Answered step by step

Verified Expert Solution

Question

1 Approved Answer

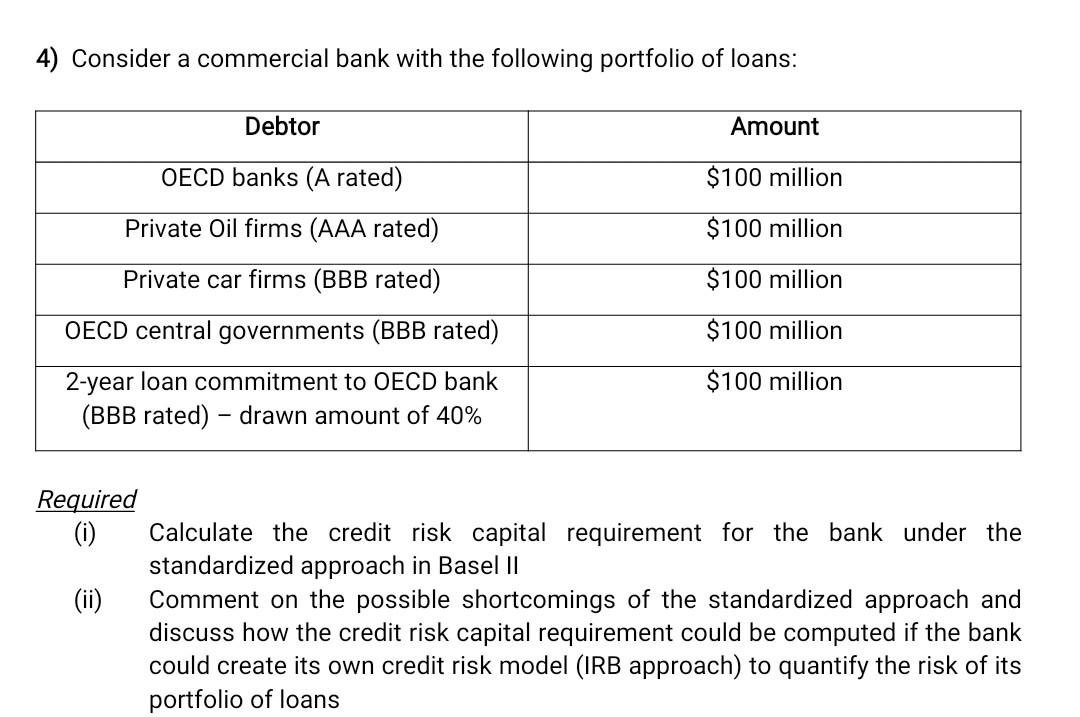

4) Consider a commercial bank with the following portfolio of loans: Debtor Amount OECD banks (A rated) $100 million Private Oil firms (AAA rated) $100

4) Consider a commercial bank with the following portfolio of loans: Debtor Amount OECD banks (A rated) $100 million Private Oil firms (AAA rated) $100 million Private car firms (BBB rated) $100 million OECD central governments (BBB rated) $100 million $100 million 2-year loan commitment to OECD bank (BBB rated) - drawn amount of 40% Required (0) Calculate the credit risk capital requirement for the bank under the standardized approach in Basel II (ii) Comment on the possible shortcomings of the standardized approach and discuss how the credit risk capital requirement could be computed if the bank could create its own credit risk model (IRB approach) to quantify the risk of its portfolio of loans 4) Consider a commercial bank with the following portfolio of loans: Debtor Amount OECD banks (A rated) $100 million Private Oil firms (AAA rated) $100 million Private car firms (BBB rated) $100 million OECD central governments (BBB rated) $100 million $100 million 2-year loan commitment to OECD bank (BBB rated) - drawn amount of 40% Required (0) Calculate the credit risk capital requirement for the bank under the standardized approach in Basel II (ii) Comment on the possible shortcomings of the standardized approach and discuss how the credit risk capital requirement could be computed if the bank could create its own credit risk model (IRB approach) to quantify the risk of its portfolio of loans

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started