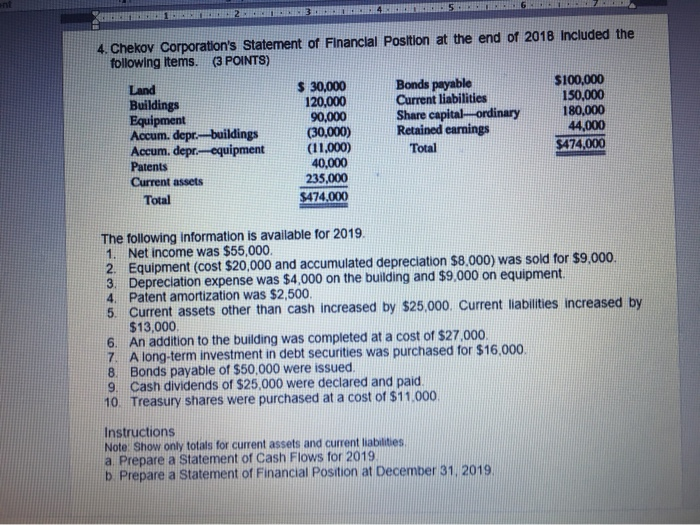

4. Chekov Corporation's Statement of Financial Position at the end of 2018 Included the following items. (3 POINTS) $100,000 150,000 180,000 44,000 $474,000 Bonds payable Current liabilities Share capital-ordinary Retained earnings $ 30,000 120,000 90,000 (30,000) (11,000) 40,000 Land Buildings Equipment Accum. depr.-buildings Accum. depr.-equipment Total Patents Current assets 235,000 $474.000 Total The following information is available for 2019. 1. Net income was $55,000. 2. Equipment (cost $20,000 and accumulated depreciation $8,000) was sold for $9,000. 3. Depreciation expense was $4,000 on the building and $9,000 on equipment. Patent amortization was $2,500. 4. 5. Current assets other than cash increased by $25,000. Current liabilities increased by $13,000. An addition to the building was completed at a cost of $27,000. 6 A long-term investment in debt securities was purchased for $16.000 7 Bonds payable of $50,000 were issued 9 Cash dividends of $25,000 were declared and paid 10. Treasury shares were purchased at a cost of $11.000. 8 Instructions Note: Show only totals for current assets and current liabilities a. Prepare a Statement of Cash Flows for 2019 b. Prepare a Statement of Financial Position at December 31, 2019. 4. Chekov Corporation's Statement of Financial Position at the end of 2018 Included the following items. (3 POINTS) $100,000 150,000 180,000 44,000 $474,000 Bonds payable Current liabilities Share capital-ordinary Retained earnings $ 30,000 120,000 90,000 (30,000) (11,000) 40,000 Land Buildings Equipment Accum. depr.-buildings Accum. depr.-equipment Total Patents Current assets 235,000 $474.000 Total The following information is available for 2019. 1. Net income was $55,000. 2. Equipment (cost $20,000 and accumulated depreciation $8,000) was sold for $9,000. 3. Depreciation expense was $4,000 on the building and $9,000 on equipment. Patent amortization was $2,500. 4. 5. Current assets other than cash increased by $25,000. Current liabilities increased by $13,000. An addition to the building was completed at a cost of $27,000. 6 A long-term investment in debt securities was purchased for $16.000 7 Bonds payable of $50,000 were issued 9 Cash dividends of $25,000 were declared and paid 10. Treasury shares were purchased at a cost of $11.000. 8 Instructions Note: Show only totals for current assets and current liabilities a. Prepare a Statement of Cash Flows for 2019 b. Prepare a Statement of Financial Position at December 31, 2019