Question

On September 10, 2020, Splish Corporation, a publicly traded company, purchased 1,200 common shares in MNL Ltd at a cost of $26.40 per share. The

On September 10, 2020, Splish Corporation, a publicly traded company, purchased 1,200 common shares in MNL Ltd at a cost of $26.40 per share. The number of shares purchased was not a significant percentage of MNLs ownership, and Splish designated the investment as fair value through other comprehensive income (FV-OCI) under IFRS. Concerned about the inherent risk of losing value through the change in market price of the shares, Splish immediately purchased an option to sell the MNL shares for $31,680. The option cost $3,800. On September 30, 2020, Splish prepared its quarterly financial statements. On that day, the MNL shares were trading at $28.90 per share. The options, on the other hand, were trading at $530.

Is this a fair-value hedge or a cash flow hedge, from Splishs perspective?

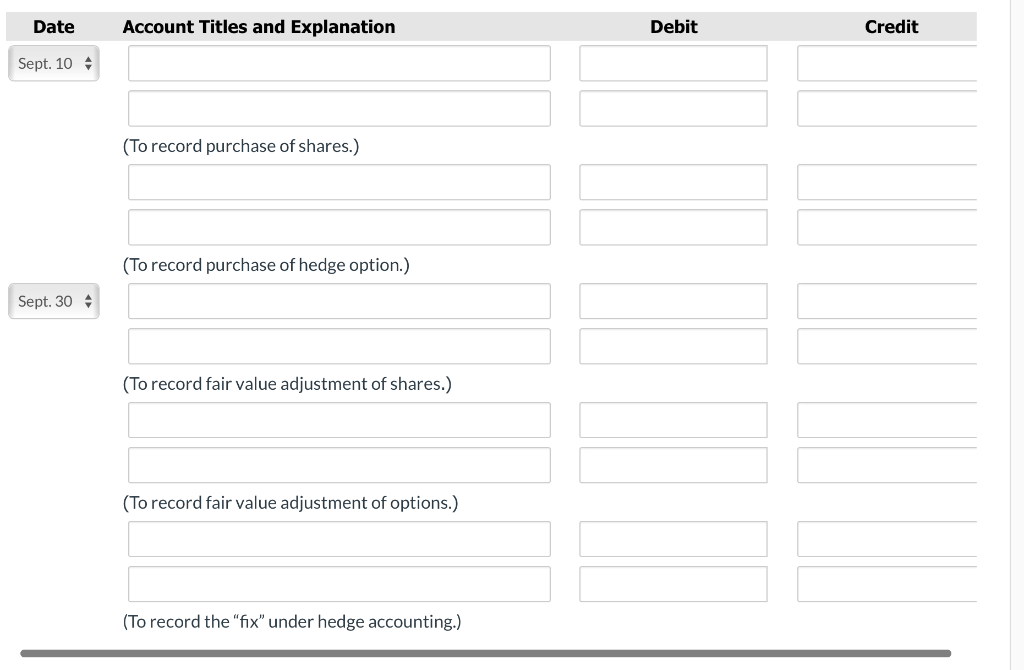

Prepare the necessary journal entries to record the above events.

Date Account Titles and Explanation Debit Credit Sept. 10 (To record purchase of shares.) (To record purchase of hedge option.) Sept. 30 A (To record fair value adjustment of shares.) (To record fair value adjustment of options.) (To record the "fix" under hedge accounting.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started