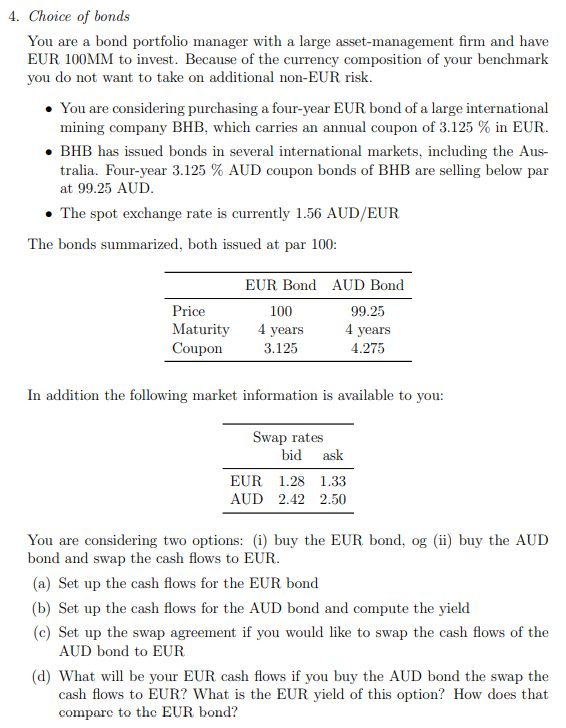

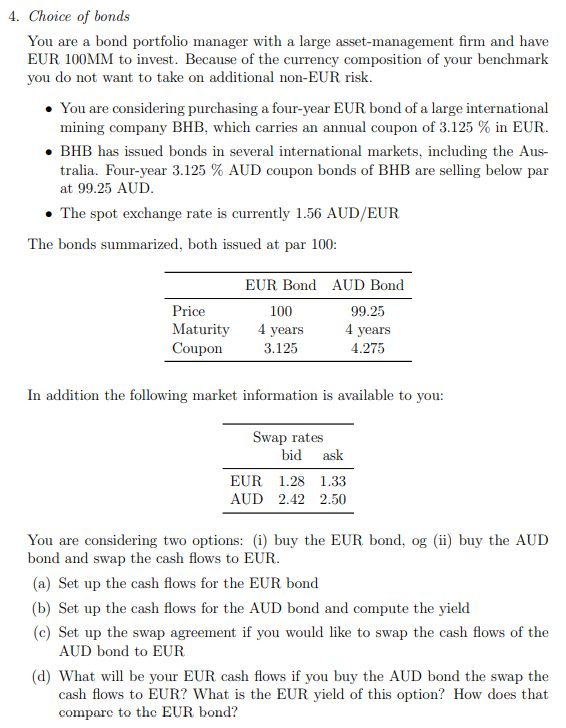

4. Choice of bonds You are a bond portfolio manager with a large asset-management firm and have EUR 100MM to invest. Because of the currency composition of your benchmark you do not want to take on additional non-EUR risk. You are considering purchasing a four-year EUR bond of a large international mining company BHB, which carries an annual coupon of 3.125 % in EUR. BHB has issued bonds in several international markets, including the Aus- tralia. Four-year 3.125 % AUD coupon bonds of BHB are selling below par at 99.25 AUD The spot exchange rate is currently 1.56 AUD/EUR The bonds summarized, both issued at par 100: Price Maturity Coupon EUR Bond AUD Bond 100 99.25 4 years 4 years 3.125 4.275 In addition the following market information is available to you: ask Swap rates bid EUR 1.28 1.33 AUD 2.42 2.50 You are considering two options: (i) buy the EUR bond, og (ii) buy the AUD bond and swap the cash flows to EUR. (a) Set up the cash flows for the EUR bond (b) Set up the cash flows for the AUD bond and compute the yield (c) Set up the swap agreement if you would like to swap the cash flows of the AUD bond to EUR (d) What will be your EUR cash flows if you buy the AUD bond the swap the cash flows to EUR? What is the EUR yield of this option? How does that compare to the EUR bond? 4. Choice of bonds You are a bond portfolio manager with a large asset-management firm and have EUR 100MM to invest. Because of the currency composition of your benchmark you do not want to take on additional non-EUR risk. You are considering purchasing a four-year EUR bond of a large international mining company BHB, which carries an annual coupon of 3.125 % in EUR. BHB has issued bonds in several international markets, including the Aus- tralia. Four-year 3.125 % AUD coupon bonds of BHB are selling below par at 99.25 AUD The spot exchange rate is currently 1.56 AUD/EUR The bonds summarized, both issued at par 100: Price Maturity Coupon EUR Bond AUD Bond 100 99.25 4 years 4 years 3.125 4.275 In addition the following market information is available to you: ask Swap rates bid EUR 1.28 1.33 AUD 2.42 2.50 You are considering two options: (i) buy the EUR bond, og (ii) buy the AUD bond and swap the cash flows to EUR. (a) Set up the cash flows for the EUR bond (b) Set up the cash flows for the AUD bond and compute the yield (c) Set up the swap agreement if you would like to swap the cash flows of the AUD bond to EUR (d) What will be your EUR cash flows if you buy the AUD bond the swap the cash flows to EUR? What is the EUR yield of this option? How does that compare to the EUR bond