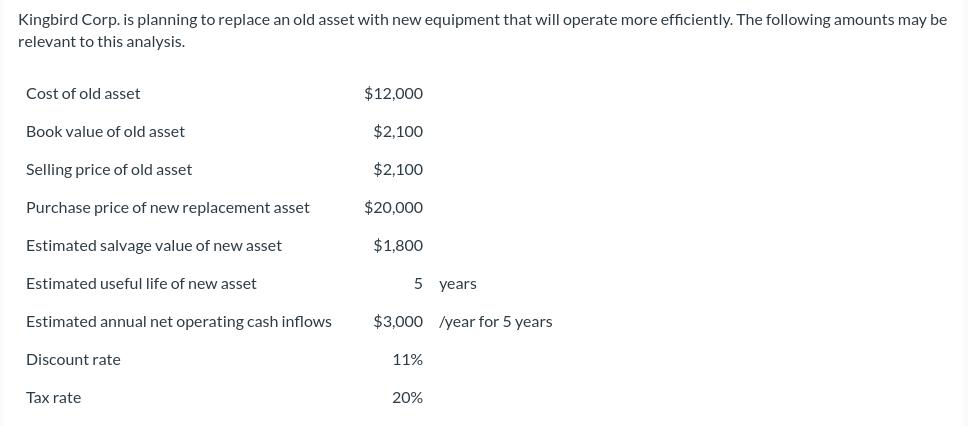

Kingbird Corp. is planning to replace an old asset with new equipment that will operate more efficiently. The following amounts may be relevant to

Kingbird Corp. is planning to replace an old asset with new equipment that will operate more efficiently. The following amounts may be relevant to this analysis. Cost of old asset $12,000 Book value of old asset $2,100 Selling price of old asset $2,100 Purchase price of new replacement asset $20,000 Estimated salvage value of new asset $1,800 Estimated useful life of new asset Estimated annual net operating cash inflows 5 years $3,000/year for 5 years Discount rate Tax rate 11% 20% Then, find the NPV of the new investment. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answer to 2 decimal places e.g. 5,125.36. Enter negative amounts using either a negative sign preceding the number, e.g. -5,125.36 or parentheses, e.g. (5,125.36).) Click here to view the factor table NPV $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To find the Net Present Value NPV of the new investment follow these steps 1 Calculate the initial c... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards