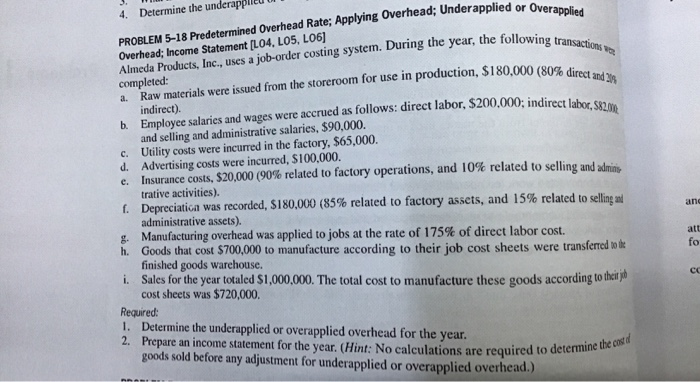

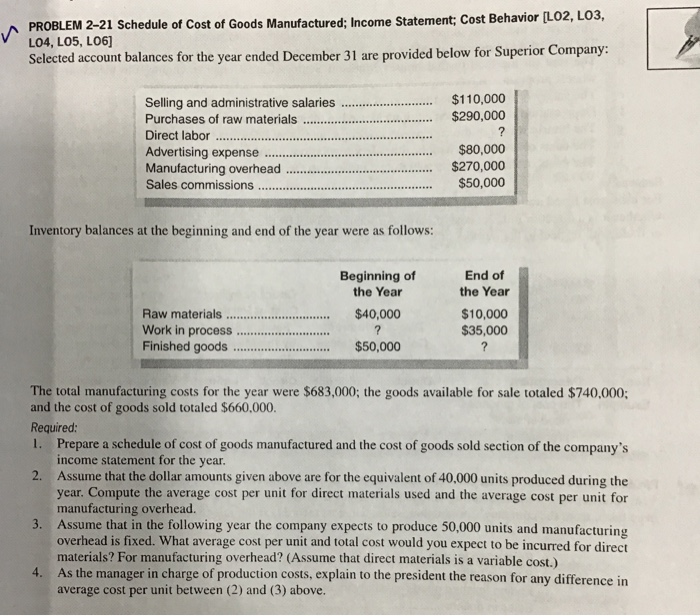

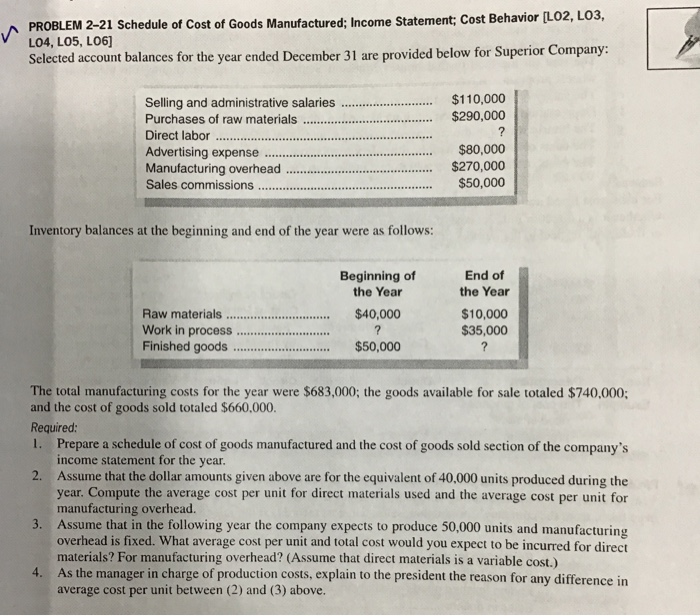

4. Determine the underap PROBLEM 5-18 Predetermined Overhead Rate; Applying Overhead; Underapplied or Overapplied Almeda Products, Inc., uses a job-order costing system. During the year, the following transactions wo a. Raw materials were issued from the storeroom for use in production, $180,000 (80% direct and 3 b. Employee salaries and wages were accrued as follows: direct labor, $200,000; indirect labor, S82,00 Overhead; Income Statement [L04, LO5, LO6] completed: indirect) and selling and administrative salaries, $90,000. c. Utility costs were incurred in the factory, $65,000. d. Advertising costs were incurred, $100,000. Insurance costs, $20,000 (90 % related to factory operations, and 10 % related to selling and admie trative activities). f. Depreciatica was recorded, $180,000 (85 % related to factory assets, and 15% related to selling a administrative assets). g. Manufacturing overhead was applied to jobs at the rate of 175% of direct labor cost. h. Goods that cost $700,000 to manufacture according to their job cost sheets were transfered to the finished goods warehouse. i Sales for the year totaled $1,000,000. The total cost to manufacture these goods according to theitjo cost sheets was $720,000. e. ane att fo co Required: 1. Determine the underapplied or overapplied overhead for the year. 2. Prepare an income statement for the year. (Hint: No calculations are required to determine the cost d goods sold before any adjustment for underapplied or overapplied overhead.) PROBLEM 2-21 Schedule of Cost of Goods Manufactured; Income Statement; Cost Behavior [LO2, LO3, L04, LO5, LO6] Selected account balances for the year ended December 31 are provided below for Superior Company: $110,000 Selling and administrative salaries $290,000 Purchases of raw materials ? Direct labor $80,000 Advertising expense Manufacturing overhead Sales commissions $270,000 $50,000 Inventory balances at the beginning and end of the year were as follows: End of Beginning of the Year the Year Raw materials $40,000 $10,000 $35,000 Work in process Finished goods ? $50,000 The total manufacturing costs for the year were $683,000; the goods available for sale totaled $740,000; and the cost of goods sold totaled $660,000. Required: 1. Prepare a schedule of cost of goods manufactured and the cost of goods sold section of the company's income statement for the year. Assume that the dollar amounts given above are for the equivalent of 40.000 units produced during the year. Compute the average cost per unit for direct materials used and the average cost per unit for manufacturing overhead. 2. Assume that in the following year the company expects to produce 50,000 units and manufacturing 3. overhead is fixed. What average cost per unit and total cost would you expect to be incurred for direct materials? For manufacturing overhead? (Assume that direct materials is a variable cost.) As the manager in charge of production costs, explain to the president the reason for any difference in average cost per unit between (2) and (3) above. 4