Answered step by step

Verified Expert Solution

Question

1 Approved Answer

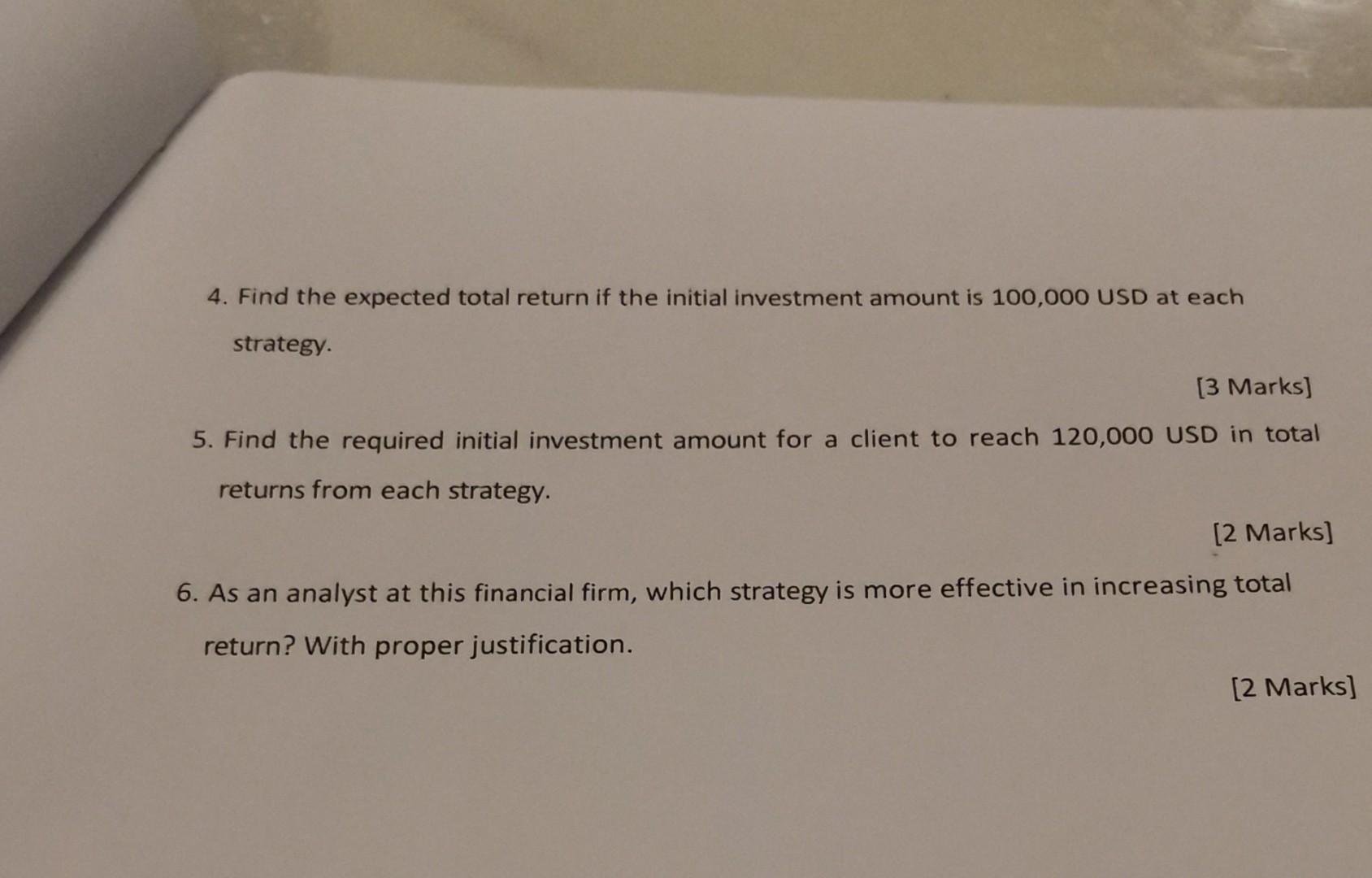

4. Find the expected total return if the initial investment amount is 100,000 USD at each strategy. [3 Marks] 5. Find the required initial investment

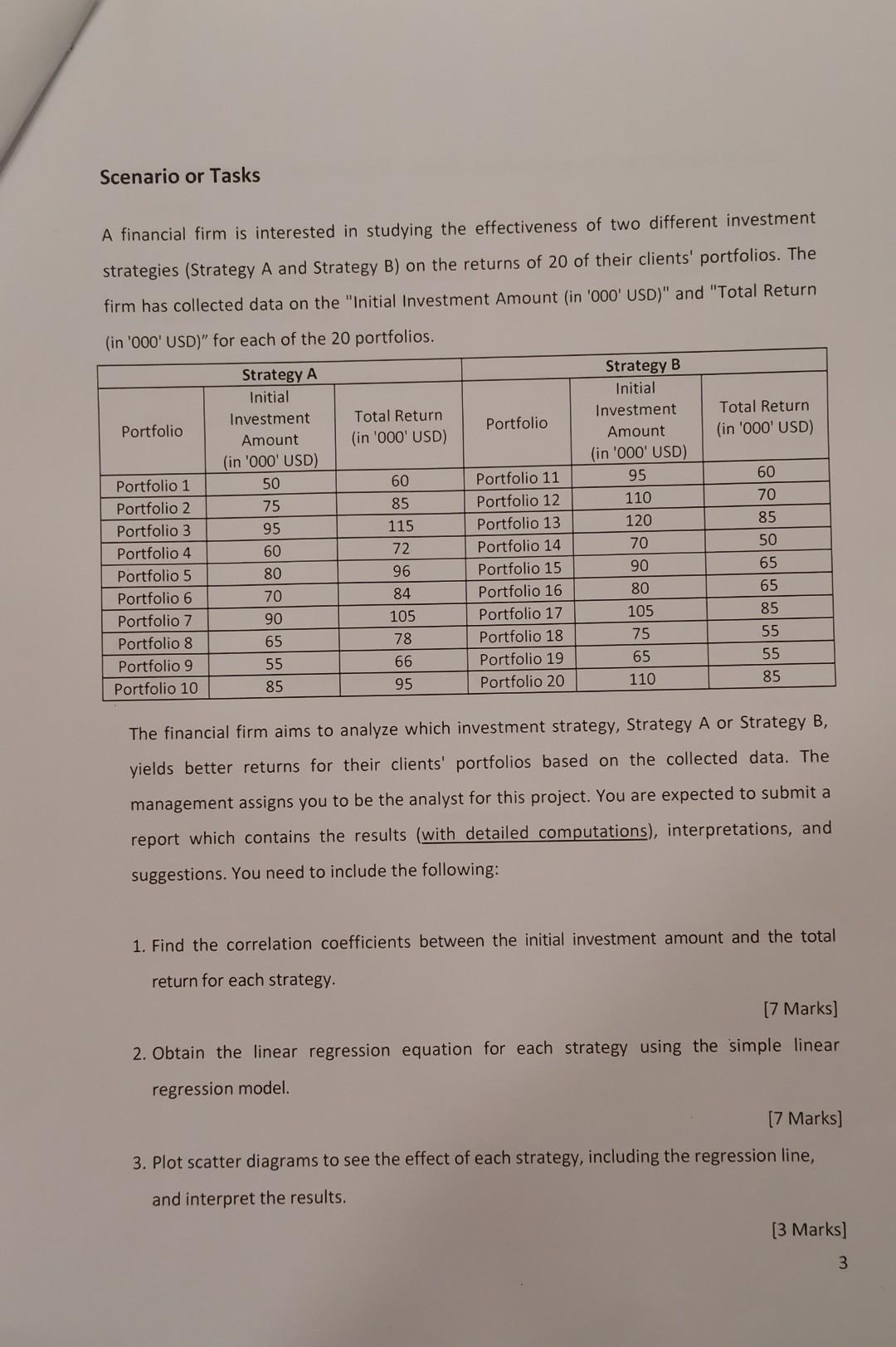

4. Find the expected total return if the initial investment amount is 100,000 USD at each strategy. [3 Marks] 5. Find the required initial investment amount for a client to reach 120,000 USD in total returns from each strategy. [2 Marks] 6. As an analyst at this financial firm, which strategy is more effective in increasing total return? With proper justification. Scenario or Tasks A financial firm is interested in studying the effectiveness of two different investment strategies (Strategy A and Strategy B) on the returns of 20 of their clients' portfolios. The firm has collected data on the "Initial Investment Amount (in 'OOO' USD)" and "Total Return (in 'nnn' (ISD)" for each of the 20 portfolios. The financial firm aims to analyze which investment strategy, Strategy A or Strategy B, yields better returns for their clients' portfolios based on the collected data. The management assigns you to be the analyst for this project. You are expected to submit a report which contains the results (with detailed computations), interpretations, and suggestions. You need to include the following: 1. Find the correlation coefficients between the initial investment amount and the total return for each strategy. [7 Marks] 2. Obtain the linear regression equation for each strategy using the simple linear regression model. [7 Marks] 3. Plot scatter diagrams to see the effect of each strategy, including the regression line, and interpret the results

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started