Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. Forecastingandvaluation Construct pro-forma financial statements for XYZ Company for the fiscal years 2016 and 2017. (It is not required to complete a cash flow

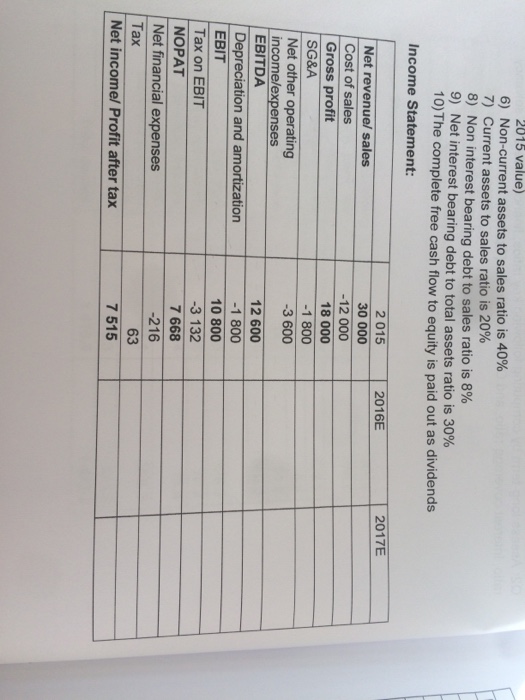

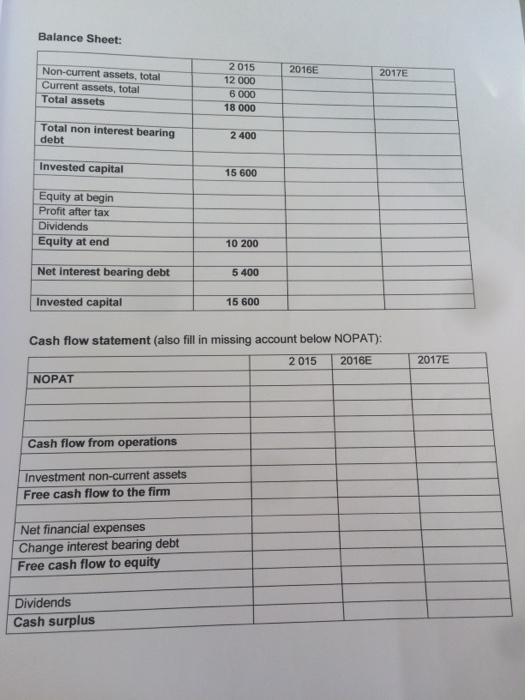

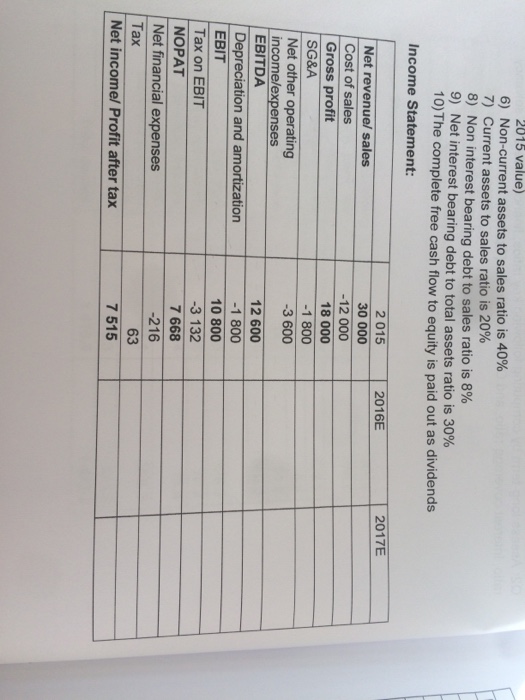

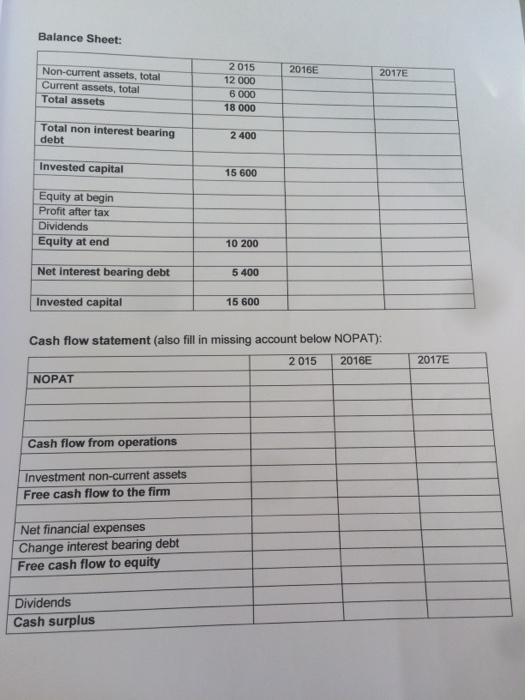

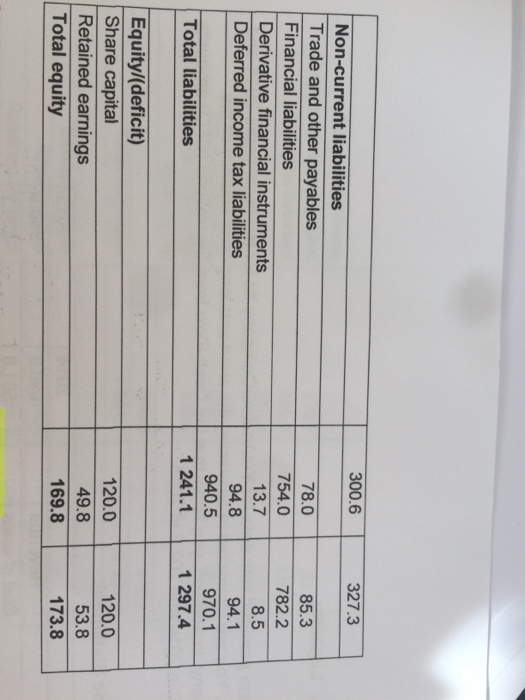

4. Forecastingandvaluation Construct pro-forma financial statements for XYZ Company for the fiscal years 2016 and 2017. (It is not required to complete a cash flow statement in 2015, but all lines required for 2016 and 2017). (each question below 8 points) Q1 balance sheet Q2 income statement, and Q3 cash flow statement Q4 Value the company using EVA valuation Q5 Value the company using DCF valuation Assumptions for forecast years: 1) T ax rate is 29% 2) Depreciation rate is 15% (use contemporaneous non-current assets as benchmark) 3) Sales grow with 3% per year 4) EBITDA margin is 35% 5) Cost of debt (interest paid on net interest bearing debt) is constant (use 2015 value) 6) Non-currentassetstosalesratiois40% 7) Current assets to sales ratio is 20% 8)Non interest bearing debt to sales ratio is 8% 9) Net interest bearing debt to total assets ratio is 30% 10)The complete free cash flow to equity is paid out as dividends

2015 value) 6) Non-current assets to sales ratio is 40% 7) Current assets to sales ratio is 20% 8) Non interest bearing debt to sales ratio is 8% 9) Net interest bearing debt to total assets ratio is 30% 10) The complete free cash flow to equity is paid out as dividends Income Statement 2016E 2017E 2 015 30 000 12000 18 000 -1 800 3 600 0 Net revenuel sales Cost of sales Gross profit SG&A Net other operating incomelexpenses EBITDA Depreciation and amortization EBIT Tax on EBIT NOPAT Net financial expenses Tax 12 600 1 800 10 800 3 132 7 668 -216 63 7 515 Net incomel Profit after tax

2015 value) 6) Non-current assets to sales ratio is 40% 7) Current assets to sales ratio is 20% 8) Non interest bearing debt to sales ratio is 8% 9) Net interest bearing debt to total assets ratio is 30% 10) The complete free cash flow to equity is paid out as dividends Income Statement 2016E 2017E 2 015 30 000 12000 18 000 -1 800 3 600 0 Net revenuel sales Cost of sales Gross profit SG&A Net other operating incomelexpenses EBITDA Depreciation and amortization EBIT Tax on EBIT NOPAT Net financial expenses Tax 12 600 1 800 10 800 3 132 7 668 -216 63 7 515 Net incomel Profit after tax

4. Forecastingandvaluation

Construct pro-forma financial statements for XYZ Company for the fiscal years 2016 and 2017. (It is not required to complete a cash flow statement in 2015, but all lines required for 2016 and 2017). (each question below 8 points)

Q1 balance sheet

Q2 income statement, and

Q3 cash flow statement

Q4 Value the company using EVA valuation Q5 Value the company using DCF valuation Assumptions for forecast years:

1) T ax rate is 29%

2) Depreciation rate is 15% (use contemporaneous non-current assets as

benchmark)

3) Sales grow with 3% per year

4) EBITDA margin is 35%

5) Cost of debt (interest paid on net interest bearing debt) is constant (use

2015 value)

6) Non-currentassetstosalesratiois40%

7) Current assets to sales ratio is 20%

8)Non interest bearing debt to sales ratio is 8%

9) Net interest bearing debt to total assets ratio is 30%

10)The complete free cash flow to equity is paid out as dividends

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started