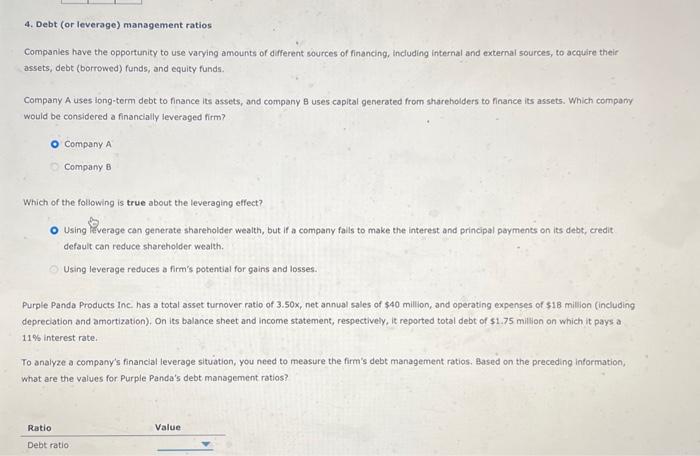

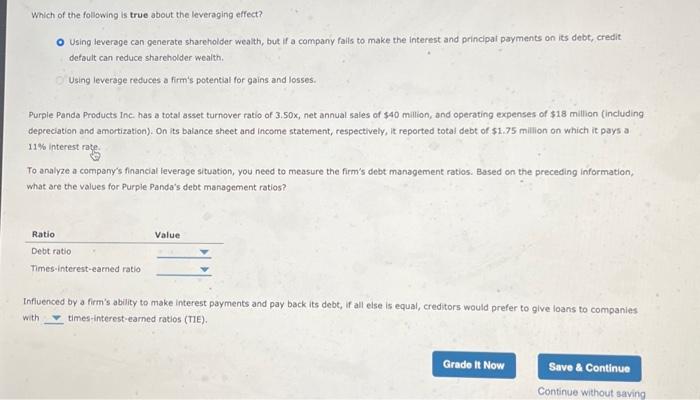

4. Debt (or leverage) management ratios Companies have the opportunity to use varying amounts of different sources of financing, Including internal and external sources, to acquire their assets; debt (borrowed) funds, and equity funds. Company A uses long-term debt to finance its assets, and company 8 uses capital generated from shareholders to finance its assets. Which compary would be considered a financially leveraged firm? Company A Company B Which of the following is true about the leveraging effect? Using Rerage can generate shareholder wealth, but if a company falls to make the interest and principal payments on its debt, credit default can reduce shareholder wealth. Using leverage reduces a firm's potential for gains and losses. Purple Panda Products Inc has a total asset turnover ratio of 3.50x, net annual sales of $40 million, and operating expenses of $18 miltion (including depreciation and amortization). On its balance sheet and income statement, respectively, it reported total debt of $1.75 million on which it pays a 11% interest rate. To analyze a company's financlal leverage situation, you need to measure the firm's debt management ratios. Based on the preceding information, What are the values for Purple Panda's debt management ratios? Which of the following is true about the leveraging effect? Using teverage can generate shareholder wealth, but if a company falls to make the interest and principai payments on its debt, credit default can reduce shareholder wealth. Using leverage reduces a firm's potential for gains and losses. Purpie Panda Products Inc. has a total asset turnover ratio of 3.50x, net annual sales of $40 million, and operating expenses of $18 million (including depreciation and amortization). On its balance sheet and income statement, respectively, it reported total debt of $1.75 million on which it pays a 11% interest rate. To analyze a company's financial leverage situation, you need to measure the firm's debt management ratios. Based on the preceding information, what are the values for Purple Panda's debt management ratios? Influenced by a firm's ability to make interest payments and pay back its debt, if all else is equal, creditors would prefer to give loans to companies with times-interest-earned ratios (TIE)