Answered step by step

Verified Expert Solution

Question

1 Approved Answer

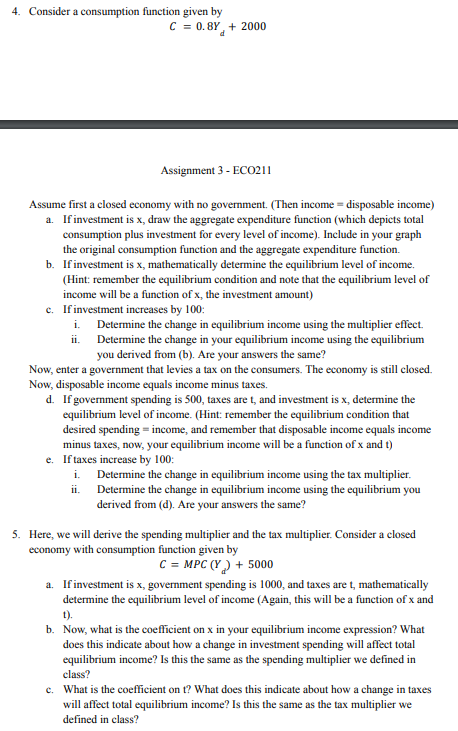

4. Consider a consumption function given by C = 0.8Y + 2000 d Assignment 3- EC0211 Assume first a closed economy with no government.

4. Consider a consumption function given by C = 0.8Y + 2000 d Assignment 3- EC0211 Assume first a closed economy with no government. (Then income = disposable income) a. If investment is x, draw the aggregate expenditure function (which depicts total consumption plus investment for every level of income). Include in your graph the original consumption function and the aggregate expenditure function. b. If investment is x, mathematically determine the equilibrium level of income. (Hint: remember the equilibrium condition and note that the equilibrium level of income will be a function of x, the investment amount) c. If investment increases by 100: i. ii. Determine the change in equilibrium income using the multiplier effect. Determine the change in your equilibrium income using the equilibrium you derived from (b). Are your answers the same? Now, enter a government that levies a tax on the consumers. The economy is still closed. Now, disposable income equals income minus taxes. d. If government spending is 500, taxes are t, and investment is x, determine the equilibrium level of income. (Hint: remember the equilibrium condition that desired spending = income, and remember that disposable income equals income minus taxes, now, your equilibrium income will be a function of x and t) e. If taxes increase by 100: i. ii. Determine the change in equilibrium income using the tax multiplier. Determine the change in equilibrium income using the equilibrium you derived from (d). Are your answers the same? 5. Here, we will derive the spending multiplier and the tax multiplier. Consider a closed economy with consumption function given by C = MPC (Y) + 5000 a. If investment is x, government spending is 1000, and taxes are t, mathematically determine the equilibrium level of income (Again, this will be a function of x and t). b. Now, what is the coefficient on x in your equilibrium income expression? What does this indicate about how a change in investment spending will affect total equilibrium income? Is this the same as the spending multiplier we defined in class? c. What is the coefficient on t? What does this indicate about how a change in taxes will affect total equilibrium income? Is this the same as the tax multiplier we defined in class?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started