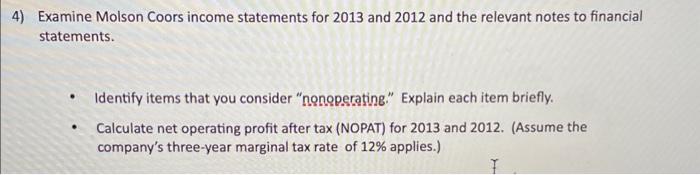

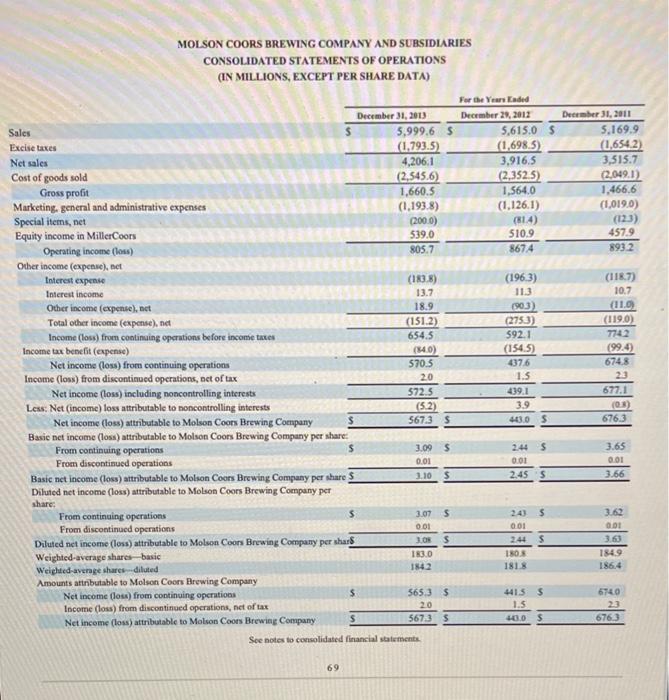

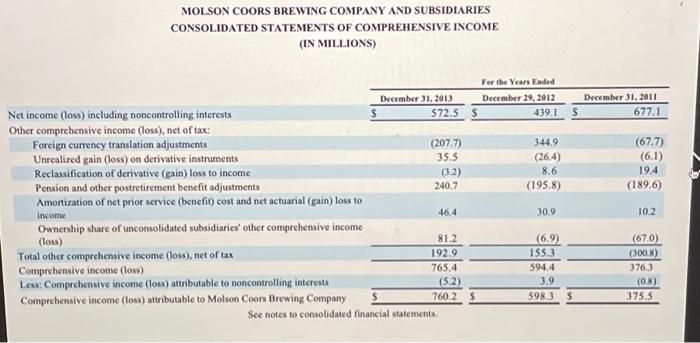

4) Examine Molson Coors income statements for 2013 and 2012 and the relevant notes to financial statements. - Identify items that you consider "nonoperating." Explain each item briefly. - Calculate net operating profit after tax (NOPAT) for 2013 and 2012. (Assume the company's three-year marginal tax rate of 12% applies.) MOLSON COORS BREWING COMPANY AND SUBSIDLARIES CONSOLIDATED STATEMENTS OF OPERATIONS (IN MILLIONS, EXCEPT PER SHARE DATA) For the Yars Eaded Sales Excise taxes Net sales Cost of goods sold Gross profit Marketing, general and administrative expenses 5Decrmber31,20135,999.6December23,201255,615.05.169.9Detmber31,2011 Special items, net Equity income in MillerCoors Operating income (loss) 4,206.1(1,793.5)3,916.5(1,698.5)3,515.7(1,654.2) Other income (expenie), Bet toterest expense 1,660.5(2,545.6)1,564.0(2,352.5)1,466.6(2,049.1) Interest income Other income (expente), nct Total other income (expense), net Income (loss) from continaing operations be fore income tates Income tax benefit (expense) Net income (loss) from continuing operations Income (loss) from discontinued operations, net of tax Less: Net (income) loss attributable to noncontrolling interests Net income (loss) attributable to Molson Coors Brewing Company Basie net income (loss) attributable to Molson Coors Brewing Company per share: From continuing operations From discontiaued operations Diluted net income (loss) attributable to Molson Coors Brewing Company per share: Soe notes to consolidated financial statements. 69 MOLSON COORS BREWING COMPANY AND SUBSIDLARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (IN MILLIONS) 4) Examine Molson Coors income statements for 2013 and 2012 and the relevant notes to financial statements. - Identify items that you consider "nonoperating." Explain each item briefly. - Calculate net operating profit after tax (NOPAT) for 2013 and 2012. (Assume the company's three-year marginal tax rate of 12% applies.) MOLSON COORS BREWING COMPANY AND SUBSIDLARIES CONSOLIDATED STATEMENTS OF OPERATIONS (IN MILLIONS, EXCEPT PER SHARE DATA) For the Yars Eaded Sales Excise taxes Net sales Cost of goods sold Gross profit Marketing, general and administrative expenses 5Decrmber31,20135,999.6December23,201255,615.05.169.9Detmber31,2011 Special items, net Equity income in MillerCoors Operating income (loss) 4,206.1(1,793.5)3,916.5(1,698.5)3,515.7(1,654.2) Other income (expenie), Bet toterest expense 1,660.5(2,545.6)1,564.0(2,352.5)1,466.6(2,049.1) Interest income Other income (expente), nct Total other income (expense), net Income (loss) from continaing operations be fore income tates Income tax benefit (expense) Net income (loss) from continuing operations Income (loss) from discontinued operations, net of tax Less: Net (income) loss attributable to noncontrolling interests Net income (loss) attributable to Molson Coors Brewing Company Basie net income (loss) attributable to Molson Coors Brewing Company per share: From continuing operations From discontiaued operations Diluted net income (loss) attributable to Molson Coors Brewing Company per share: Soe notes to consolidated financial statements. 69 MOLSON COORS BREWING COMPANY AND SUBSIDLARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (IN MILLIONS)