Answered step by step

Verified Expert Solution

Question

1 Approved Answer

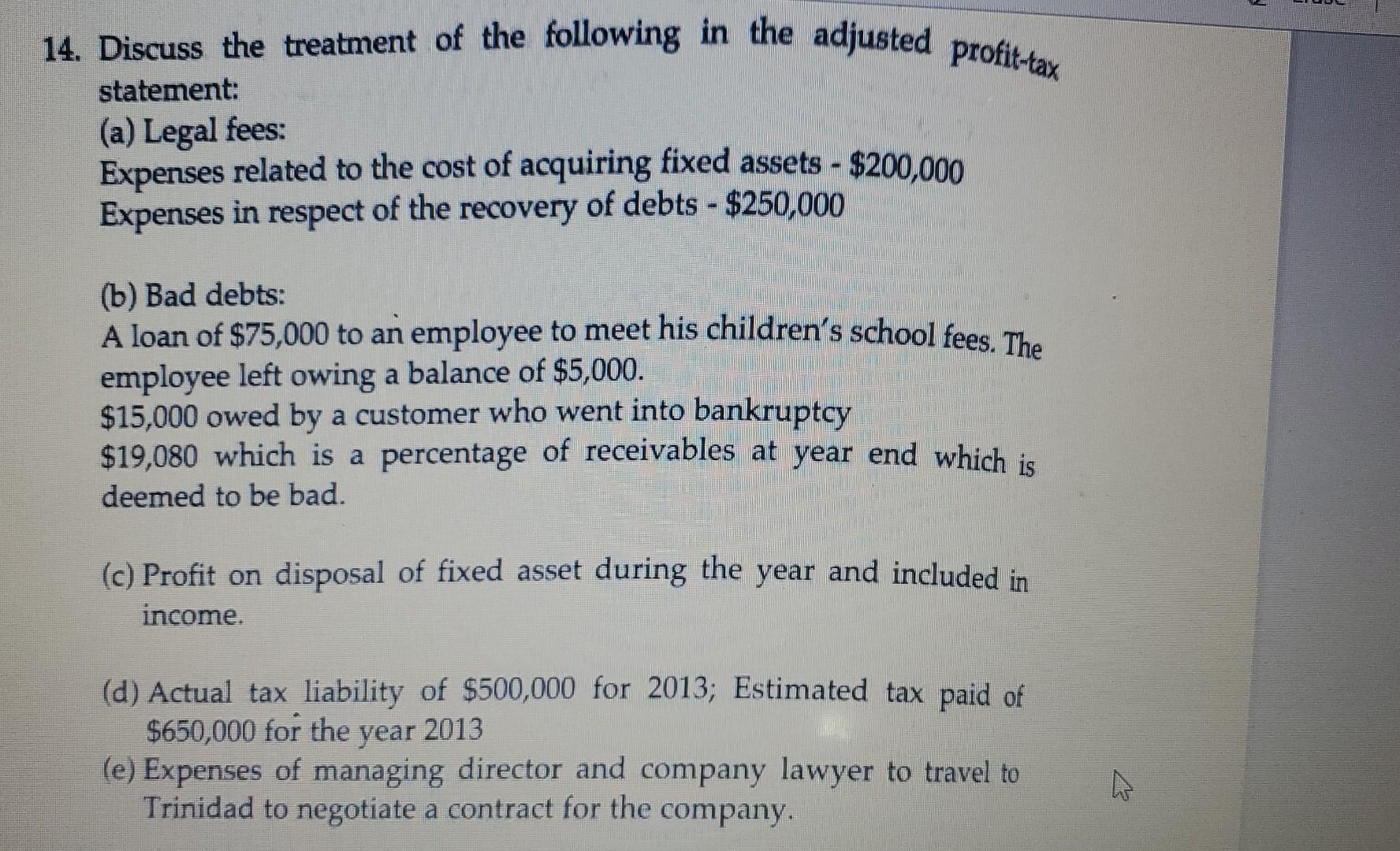

4. Discuss the treatment of the following in the adjusted profit-tax statement: (a) Legal fees: Expenses related to the cost of acquiring fixed assets -

4. Discuss the treatment of the following in the adjusted profit-tax statement: (a) Legal fees: Expenses related to the cost of acquiring fixed assets - $200,000 Expenses in respect of the recovery of debts $250,000 (b) Bad debts: A loan of $75,000 to an employee to meet his children's school fees. The employee left owing a balance of $5,000. $15,000 owed by a customer who went into bankruptcy $19,080 which is a percentage of receivables at year end which is deemed to be bad. (c) Profit on disposal of fixed asset during the year and included in income. (d) Actual tax liability of $500,000 for 2013; Estimated tax paid of $650,000 for the year 2013 (e) Expenses of managing director and company lawyer to travel to Trinidad to negotiate a contract for the company

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started