Answered step by step

Verified Expert Solution

Question

1 Approved Answer

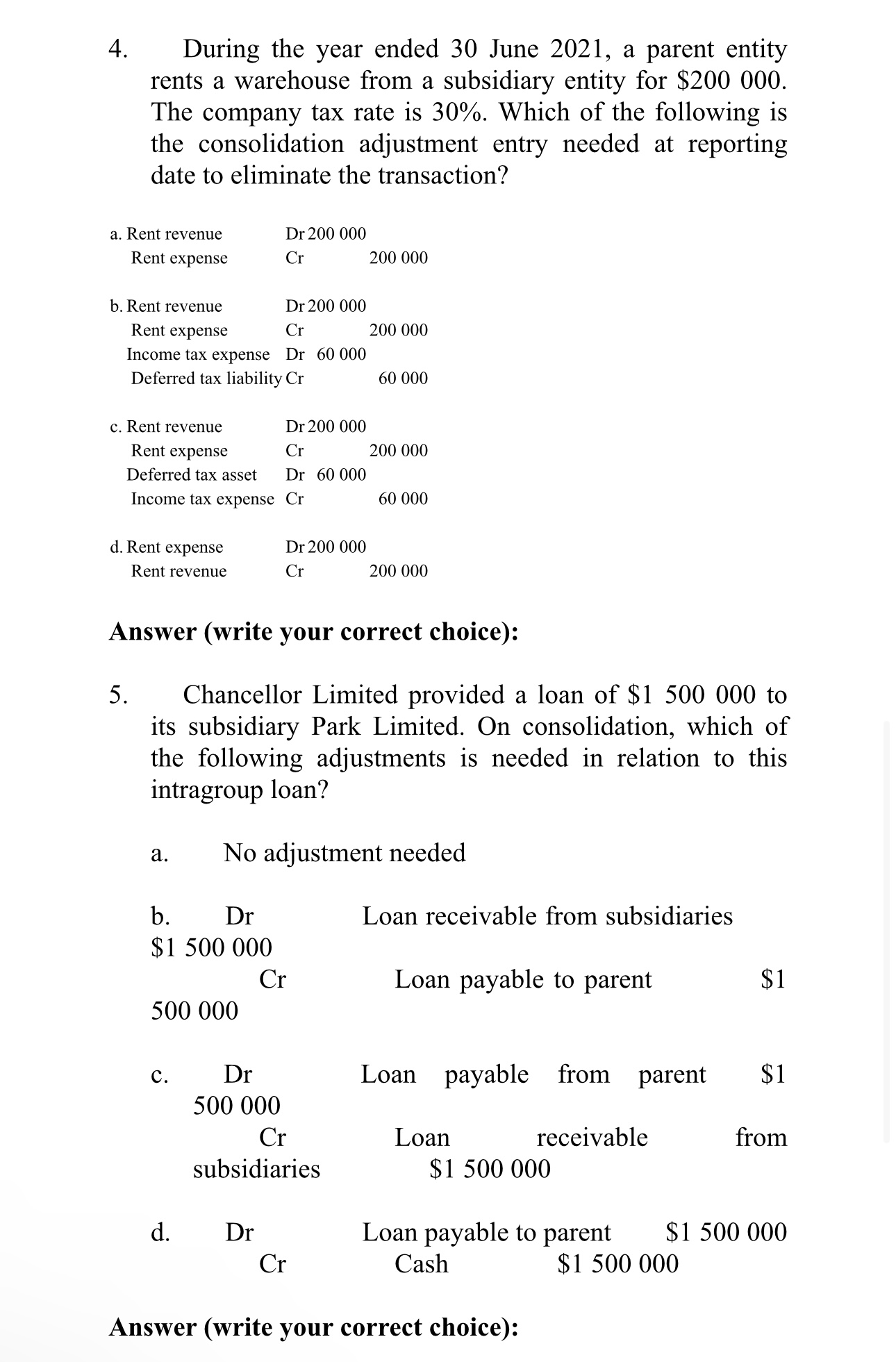

4. During the year ended 30 June 2021 , a parent entity rents a warehouse from a subsidiary entity for $200000. The company tax rate

4. During the year ended 30 June 2021 , a parent entity rents a warehouse from a subsidiary entity for $200000. The company tax rate is 30%. Which of the following is the consolidation adjustment entry needed at reporting date to eliminate the transaction? a. Rent revenue Rent expense Dr 200000 Cr200000 d. Rent expense Rent revenue Dr 200000 Cr200000 Answer (write your correct choice): 5. Chancellor Limited provided a loan of $1500000 to its subsidiary Park Limited. On consolidation, which of the following adjustments is needed in relation to this intragroup loan? a. No adjustment needed b. Dr $1500000 500000 c. Dr 500000 Cr subsidiaries Loan receivable from subsidiaries Loan payable to parent Loan payable from parent $1 from $1500000 $1 d. Dr Loan payable to parent $1500000 Cr Cash $1500000

4. During the year ended 30 June 2021 , a parent entity rents a warehouse from a subsidiary entity for $200000. The company tax rate is 30%. Which of the following is the consolidation adjustment entry needed at reporting date to eliminate the transaction? a. Rent revenue Rent expense Dr 200000 Cr200000 d. Rent expense Rent revenue Dr 200000 Cr200000 Answer (write your correct choice): 5. Chancellor Limited provided a loan of $1500000 to its subsidiary Park Limited. On consolidation, which of the following adjustments is needed in relation to this intragroup loan? a. No adjustment needed b. Dr $1500000 500000 c. Dr 500000 Cr subsidiaries Loan receivable from subsidiaries Loan payable to parent Loan payable from parent $1 from $1500000 $1 d. Dr Loan payable to parent $1500000 Cr Cash $1500000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started