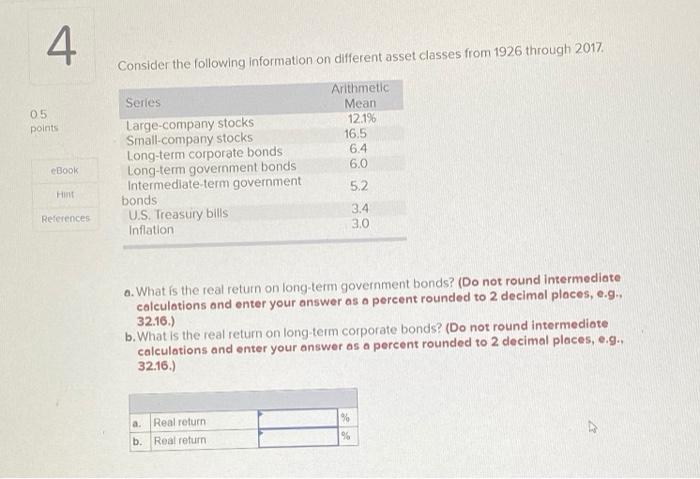

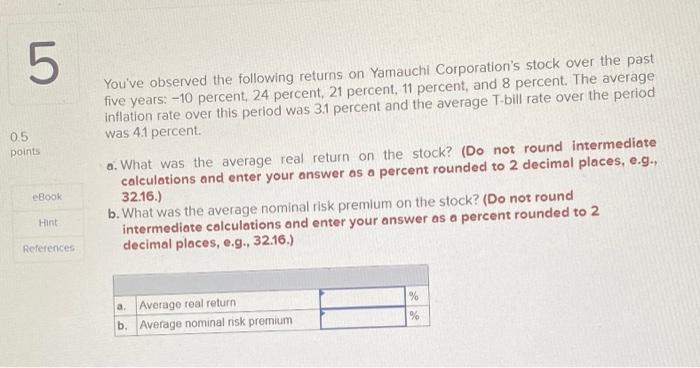

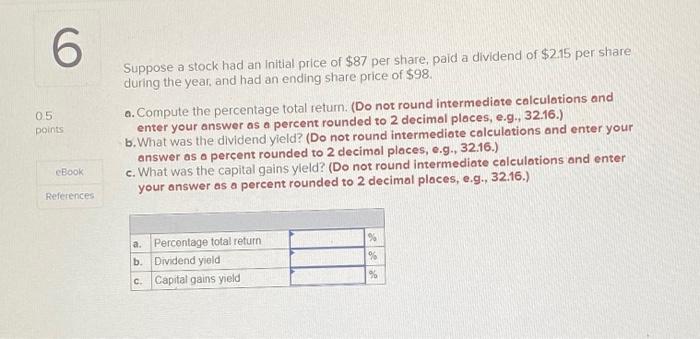

4. Consider the following information on different asset classes from 1926 through 2017 05 points Arithmetic Mean 12.1% 16.5 6.4 6.0 5.2 Series Large-company stocks Small-company stocks Long-term corporate bonds Long-term government bonds Intermediate term government bonds U.S. Treasury bills Inflation eBook HI References 3.4 3.0 a. What is the real return on long-term government bonds? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the real return on long term corporate bonds? (Do not round intermediate calculations and enter your answer os a percent rounded to 2 decimal places, e.g., 32.16.) 96 a Real return b. Real return 99 07 5 0.5 points You've observed the following returns on Yamauchi Corporation's stock over the past five years: -10 percent, 24 percent, 21 percent, 11 percent, and 8 percent. The average inflation rate over this period was 3.1 percent and the average T-bill rate over the period was 4.1 percent. a. What was the average real return on the stock? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What was the average nominal risk premium on the stock? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) eBook Hint References a. Average real return b. Average nominal risk premium % % 6 0.5 points Suppose a stock had an initial price of $87 per share, paid a dividend of $215 per share during the year, and had an ending share price of $98. a. Compute the percentage total return. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What was the dividend yield? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. What was the capital gains yleld? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) CBOOK References % a. Percentage total return b. Dividend yield c. Capital gains yield