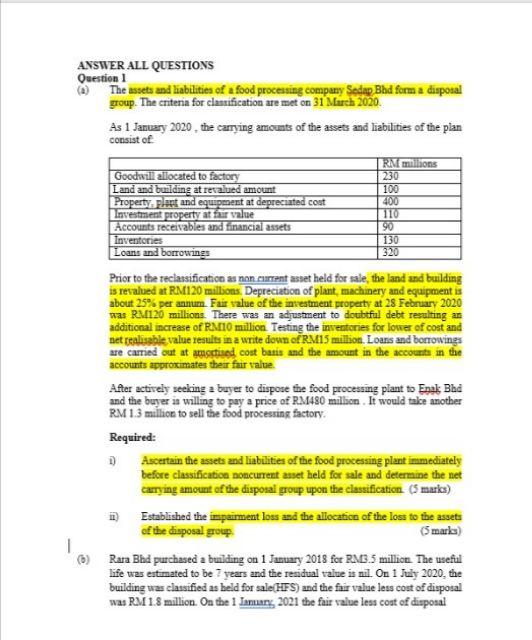

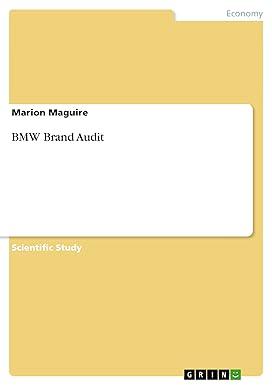

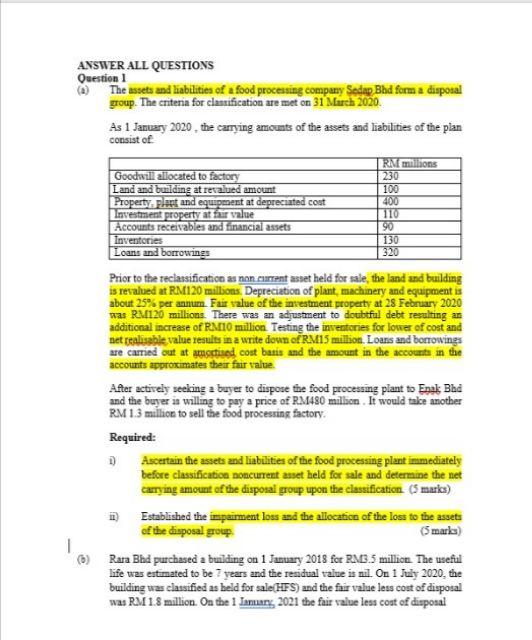

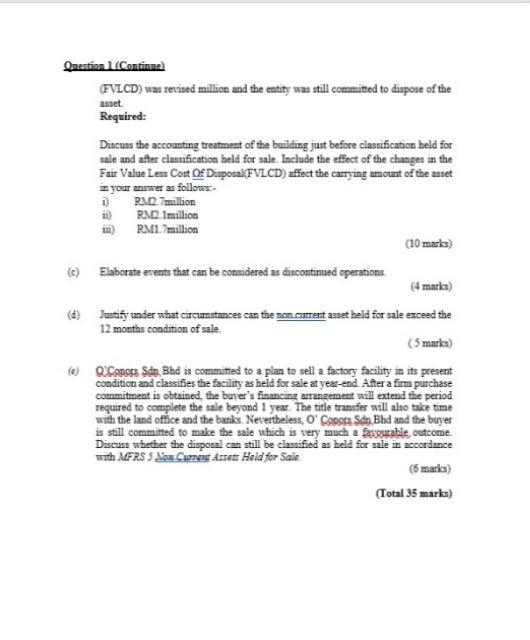

ANSWER ALL QUESTIONS Question 1 The assets and liabilities of a food processing company Sedap Bhd form a disposal group. The criteria for classification are met on 31 March 2020. As 1 January 2020, the carrying amounts of the assets and liabilities of the plan consist of Goodwill allocated to factory Land and building at revalued amount Property, plant and equipment at depreciated cost Investment property at fur Value Accounts receivables and financial assets Inventories Loans and borrowings RM millions 230 100 400 110 90 130 320 Prior to the reclassification as non current asset held for sale, the land and building is revalued at RM120 millions Depreciation of plant, machinery and equipment is about 25% per annum. Fair value of the investment property at 28 February 2020 was RM120 millions There was an adjustment to doubtful debt resulting as additional increase of RM10 million Testing the inventories for lower of cost and net realisable value results in a write down of RM15 million. Loans and borrowings are carried out at antised cost basis and the amount in the accounts in the accounts approximates the fair value After actively seeking a buyer to dispose the food processing plant to Enak Bhd and the buyer a willing to pay a price of RM480 millionIt would take another RM 1.3 million to sell the food processing factory. Required: Ascertain the assets and liabilities of the food processing plant immediately before classification noncurent asset held for sale and determine the net carrying amount of the disposal group upon the classification (3 marks) Established the impairment loss and the allocation of the loss to the assets of the disposal group (5 marks) Rara Bhd purchased a building on 1 January 2018 for RM3.5 million The useful life was estimated to be 7 years and the residual value is nil. On 1 July 2020. the building was classified as held for sale/HFS) and the fair value less cost of disposal was RM 1.8 million. On the 1 January, 2021 the fair value less cost of disposal Question 1 (Continae) (FVLCD) was revised million and the entity was still committed to dispose of the autet Required: Discuss the accounting treatment of the building just before classification held for sale and after classification held for sale. Include the effect of the changes in the Fair Value Les Cost Of Disposal (FVLCD) affect the carrying amount of the asset in your answer as follows RM2.7 million 1) RMC. Imillion in) RM1million (10 marks) () Elaborate events that can be considered as discontinued operations (4 marka) (2) Justify under what circumstances can the son content asset held for sale exceed the 12 months condition of sale (5 marks) () O'Conors Sdn Bhd is committed to a plan to sell a factory facility in its present condition and classifies the facility as held for sale at year-end After a firm purchase commitment is obtained the buver's financing arrangement will extend the period required to complete the sale beyond 1 year. The title transfer will also take time with the land office and the banks. Nevertheless, O Consss Sdn Bhd and the buyer is still committed to make the sale which is tery much a fasoarable outcome Discuss whether the disposal can still be classified as held for sale in accordance with MFRS 5 Non Current Assets Held for Sale (6 marks) (Total 35 marks) ANSWER ALL QUESTIONS Question 1 The assets and liabilities of a food processing company Sedap Bhd form a disposal group. The criteria for classification are met on 31 March 2020. As 1 January 2020, the carrying amounts of the assets and liabilities of the plan consist of Goodwill allocated to factory Land and building at revalued amount Property, plant and equipment at depreciated cost Investment property at fur Value Accounts receivables and financial assets Inventories Loans and borrowings RM millions 230 100 400 110 90 130 320 Prior to the reclassification as non current asset held for sale, the land and building is revalued at RM120 millions Depreciation of plant, machinery and equipment is about 25% per annum. Fair value of the investment property at 28 February 2020 was RM120 millions There was an adjustment to doubtful debt resulting as additional increase of RM10 million Testing the inventories for lower of cost and net realisable value results in a write down of RM15 million. Loans and borrowings are carried out at antised cost basis and the amount in the accounts in the accounts approximates the fair value After actively seeking a buyer to dispose the food processing plant to Enak Bhd and the buyer a willing to pay a price of RM480 millionIt would take another RM 1.3 million to sell the food processing factory. Required: Ascertain the assets and liabilities of the food processing plant immediately before classification noncurent asset held for sale and determine the net carrying amount of the disposal group upon the classification (3 marks) Established the impairment loss and the allocation of the loss to the assets of the disposal group (5 marks) Rara Bhd purchased a building on 1 January 2018 for RM3.5 million The useful life was estimated to be 7 years and the residual value is nil. On 1 July 2020. the building was classified as held for sale/HFS) and the fair value less cost of disposal was RM 1.8 million. On the 1 January, 2021 the fair value less cost of disposal Question 1 (Continae) (FVLCD) was revised million and the entity was still committed to dispose of the autet Required: Discuss the accounting treatment of the building just before classification held for sale and after classification held for sale. Include the effect of the changes in the Fair Value Les Cost Of Disposal (FVLCD) affect the carrying amount of the asset in your answer as follows RM2.7 million 1) RMC. Imillion in) RM1million (10 marks) () Elaborate events that can be considered as discontinued operations (4 marka) (2) Justify under what circumstances can the son content asset held for sale exceed the 12 months condition of sale (5 marks) () O'Conors Sdn Bhd is committed to a plan to sell a factory facility in its present condition and classifies the facility as held for sale at year-end After a firm purchase commitment is obtained the buver's financing arrangement will extend the period required to complete the sale beyond 1 year. The title transfer will also take time with the land office and the banks. Nevertheless, O Consss Sdn Bhd and the buyer is still committed to make the sale which is tery much a fasoarable outcome Discuss whether the disposal can still be classified as held for sale in accordance with MFRS 5 Non Current Assets Held for Sale (6 marks) (Total 35 marks)