Answered step by step

Verified Expert Solution

Question

1 Approved Answer

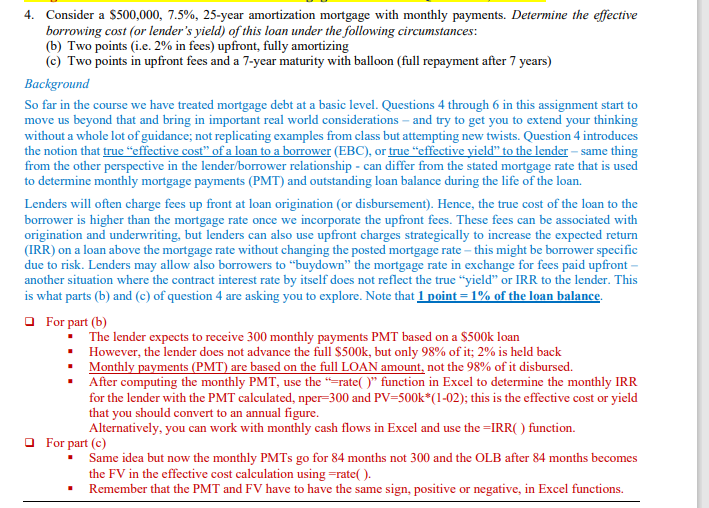

4. Consider a $500,000, 7.5%, 25-year amortization mortgage with monthly payments. Determine the effective borrowing cost (or lender's yield) of this loan under the

4. Consider a $500,000, 7.5%, 25-year amortization mortgage with monthly payments. Determine the effective borrowing cost (or lender's yield) of this loan under the following circumstances: (b) Two points (i.e. 2% in fees) upfront, fully amortizing (c) Two points in upfront fees and a 7-year maturity with balloon (full repayment after 7 years) Background So far in the course we have treated mortgage debt at a basic level. Questions 4 through 6 in this assignment start to move us beyond that and bring in important real world considerations - and try to get you to extend your thinking without a whole lot of guidance; not replicating examples from class but attempting new twists. Question 4 introduces the notion that true "effective cost" of a loan to a borrower (EBC), or true "effective yield" to the lender - same thing from the other perspective in the lender/borrower relationship - can differ from the stated mortgage rate that is used to determine monthly mortgage payments (PMT) and outstanding loan balance during the life of the loan. Lenders will often charge fees up front at loan origination (or disbursement). Hence, the true cost of the loan to the borrower is higher than the mortgage rate once we incorporate the upfront fees. These fees can be associated with origination and underwriting, but lenders can also use upfront charges strategically to increase the expected return (IRR) on a loan above the mortgage rate without changing the posted mortgage rate - this might be borrower specific due to risk. Lenders may allow also borrowers to "buydown" the mortgage rate in exchange for fees paid upfront - another situation where the contract interest rate by itself does not reflect the true "yield" or IRR to the lender. This is what parts (b) and (c) of question 4 are asking you to explore. Note that 1 point = 1% of the loan balance. For part (b) The lender expects to receive 300 monthly payments PMT based on a $500k loan However, the lender does not advance the full $500k, but only 98% of it; 2% is held back Monthly payments (PMT) are based on the full LOAN amount, not the 98% of it disbursed. . After computing the monthly PMT, use the "=rate()" function in Excel to determine the monthly IRR for the lender with the PMT calculated, nper-300 and PV=500k*(1-02); this is the effective cost or yield that you should convert to an annual figure. Alternatively, you can work with monthly cash flows in Excel and use the IRR() function. For part (c) Same idea but now the monthly PMTs go for 84 months not 300 and the OLB after 84 months becomes the FV in the effective cost calculation using =rate(). Remember that the PMT and FV have to have the same sign, positive or negative, in Excel functions. I

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

b Two points upfront fully amortizing Loan amount 500000 Points fees 2 of 50...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started