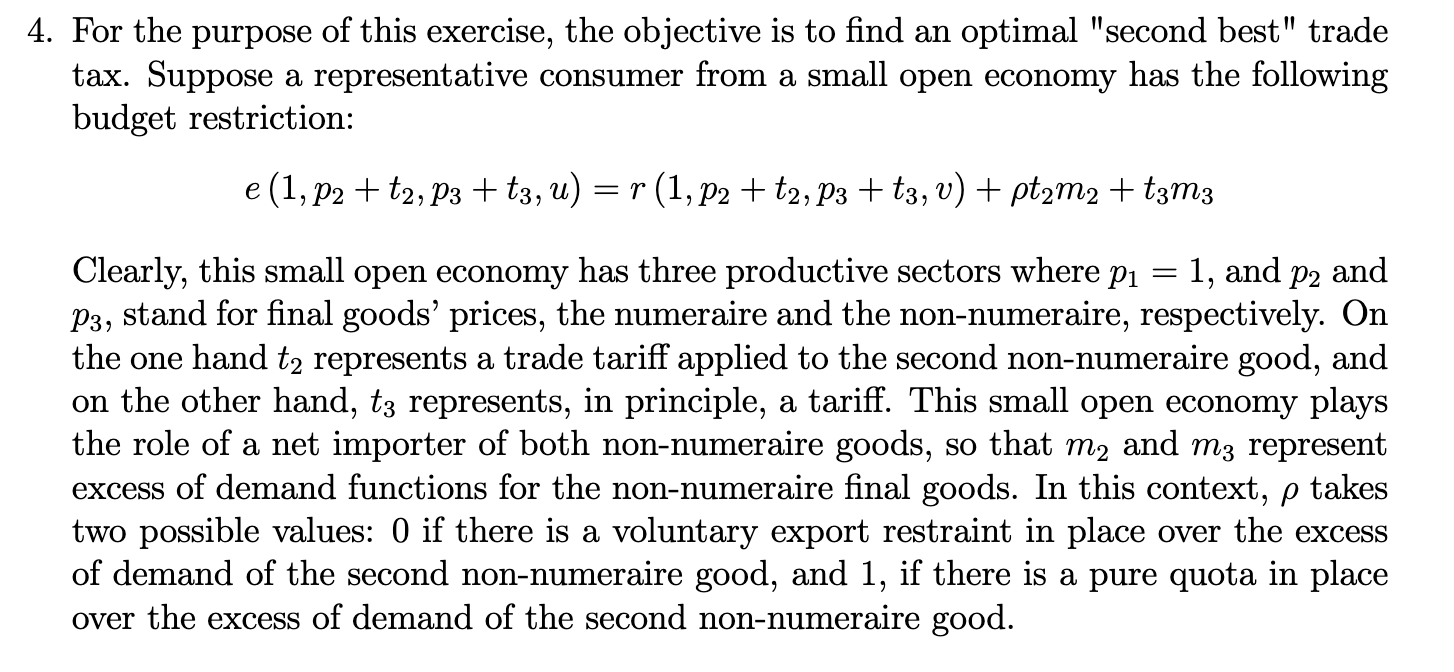

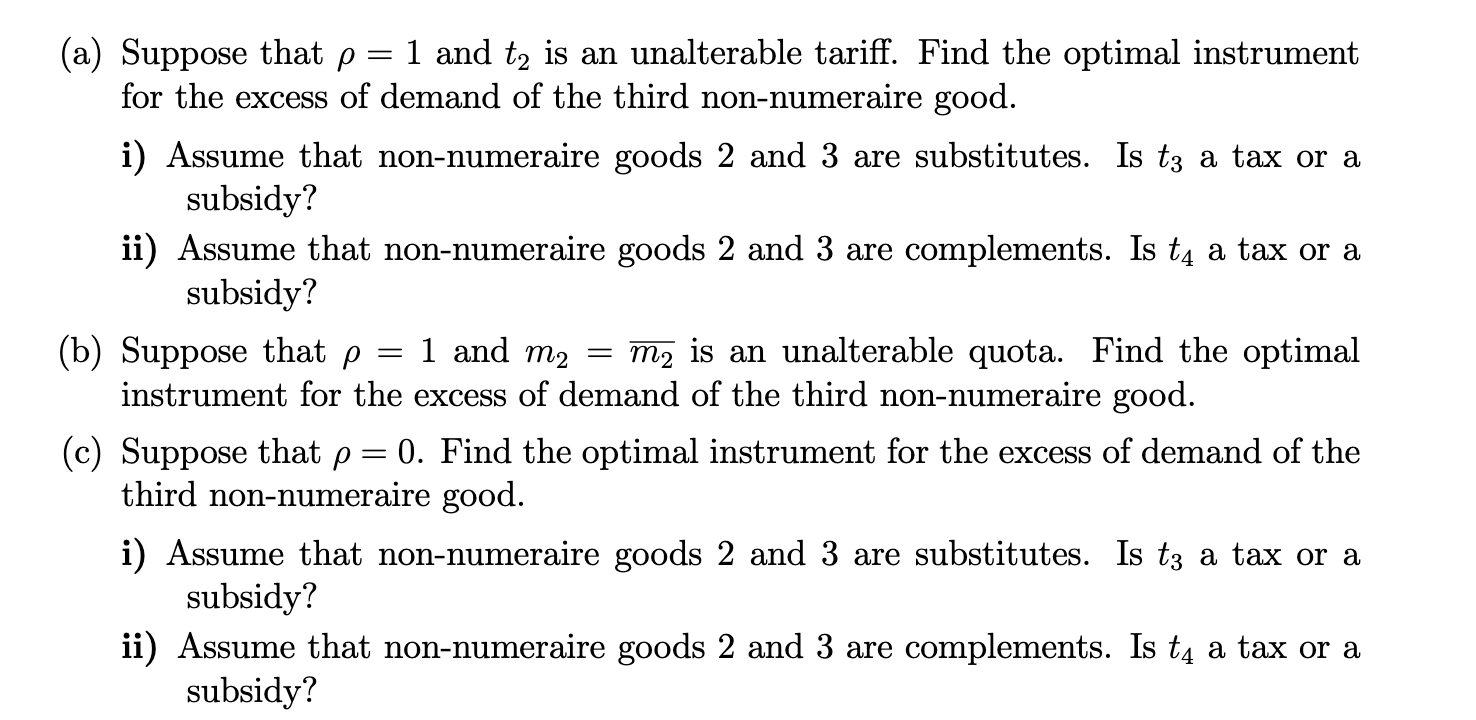

4. For the purpose of this exercise, the objective is to find an optimal "second best" trade tax. Suppose a representative consumer from a small open economy has the following budget restriction: e (1, p2 + t2, P3 + t3, u) = r (1, p2 + t2, P3 + t3, v) + pt2m2 + t3m3 = and P2 and Clearly, this small open economy has three productive sectors where p P3, stand for final goods' prices, the numeraire and the non-numeraire, respectively. On the one hand to represents a trade tariff applied to the second non-numeraire good, and on the other hand, t represents, in principle, a tariff. This small open economy plays the role of a net importer of both non-numeraire goods, so that m and m represent excess of demand functions for the non-numeraire final goods. In this context, p takes two possible values: 0 if there is a voluntary export restraint in place over the excess of demand of the second non-numeraire good, and 1, if there is a pure quota in place over the excess of demand of the second non-numeraire good. 19 (a) Suppose that p = 1 and t is an unalterable tariff. Find the optimal instrument for the excess of demand of the third non-numeraire good. i) Assume that non-numeraire goods 2 and 3 are substitutes. Is t a tax or a subsidy? ii) Assume that non-numeraire goods 2 and 3 are complements. Is t a tax or a subsidy? = (b) Suppose that p 1 and m = m is an unalterable quota. Find the optimal instrument for the excess of demand of the third non-numeraire good. (c) Suppose that p 0. Find the optimal instrument for the excess of demand of the third non-numeraire good. = i) Assume that non-numeraire goods 2 and 3 are substitutes. Is t3 a tax or a subsidy? ii) Assume that non-numeraire goods 2 and 3 are complements. Is t4 a tax or a subsidy? 4. For the purpose of this exercise, the objective is to find an optimal "second best" trade tax. Suppose a representative consumer from a small open economy has the following budget restriction: e (1, p2 + t2, P3 + t3, u) = r (1, p2 + t2, P3 + t3, v) + pt2m2 + t3m3 = and P2 and Clearly, this small open economy has three productive sectors where p P3, stand for final goods' prices, the numeraire and the non-numeraire, respectively. On the one hand to represents a trade tariff applied to the second non-numeraire good, and on the other hand, t represents, in principle, a tariff. This small open economy plays the role of a net importer of both non-numeraire goods, so that m and m represent excess of demand functions for the non-numeraire final goods. In this context, p takes two possible values: 0 if there is a voluntary export restraint in place over the excess of demand of the second non-numeraire good, and 1, if there is a pure quota in place over the excess of demand of the second non-numeraire good. 19 (a) Suppose that p = 1 and t is an unalterable tariff. Find the optimal instrument for the excess of demand of the third non-numeraire good. i) Assume that non-numeraire goods 2 and 3 are substitutes. Is t a tax or a subsidy? ii) Assume that non-numeraire goods 2 and 3 are complements. Is t a tax or a subsidy? = (b) Suppose that p 1 and m = m is an unalterable quota. Find the optimal instrument for the excess of demand of the third non-numeraire good. (c) Suppose that p 0. Find the optimal instrument for the excess of demand of the third non-numeraire good. = i) Assume that non-numeraire goods 2 and 3 are substitutes. Is t3 a tax or a subsidy? ii) Assume that non-numeraire goods 2 and 3 are complements. Is t4 a tax or a subsidy