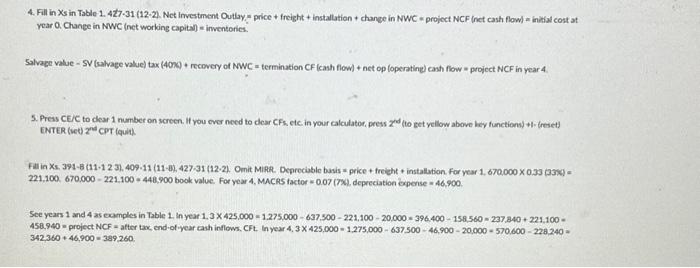

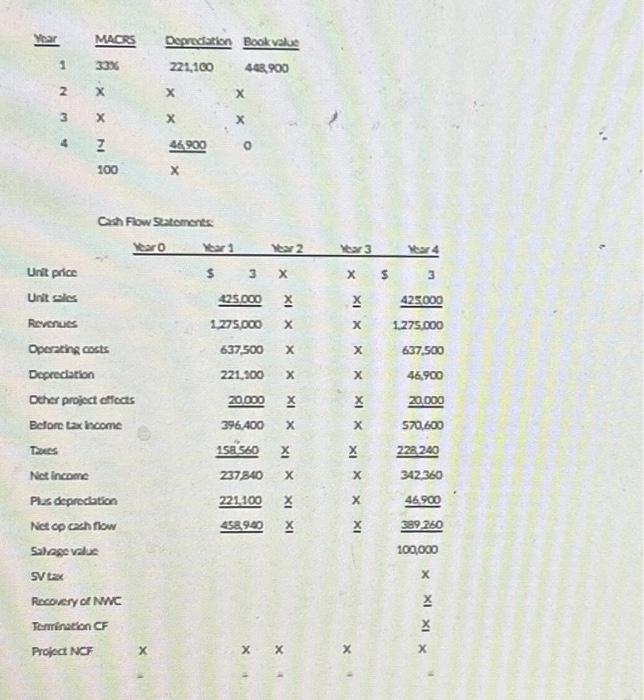

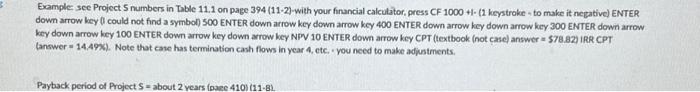

4. Fill in Xs in Table 1. 4Z7-31 (12-2). Net investment Outlay = price + freight + installation + change in NWC * project NCF (net cash flow) = inkikal cost at vear 0 . Change in NWC (net working capital) = inventories. Salvage value - SV (salvage value) tax (40nG) + recovery of NWC= termination CF (cash flew) + net op (operatine) canh flow = project NCF in ycar 4. 5. Press CE/C to clear 1 number on screen. If vou over need to dear CFs, etc in vour calculatoe, press Ztd (to get yellow above hey functions) +1- (reset) 221.100.670,000=221.100=448,900 book value. For year 4, MACRS factor =0.07(7x). depreciation expense =46,900. See years 1 and 4 as examples in Table 1 In year 1,3425,000=1.275,000637,300221,10020,000=396,400158,560=237,340+221,100= 342,360+46,900=399,260. Cah Fow Satoments: Example see Project 5 numbers in Table 11.1 on page 394(112)-with your financial calcutator, press CF 1000 +1- (1 keystroke - to make it negative) ENTER down arrow key (0 could not find a symbol) 500 ENTER down arrow key down arrow key 400 ENTER down arrow key down arrow key 300 ENTER down arrow key down arrow key 100 ENTER down arrow key down arrow key NIV 10 ENTER down arrow key CPT (textbook (not Case) answer = $78.82 ) IRR CPT (answer =14,49%). Note that case has termination cash flows in year 4, etc, " you need to make adjustments. 4. Fill in Xs in Table 1. 4Z7-31 (12-2). Net investment Outlay = price + freight + installation + change in NWC * project NCF (net cash flow) = inkikal cost at vear 0 . Change in NWC (net working capital) = inventories. Salvage value - SV (salvage value) tax (40nG) + recovery of NWC= termination CF (cash flew) + net op (operatine) canh flow = project NCF in ycar 4. 5. Press CE/C to clear 1 number on screen. If vou over need to dear CFs, etc in vour calculatoe, press Ztd (to get yellow above hey functions) +1- (reset) 221.100.670,000=221.100=448,900 book value. For year 4, MACRS factor =0.07(7x). depreciation expense =46,900. See years 1 and 4 as examples in Table 1 In year 1,3425,000=1.275,000637,300221,10020,000=396,400158,560=237,340+221,100= 342,360+46,900=399,260. Cah Fow Satoments: Example see Project 5 numbers in Table 11.1 on page 394(112)-with your financial calcutator, press CF 1000 +1- (1 keystroke - to make it negative) ENTER down arrow key (0 could not find a symbol) 500 ENTER down arrow key down arrow key 400 ENTER down arrow key down arrow key 300 ENTER down arrow key down arrow key 100 ENTER down arrow key down arrow key NIV 10 ENTER down arrow key CPT (textbook (not Case) answer = $78.82 ) IRR CPT (answer =14,49%). Note that case has termination cash flows in year 4, etc, " you need to make adjustments