Question

4) Company C is a machinery manufacturing enterprise, the applicable corporate income tax rate is 25%, and the minimum rate of return required by the

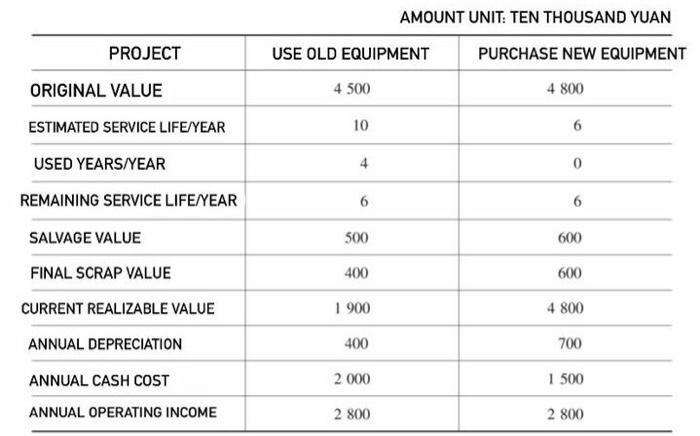

4) Company C is a machinery manufacturing enterprise, the applicable corporate income tax rate is 25%, and the minimum rate of return required by the company is 12%. In order to save costs and improve operating efficiency

Other information is as follows: Information: The new and old equipment data are shown in Table 1-16.

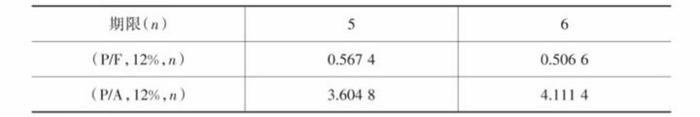

Data 2: The relevant currency time value coefficients are shown in Table 1-17.

2 Calculate the following indicators related to the use of old equipment:

It is known that the net present value (NPV) of the used equipment is 9,432,900 yuan. Based on the above calculation results, make a decision on whether to update the fixed assets and explain the reasons.

(n) 5 6. (P/F, 12%, n) 0.567 4 0.506 6 ( P/A, 12%, n) 3.604 8 4.111 4

Step by Step Solution

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Let us first understand what a Lead Business Analyst does in an organization Any Lead Business Analysts role is to support the organizational process by developing a plan to efficiently design finan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started