Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4) Consider the following projections for a firm: Assume that the appropriate tax rate =28%, the WACC=9.40%, and the terminal growth rate =3.90% Also assume

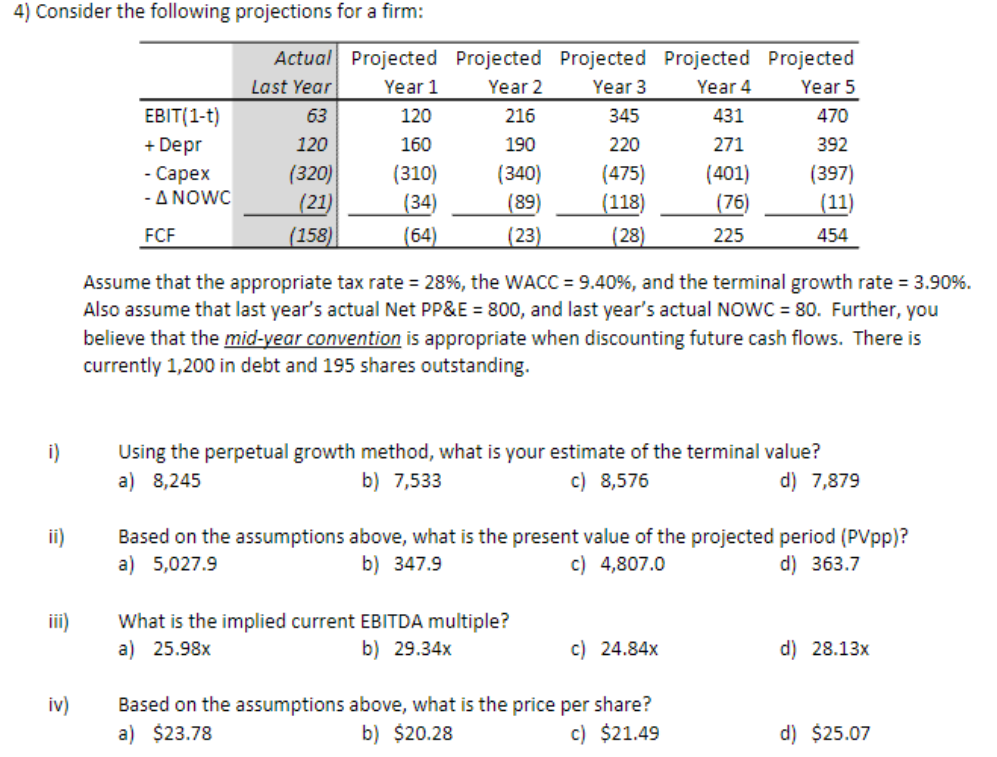

4) Consider the following projections for a firm: Assume that the appropriate tax rate =28%, the WACC=9.40%, and the terminal growth rate =3.90% Also assume that last year's actual Net PP\&E =800, and last year's actual NOWC =80. Further, you believe that the mid-year convention is appropriate when discounting future cash flows. There is currently 1,200 in debt and 195 shares outstanding. i) Using the perpetual growth method, what is your estimate of the terminal value? a) 8,245 b) 7,533 c) 8,576 d) 7,879 ii) Based on the assumptions above, what is the present value of the projected period (PVpp)? a) 5,027.9 b) 347.9 c) 4,807.0 d) 363.7 iii) What is the implied current EBITDA multiple? a) 25.98x b) 29.34x c) 24.84x d) 28.13x iv) Based on the assumptions above, what is the price per share? a) $23.78 b) $20.28 c) $21.49 d) $25.07

4) Consider the following projections for a firm: Assume that the appropriate tax rate =28%, the WACC=9.40%, and the terminal growth rate =3.90% Also assume that last year's actual Net PP\&E =800, and last year's actual NOWC =80. Further, you believe that the mid-year convention is appropriate when discounting future cash flows. There is currently 1,200 in debt and 195 shares outstanding. i) Using the perpetual growth method, what is your estimate of the terminal value? a) 8,245 b) 7,533 c) 8,576 d) 7,879 ii) Based on the assumptions above, what is the present value of the projected period (PVpp)? a) 5,027.9 b) 347.9 c) 4,807.0 d) 363.7 iii) What is the implied current EBITDA multiple? a) 25.98x b) 29.34x c) 24.84x d) 28.13x iv) Based on the assumptions above, what is the price per share? a) $23.78 b) $20.28 c) $21.49 d) $25.07 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started