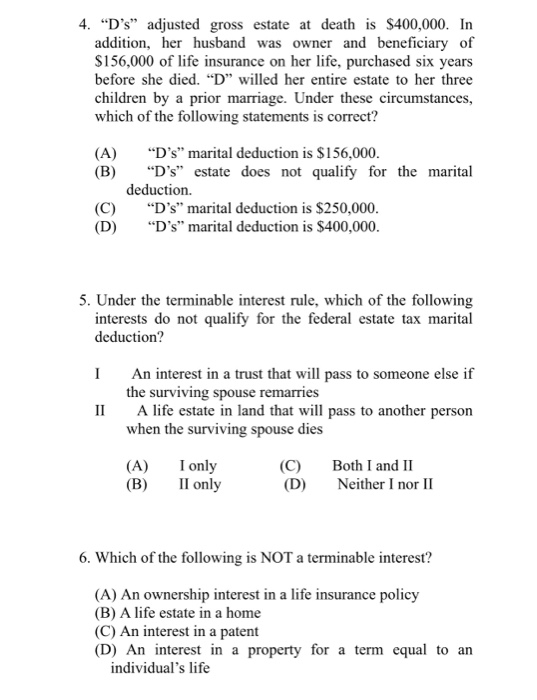

4. D's" adjusted gross estate at death is $400,000. In addition, her husband was owner and beneficiary of $156,000 of life insurance on her life, purchased six years before she died. "D" willed her entire estate to her three children by a prior marriage. Under these circumstances, which of the following statements is correct? (A) (B) "D's" marital deduction is $156,000. D's" estate does not qualify for the marital deduction. D's" marital deduction is $250,000. D's" marital deduction is $400,000. (D) 5. Under the terminable interest rule, which of the following interests do not qualify for the federal estate tax marital deduction? 1 An interest in a trust that will pass to someone else if the surviving spouse remarries A life estate in land that will pass to another person when the surviving spouse dies II (A) (B) I only II only (C) (D) Both I and II Neither I nor II 6. Which of the following is NOT a terminable interest? (A) An ownership interest in a life insurance policy (B) A life estate in a home (C) An interest in a patent (D) An interest in a property for a term equal to an individual's life 4. D's" adjusted gross estate at death is $400,000. In addition, her husband was owner and beneficiary of $156,000 of life insurance on her life, purchased six years before she died. "D" willed her entire estate to her three children by a prior marriage. Under these circumstances, which of the following statements is correct? (A) (B) "D's" marital deduction is $156,000. D's" estate does not qualify for the marital deduction. D's" marital deduction is $250,000. D's" marital deduction is $400,000. (D) 5. Under the terminable interest rule, which of the following interests do not qualify for the federal estate tax marital deduction? 1 An interest in a trust that will pass to someone else if the surviving spouse remarries A life estate in land that will pass to another person when the surviving spouse dies II (A) (B) I only II only (C) (D) Both I and II Neither I nor II 6. Which of the following is NOT a terminable interest? (A) An ownership interest in a life insurance policy (B) A life estate in a home (C) An interest in a patent (D) An interest in a property for a term equal to an individual's life