Answered step by step

Verified Expert Solution

Question

1 Approved Answer

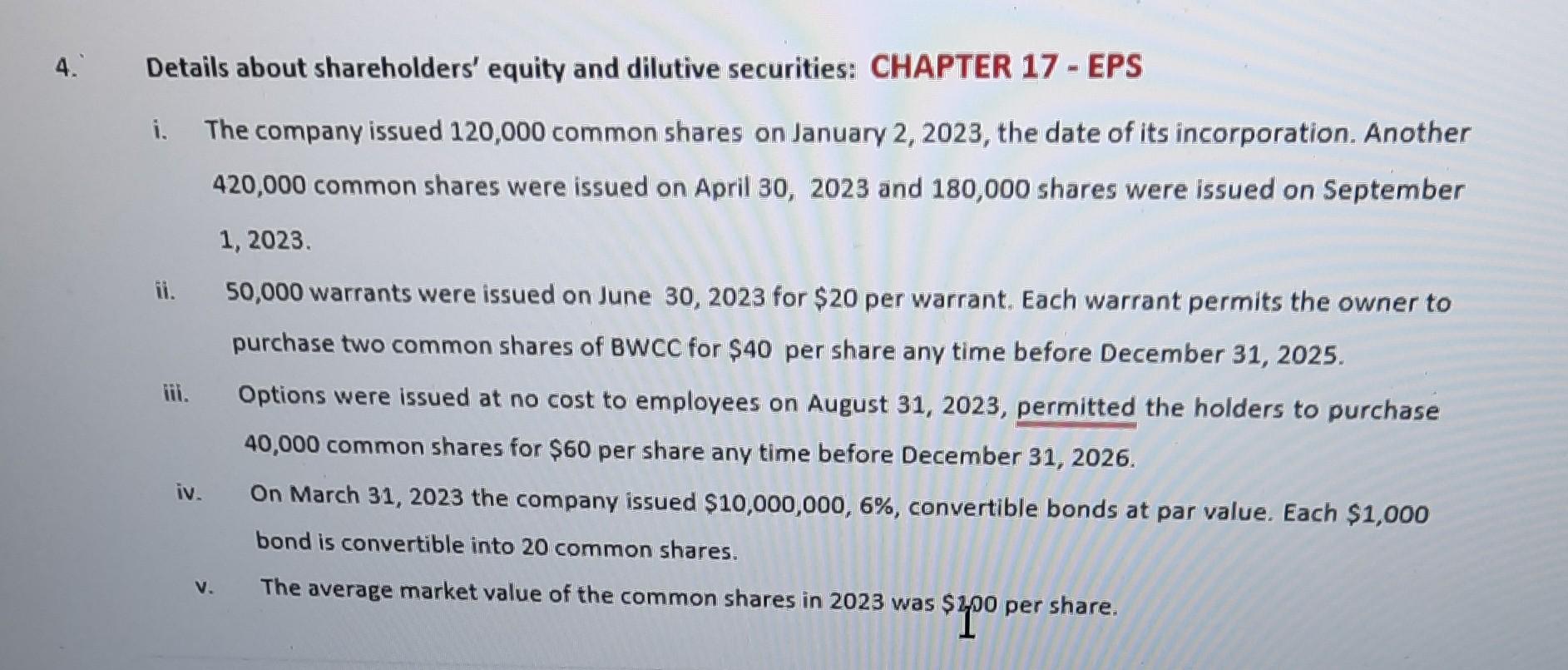

4. Details about shareholders' equity and dilutive securities: CHAPTER 17 - EPS i. The company issued 120,000 common shares on January 2,2023 , the date

4. Details about shareholders' equity and dilutive securities: CHAPTER 17 - EPS i. The company issued 120,000 common shares on January 2,2023 , the date of its incorporation. Another 420,000 common shares were issued on April 30, 2023 and 180,000 shares were issued on September 1,2023 ii. 50,000 warrants were issued on June 30,2023 for $20 per warrant. Each warrant permits the owner to purchase two common shares of BWCC for $40 per share any time before December 31, 2025. iii. Options were issued at no cost to employees on August 31, 2023, permitted the holders to purchase 40,000 common shares for $60 per share any time before December 31, 2026. iv. On March 31,2023 the company issued $10,000,000,6%, convertible bonds at par value. Each $1,000 bond is convertible into 20 common shares. v. The average market value of the common shares in 2023 was \$2p0 per share. 4. Details about shareholders' equity and dilutive securities: CHAPTER 17 - EPS i. The company issued 120,000 common shares on January 2,2023 , the date of its incorporation. Another 420,000 common shares were issued on April 30, 2023 and 180,000 shares were issued on September 1,2023 ii. 50,000 warrants were issued on June 30,2023 for $20 per warrant. Each warrant permits the owner to purchase two common shares of BWCC for $40 per share any time before December 31, 2025. iii. Options were issued at no cost to employees on August 31, 2023, permitted the holders to purchase 40,000 common shares for $60 per share any time before December 31, 2026. iv. On March 31,2023 the company issued $10,000,000,6%, convertible bonds at par value. Each $1,000 bond is convertible into 20 common shares. v. The average market value of the common shares in 2023 was \$2p0 per share

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started