Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. Develop a set of specific recommendations for improving the financial performance of James Confectioners using the analysis you conducted in questions 1 to 3.

4. Develop a set of specific recommendations for improving the financial performance of James Confectioners using the analysis you conducted in questions 1 to 3.

5. What pricing recommendations and rationale can you make to James Confectioners?

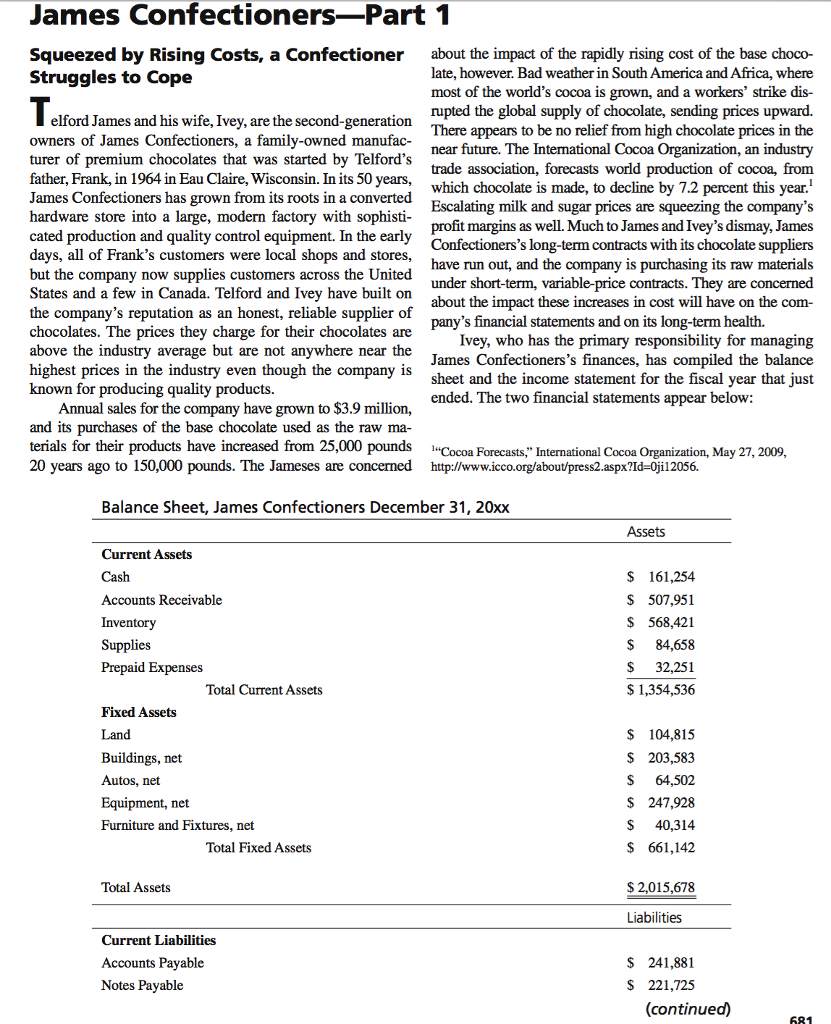

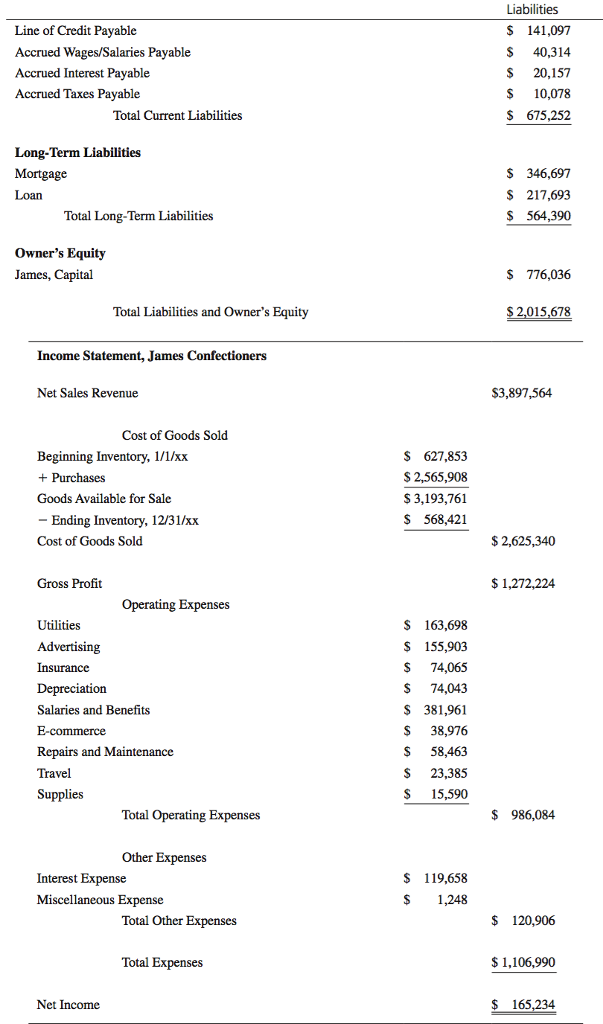

James ConfectionersPart 1 Squeezed by Rising Costs, a Confectioner about the impact of the rapidly rising cost of the base choco- Struggles to Cope late, however. Bad weather in South America and Africa, where most of the world's cocoa is grown, and a workers' strike dis- Telford James and his wife, Ivey, are the second-generation mupted the global supply of chocolate, seading proces tuerai. There appears to be no relief from high chocolate prices in the owners of James Confectioners, a family-owned manufac- near future. The International Cocoa Organization, an industry turer of premium chocolates that was started by Telford's father, Frank, in 1964 in Eau Claire, Wisconsin. In its 50 years, which chocolate is made, to decline by 7.2 percent this year.' trade association, forecasts world production of cocoa, from James Confectioners has grown from its roots in a converted Escalating milk and sugar prices are squeezing the company's hardware store into a large, modern factory with sophisti- profit margins as well. Much to James and Iveys dismay, James cated production and quality control equipment. In the early Confectioners's long-term contracts with its chocolate suppliers days, all of Frank's customers were local shops and stores, have run out, and the company is purchasing its raw materials but the company now supplies customers across the United under short-term, variable-price contracts. They are concerned States and a few in Canada. Telford and Ivey have built on about the impact these increases in cost will have on the com- the company's reputation as an honest, reliable supplier of pany's financial statements and on its long-term health. chocolates. The prices they charge for their chocolates are Ivey, who has the primary responsibility for managing above the industry average but are not anywhere near the James Confectioners's finances, has compiled the balance highest prices in the industry even though the company is sheet and the income statement for the fiscal year that just known for producing quality products. ended. The two financial statements appear below: Annual sales for the company have grown to $3.9 million, and its purchases of the base chocolate used as the raw ma- terials for their products have increased from 25,000 pounds "Cocoa Forecasts," International Cocoa Organization, May 27, 2009, 20 years ago to 150,000 pounds. The Jameses are concerned http://www.icco.org/about/press2.aspx?Id=Oji12056. Balance Sheet, James Confectioners December 31, 20xx Assets $ 161,254 $ 507,951 $ 568,421 $ 84,658 $ 32,251 $ 1,354,536 Current Assets Cash Accounts Receivable Inventory Supplies Prepaid Expenses Total Current Assets Fixed Assets Land Buildings, net Autos, net Equipment, net Furniture and Fixtures, net Total Fixed Assets $ 104,815 $ 203,583 $ 64,502 $ 247,928 $ 40,314 $ 661,142 Total Assets $ 2,015,678 Liabilities Current Liabilities Accounts Payable Notes Payable $ 241,881 $ 221,725 (continued) 681 Line of Credit Payable Accrued Wages/Salaries Payable Accrued Interest Payable Accrued Taxes Payable Total Current Liabilities Liabilities $ 141,097 $ 40,314 $ 20,157 S 10,078 $ 675,252 Long-Term Liabilities Mortgage Loan Total Long-Term Liabilities $ 346,697 $ 217,693 $ 564,390 Owner's Equity James, Capital $ 776,036 Total Liabilities and Owner's Equity $ 2,015,678 Income Statement, James Confectioners Net Sales Revenue $3,897,564 Cost of Goods Sold Beginning Inventory, 1/1/xx + Purchases Goods Available for Sale - Ending Inventory, 12/31/xx Cost of Goods Sold $ 627,853 $ 2,565,908 $ 3,193,761 $ 568,421 $ 2,625,340 $ 1,272,224 Gross Profit Operating Expenses Utilities Advertising Insurance Depreciation Salaries and Benefits E-commerce Repairs and Maintenance Travel Supplies Total Operating Expenses $ 163,698 $ 155,903 S 74,065 $ 74,043 $ 381,961 $ 38,976 $ 58,463 $ 23,385 $ 15,590 $ 986,084 Other Expenses Interest Expense Miscellaneous Expense Total Other Expenses $ 119,658 $ 1,248 $ 120,906 Total Expenses $ 1,106,990 Net Income $ 165,234Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started