Answered step by step

Verified Expert Solution

Question

1 Approved Answer

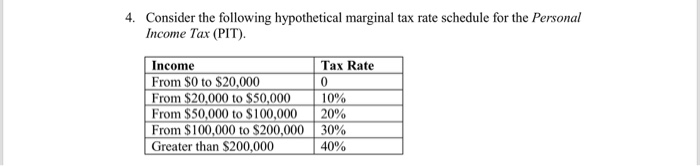

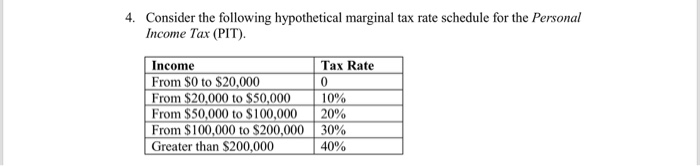

4. Consider the following hypothetical marginal tax rate schedule for the Personal Income Tax (PIT). Tax Rate Income From $0 to $20,000 From $20,000 to

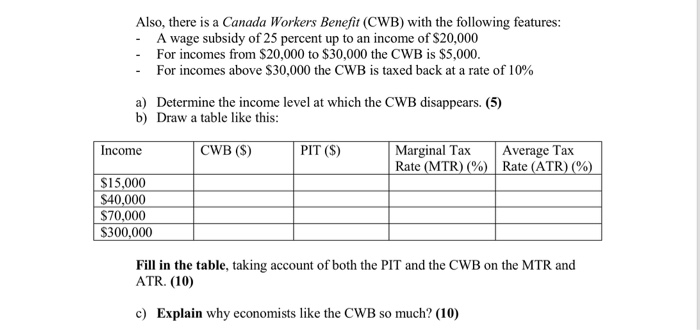

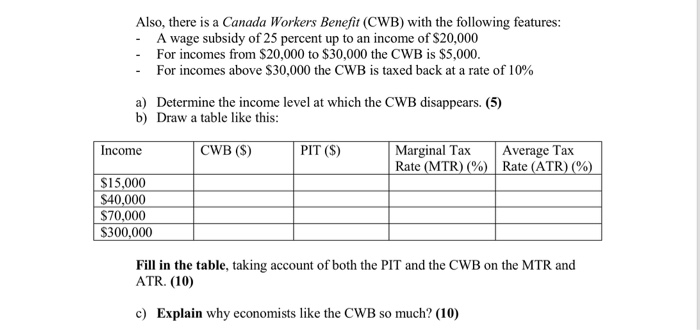

4. Consider the following hypothetical marginal tax rate schedule for the Personal Income Tax (PIT). Tax Rate Income From $0 to $20,000 From $20,000 to $50,000 From $50,000 to $100,000 From $100,000 to $200,000 Greater than $200,000 10% 20% 30% 40% Also, there is a Canada Workers Benefit (CWB) with the following features: - A wage subsidy of 25 percent up to an income of $20,000 - For incomes from $20,000 to $30,000 the CWB is $5,000. - For incomes above $30,000 the CWB is taxed back at a rate of 10% a) Determine the income level at which the CWB disappears. (5) b) Draw a table like this: Income CWB ($) PIT ($) Marginal Tax Average Tax Rate (MTR) (%) Rate (ATR) (%) $15,000 $40,000 $70,000 $300,000 Fill in the table, taking account of both the PIT and the CWB on the MTR and ATR. (10) c) Explain why economists like the CWB so much

4. Consider the following hypothetical marginal tax rate schedule for the Personal Income Tax (PIT). Tax Rate Income From $0 to $20,000 From $20,000 to $50,000 From $50,000 to $100,000 From $100,000 to $200,000 Greater than $200,000 10% 20% 30% 40% Also, there is a Canada Workers Benefit (CWB) with the following features: - A wage subsidy of 25 percent up to an income of $20,000 - For incomes from $20,000 to $30,000 the CWB is $5,000. - For incomes above $30,000 the CWB is taxed back at a rate of 10% a) Determine the income level at which the CWB disappears. (5) b) Draw a table like this: Income CWB ($) PIT ($) Marginal Tax Average Tax Rate (MTR) (%) Rate (ATR) (%) $15,000 $40,000 $70,000 $300,000 Fill in the table, taking account of both the PIT and the CWB on the MTR and ATR. (10) c) Explain why economists like the CWB so much

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started