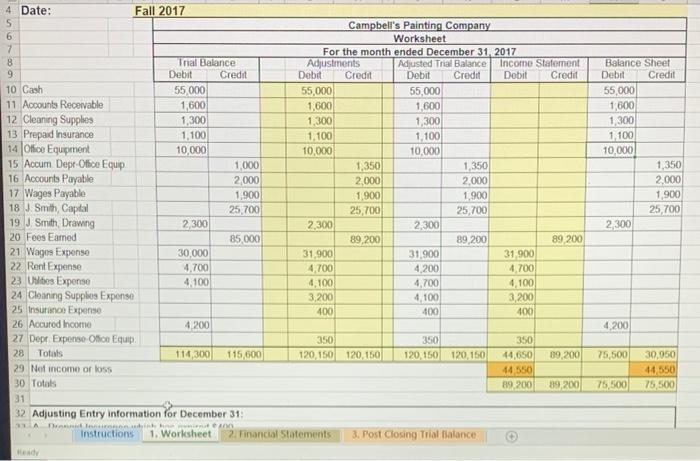

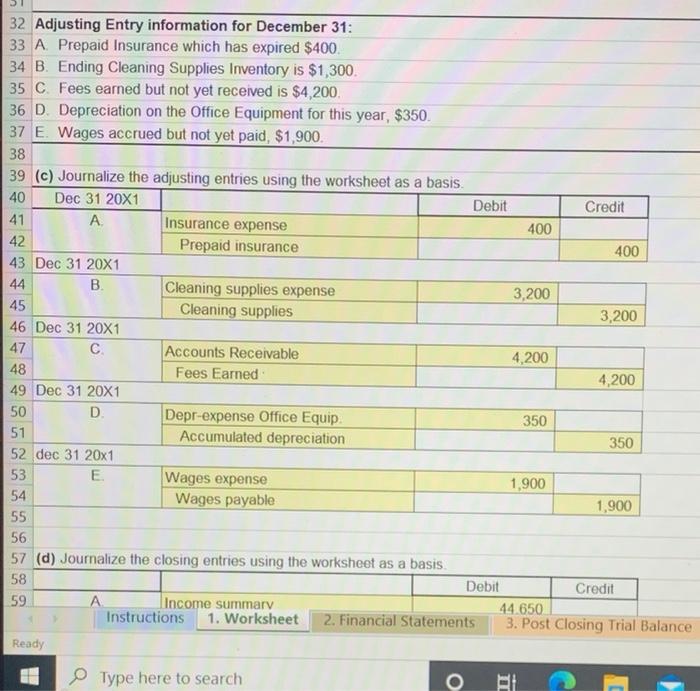

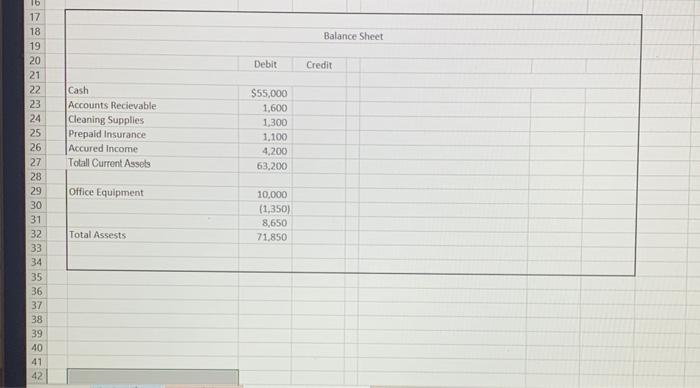

4. Date: Fall 2017 5 Campbell's Painting Company 6 Worksheet 7 For the month ended December 31, 2017 8 Tnal Balance Adjustments Adjusted Trial Balance Income Statement 9 Debit Credit Debit Credit Debit Credit Dobit Credit 10 Cash 55,000 55,000 55,000 11 Accounts Receivable 1,600 1,600 1,600 12 Cleaning Supplies 1,300 1,300 1,300 13 Prepaid Insurance 1,100 1.100 1,100 14 Ofice Equipment 10,000 10,000 10.000 15 Accum Depr-Othise Equip 1,000 1,350 1350 16 Accounts Payable 2,000 2,000 2.000 17 Wages Payable 1.900 1.900 18 J. Smith, Capital 25,700 25,700 25,700 19 J. Smith Drawing 2,300 2,300 2,300 20 Foes Eamed 85,000 89,200 89,200 89 200 21 Wages Expense 30,000 31,900 31.900 31 900 22 Rent Expense 4,700 4,700 4,200 4,700 23 Uites Expense 4.100 4,100 4,700 4,100 24 Cleaning Supplies Exponse 3.200 4,100 3,200 25 Insurance Expense 400 400 400 26 Accured Income 4200 27 Der Exponse Obion Equip 350 350 350 28 Totals 114,300 115,600 120,150 120,150 120,150 120,150 44,650 09.200 29 Nof income of loss 44550 30 Totals 89 200 89,200 31 32 Adjusting Entry information for December 31: A Denne Instructions 1. Worksheet 2. Financial Statements 3. Post Closing Trial Balance Balance Sheet Debit Credit 55,000 1,600 1,300 1,100 10,000 1,350 2,000 1,900 25,700 2,300 1,900 4.200 75,500 30,050 44550 75,500 75,500 32 Adjusting Entry information for December 31: 33 A Prepaid Insurance which has expired $400 34 B. Ending Cleaning Supplies Inventory is $1,300 35 C Fees earned but not yet received is $4,200. 36 D Depreciation on the Office Equipment for this year, $350. 37 E Wages accrued but not yet paid, $1,900. 38 39 (c) Journalize the adjusting entries using the worksheet as a basis. 40 Dec 31 20X1 Debit Credit 41 A Insurance expense 400 42 Prepaid insurance 400 43 Dec 31 20X1 44 B. Cleaning supplies expense 3,200 45 Cleaning supplies 3,200 46 Dec 31 20X1 47 C Accounts Receivable 4,200 48 Fees Earned 4,200 49 Dec 31 20X1 50 D Depr-expense Office Equip 350 51 Accumulated depreciation 350 52 dec 31 20x1 53 E Wages expense 1,900 54 Wages payable 1,900 55 56 57 (d) Journalize the closing entries using the worksheet as a basis. 58 Debit Credit 59 . Income summary 44.650 Instructions 1. Worksheet 2. Financial Statements 3. Post Closing Trial Balance Ready Type here to search o BI Balance Sheet Debit Credit Cash Accounts Recievable Cleaning Supplies Prepaid Insurance Accured Income Totall Current Assets $55,000 1,600 1,300 1.100 4,200 63,200 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 Office Equipment 10,000 (1,350) 8,650 71.850 Total Assests 4. Date: Fall 2017 5 Campbell's Painting Company 6 Worksheet 7 For the month ended December 31, 2017 8 Tnal Balance Adjustments Adjusted Trial Balance Income Statement 9 Debit Credit Debit Credit Debit Credit Dobit Credit 10 Cash 55,000 55,000 55,000 11 Accounts Receivable 1,600 1,600 1,600 12 Cleaning Supplies 1,300 1,300 1,300 13 Prepaid Insurance 1,100 1.100 1,100 14 Ofice Equipment 10,000 10,000 10.000 15 Accum Depr-Othise Equip 1,000 1,350 1350 16 Accounts Payable 2,000 2,000 2.000 17 Wages Payable 1.900 1.900 18 J. Smith, Capital 25,700 25,700 25,700 19 J. Smith Drawing 2,300 2,300 2,300 20 Foes Eamed 85,000 89,200 89,200 89 200 21 Wages Expense 30,000 31,900 31.900 31 900 22 Rent Expense 4,700 4,700 4,200 4,700 23 Uites Expense 4.100 4,100 4,700 4,100 24 Cleaning Supplies Exponse 3.200 4,100 3,200 25 Insurance Expense 400 400 400 26 Accured Income 4200 27 Der Exponse Obion Equip 350 350 350 28 Totals 114,300 115,600 120,150 120,150 120,150 120,150 44,650 09.200 29 Nof income of loss 44550 30 Totals 89 200 89,200 31 32 Adjusting Entry information for December 31: A Denne Instructions 1. Worksheet 2. Financial Statements 3. Post Closing Trial Balance Balance Sheet Debit Credit 55,000 1,600 1,300 1,100 10,000 1,350 2,000 1,900 25,700 2,300 1,900 4.200 75,500 30,050 44550 75,500 75,500 32 Adjusting Entry information for December 31: 33 A Prepaid Insurance which has expired $400 34 B. Ending Cleaning Supplies Inventory is $1,300 35 C Fees earned but not yet received is $4,200. 36 D Depreciation on the Office Equipment for this year, $350. 37 E Wages accrued but not yet paid, $1,900. 38 39 (c) Journalize the adjusting entries using the worksheet as a basis. 40 Dec 31 20X1 Debit Credit 41 A Insurance expense 400 42 Prepaid insurance 400 43 Dec 31 20X1 44 B. Cleaning supplies expense 3,200 45 Cleaning supplies 3,200 46 Dec 31 20X1 47 C Accounts Receivable 4,200 48 Fees Earned 4,200 49 Dec 31 20X1 50 D Depr-expense Office Equip 350 51 Accumulated depreciation 350 52 dec 31 20x1 53 E Wages expense 1,900 54 Wages payable 1,900 55 56 57 (d) Journalize the closing entries using the worksheet as a basis. 58 Debit Credit 59 . Income summary 44.650 Instructions 1. Worksheet 2. Financial Statements 3. Post Closing Trial Balance Ready Type here to search o BI Balance Sheet Debit Credit Cash Accounts Recievable Cleaning Supplies Prepaid Insurance Accured Income Totall Current Assets $55,000 1,600 1,300 1.100 4,200 63,200 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 Office Equipment 10,000 (1,350) 8,650 71.850 Total Assests