Answered step by step

Verified Expert Solution

Question

1 Approved Answer

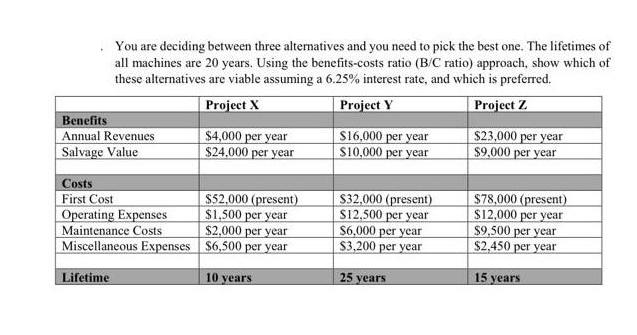

You are deciding between three alternatives and you need to pick the best one. The lifetimes of all machines are 20 years. Using the

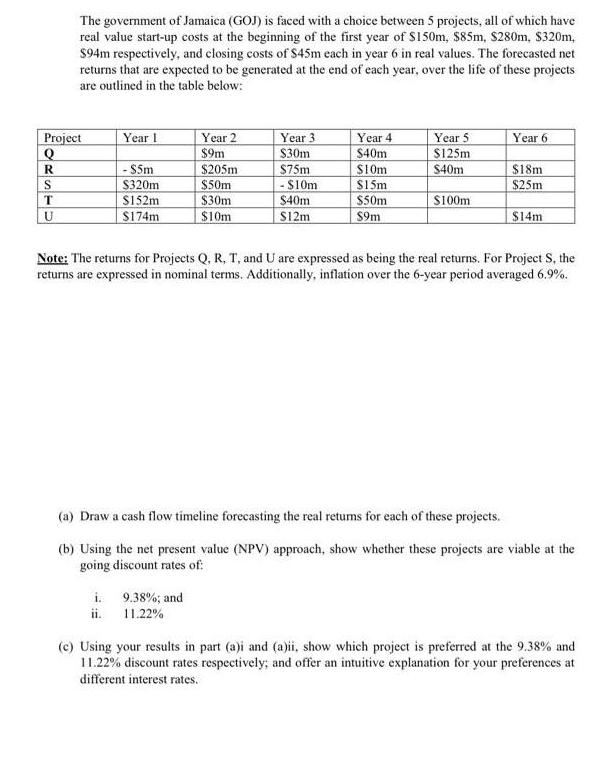

You are deciding between three alternatives and you need to pick the best one. The lifetimes of all machines are 20 years. Using the benefits-costs ratio (B/C ratio) approach, show which of these alternatives are viable assuming a 6.25% interest rate, and which is preferred. Project X Project Y Project Z Benefits Annual Revenues Salvage Value Costs First Cost Operating Expenses Maintenance Costs Miscellaneous Expenses Lifetime $4,000 per year $24,000 per year $52,000 (present) $1,500 per year $2,000 per year $6,500 per year 10 years $16,000 per year $10,000 per year $32,000 (present) $12,500 per year $6,000 per year $3,200 per year 25 years $23,000 per year $9,000 per year $78,000 (present) $12,000 per year $9,500 per year $2,450 per year 15 years The government of Jamaica (GOJ) is faced with a choice between 5 projects, all of which have real value start-up costs at the beginning of the first year of $150m, $85m, $280m, $320m, $94m respectively, and closing costs of $45m each in year 6 in real values. The forecasted net returns that are expected to be generated at the end of each year, over the life of these projects are outlined in the table below: Project Q R S T U Year 1 - $5m $320m $152m $174m Year 2 $9m $205m $50m $30m $10m i. 9.38%; and ii. 11.22% Year 3 $30m $75m - $10m $40m $12m Year 4 $40m $10m $15m $50m $9m Year 5 $125m $40m $100m Year 6 $18m. $25m $14m Note: The returns for Projects Q, R, T. and U are expressed as being the real returns. For Project S, the returns are expressed in nominal terms. Additionally, inflation over the 6-year period averaged 6.9%. (a) Draw a cash flow timeline forecasting the real returns for each of these projects. (b) Using the net present value (NPV) approach, show whether these projects are viable at the going discount rates of: (c) Using your results in part (a)i and (a)ii, show which project is preferred at the 9.38% and 11.22% discount rates respectively; and offer an intuitive explanation for your preferences at different interest rates.

Step by Step Solution

★★★★★

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started