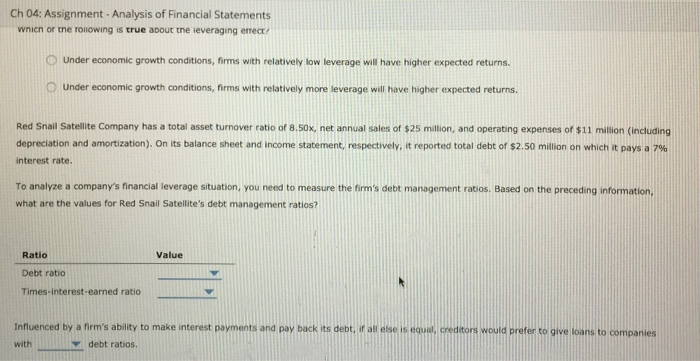

4. Debt (or leverage) management ratios Companies have the opportunity to use varying amounts of different sources of financing, including internal and external sources, to acquire their assets, debt (borrowed) funds, and equity funds. Aunt Dottie's Linen Inc. reported no long-term debt in its most recent balance sheet. A company with no debt on its books is referred to as: A company with no leverage, or an unleveraged company A company with leverage, or a leveraged company Which of the following is true about the leveraging effect? Under economic growth conditions, firms with relatively low leverage will have higher expected returns. Under economic growth conditions, firms with relatively more leverage will have higher expected returns Red Snail Satellite Company has a total asset turnover ratio of 8.50x, net annual sales of $25 million, and operating expenses of $11 million (including depreciation and amortization). On its balance sheet and income statement, respectively, it reported total debt of $2.50 million on which it pays a 7% interest rate, To analyze a company's financial leverage station, you need to measure the firm's debt management ratios. Based on the preceding information, what are the values for Red Snail Satellite's debt management ratios? Ch 04: Assignment - Analysis of Financial Statements wnien or the following is true about the leveraging ereck Under economic growth conditions, firms with relatively low leverage will have higher expected returns. Under economic growth conditions, firms with relatively more leverage will have higher expected returns. Red Snail Satellite Company has a total asset turnover ratio of 8.50x, net annual sales of $25 million, and operating expenses of $11 million (including depreciation and amortization). On its balance sheet and income statement, respectively, it reported total debt of $2.50 million on which it pays a 7% interest rate. To analyze a company's financial leverage situation, you need to measure the firm's debt management ratios. Based on the preceding information, what are the values for Red Snail Satellite's debt management ratios? Ratio Value Debt ratio Times-interest-earned ratio condition would prefer to give loans to companies Influenced by a firm's ability to make interest payments and pay back its debt, if all else is with debt ratios