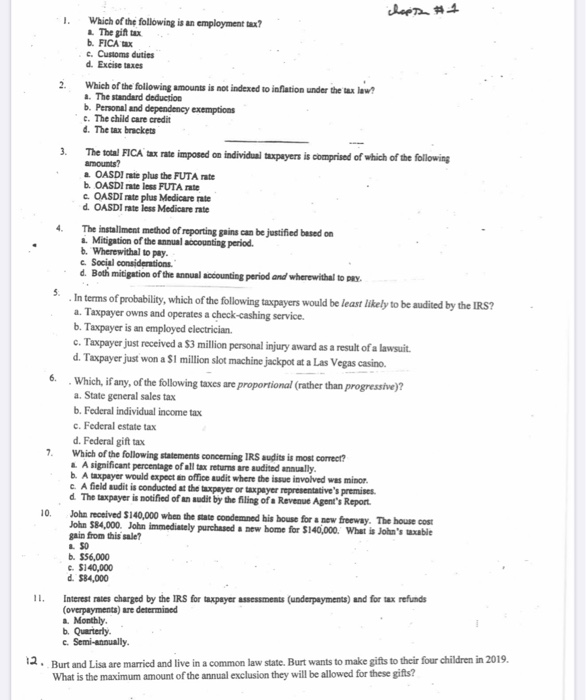

4. choosh #1 1. Which of the following is an employment tax? The gift tax b. FICA EX c. Customs duties d. Excise taxes 2. Which of the following amounts is not indexed to inflation under the tax law? a. The standard deduction b. Personal and dependency exemptions c. The child care credit d. The tax brackets The total FICA tax rate imposed on individual taxpayers is comprised of which of the following a OASDI rate plus the FUTA rate b. OASDI rate less FUTA rate c. OASDI rate plus Medicare rate d. OASDI rate less Medicare rate The installment method of reporting pains can be justified based on Mitigation of the annual sccounting period. b. Wherewithal to pay Social considerations. d. Both mitigation of the annual accounting period and wherewithal to pay In terms of probability, which of the following taxpayers would be least likely to be audited by the IRS? a. Tuxpayer owns and operates a check-cashing service. b. Tuxpayer is an employed electrician. c. Taxpayer just received a $3 million personal injury award as a result of a lawsuit. d. Tuxpayer just won a $1 million slot machine jackpot at a Las Vegas casino. 6. Which, if any, of the following taxes are proportional (rather than progressive)? a. State general sales tax b. Federal individual income tax c. Federal estate tax d. Federal gift tax Which of the following statements concerning IRS audits is most correct? 2. A significant percentage of all tax returns are audited annually. b. A taxpayer would expect in office sudit where the issue involved was minor c. A field audit is conducted at the taxpayer or taxpayer representative's premises d. The taxpayer is notified of an audit by the filing of a Revenue Agent's Report 10. John received $140,000 when the state condemned his house for a new freeway. The house cost John 584,000. John immediately purchased a new home for $140,000. What is John's taxable gain from this sale? 50 b. $56,000 c. $140,000 d. 584,000 Interest rates charged by the IRS for taxpayer assessments (underpayments) and for tax refunds (overpayments) are determined a. Monthly. b. Quarterly c. Semi-annually. 12 . Burt and Lisa are married and live in a common law state. Burt wants to make gifts to their four children in 2019. What is the maximum amount of the annual exclusion they will be allowed for these gifts? 7