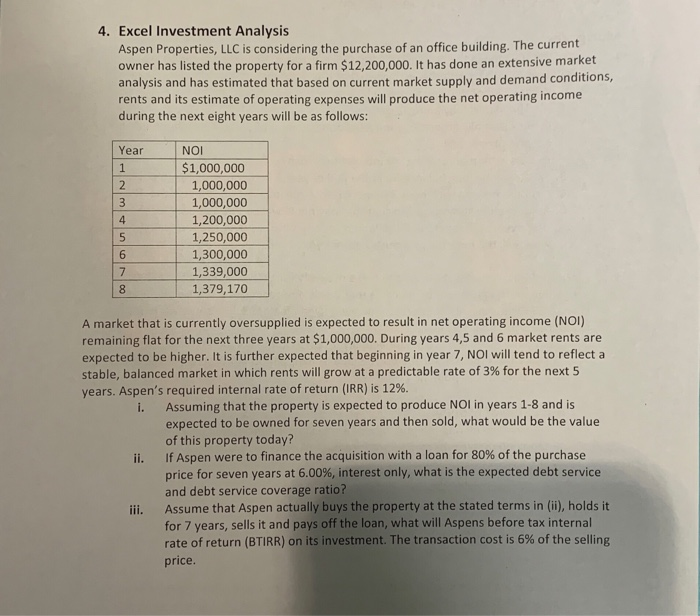

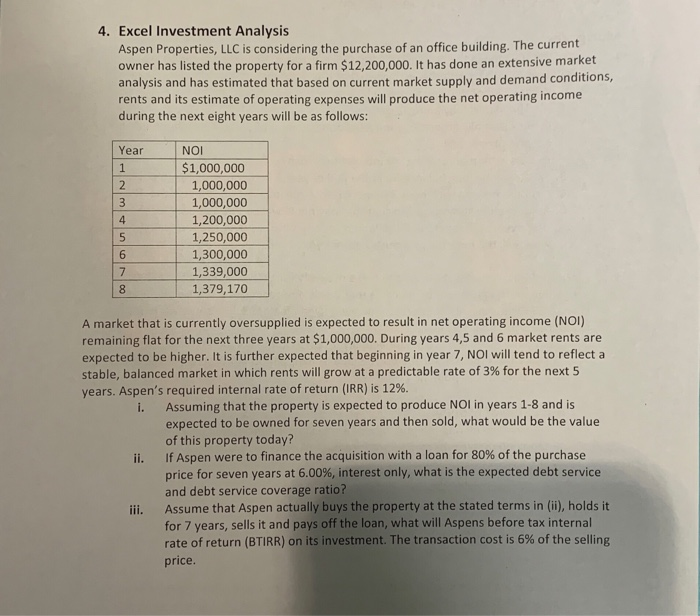

4. Excel Investment Analysis Aspen Properties, LLC is considering the purchase of an office building. The current owner has listed the property for a firm $12,200,000. It has done an extensive market analysis and has estimated that based on current market supply and demand conditions, rents and its estimate of operating expenses will produce the net operating income during the next eight years will be as follows: Year NOI $1,000,000 1,000,000 1,000,000 1,200,000 1,250,000 1,300,000 1,339,000 1,379,170 4 6 A market that is currently oversupplied is expected to result in net operating income (NOI) remaining flat for the next three years at $1,000,000. During years 4,5 and 6 market rents are expected to be higher. It is further expected that beginning in year 7, NOI will tend to reflect a stable, balanced market in which rents will grow at a predictable rate of 3% for the next 5 years. Aspen's required internal rate of return (IRR) is 12%. Assuming that the property is expected to produce NOI in years 1-8 and is expected to be owned for seven years and then sold, what would be the value of this property today? If Aspen were to finance the acquisition with a loan for 80% of the purchase price for seven years at 6.00%, interest only, what is the expected debt service and debt service coverage ratio? Assume that Aspen actually buys the property at the stated terms in (ii), holds it for 7 years, sells it and pays off the loan, what will Aspens before tax internal rate of return (BTRR) on its investment. The transaction cost is 6% of the selling price i. ii. ili. 4. Excel Investment Analysis Aspen Properties, LLC is considering the purchase of an office building. The current owner has listed the property for a firm $12,200,000. It has done an extensive market analysis and has estimated that based on current market supply and demand conditions, rents and its estimate of operating expenses will produce the net operating income during the next eight years will be as follows: Year NOI $1,000,000 1,000,000 1,000,000 1,200,000 1,250,000 1,300,000 1,339,000 1,379,170 4 6 A market that is currently oversupplied is expected to result in net operating income (NOI) remaining flat for the next three years at $1,000,000. During years 4,5 and 6 market rents are expected to be higher. It is further expected that beginning in year 7, NOI will tend to reflect a stable, balanced market in which rents will grow at a predictable rate of 3% for the next 5 years. Aspen's required internal rate of return (IRR) is 12%. Assuming that the property is expected to produce NOI in years 1-8 and is expected to be owned for seven years and then sold, what would be the value of this property today? If Aspen were to finance the acquisition with a loan for 80% of the purchase price for seven years at 6.00%, interest only, what is the expected debt service and debt service coverage ratio? Assume that Aspen actually buys the property at the stated terms in (ii), holds it for 7 years, sells it and pays off the loan, what will Aspens before tax internal rate of return (BTRR) on its investment. The transaction cost is 6% of the selling price i. ii. ili