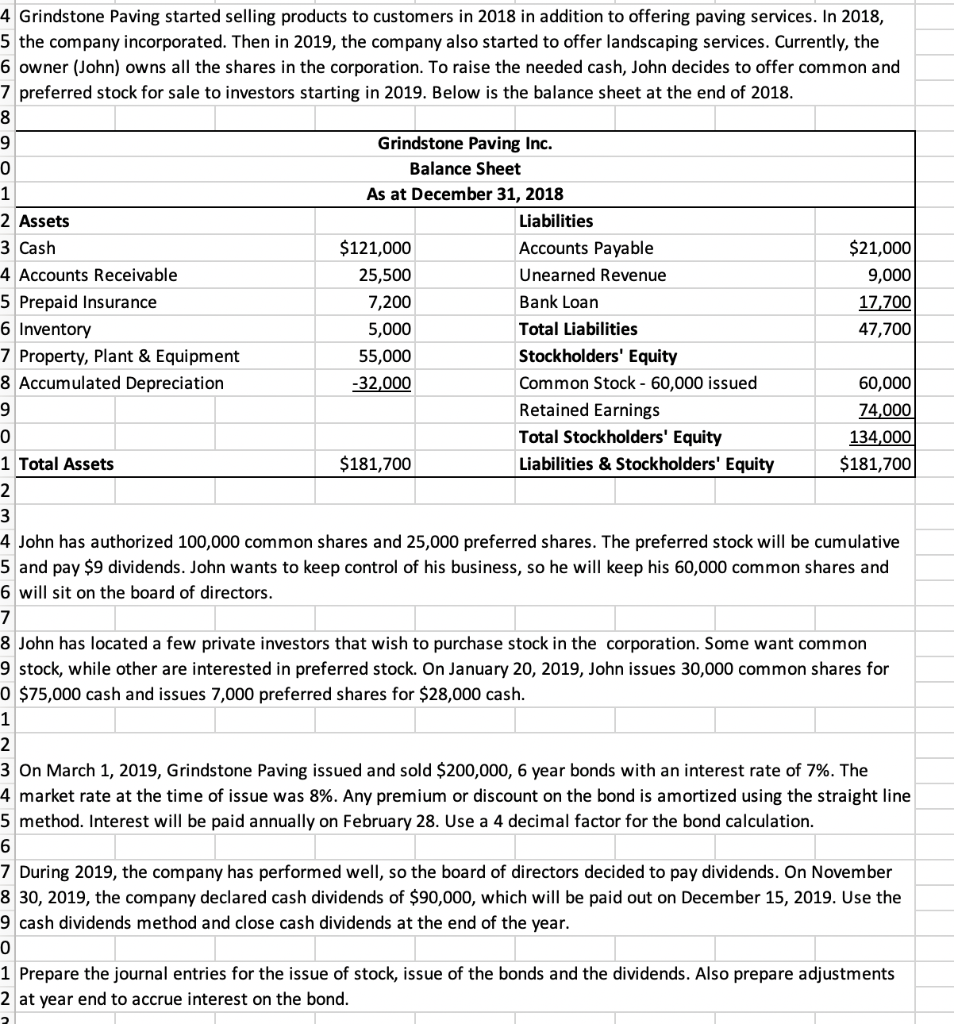

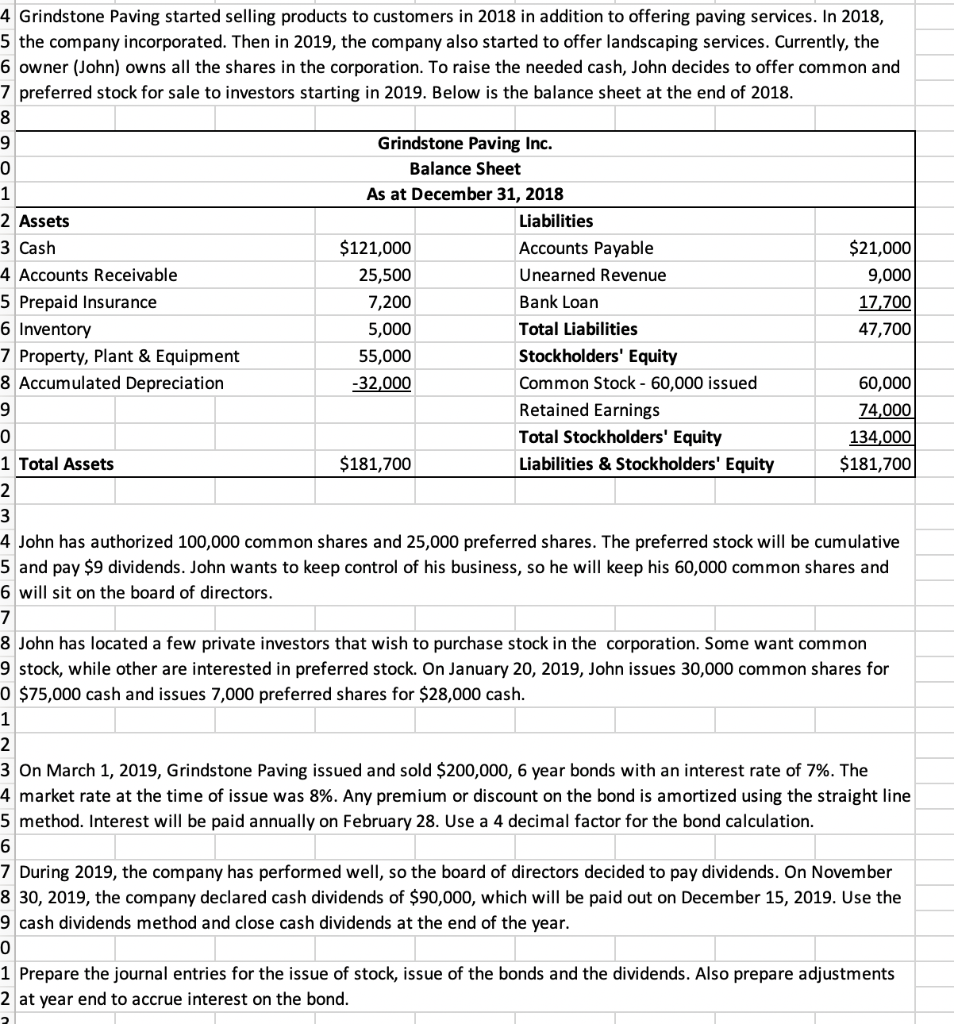

4 Grindstone Paving started selling products to customers in 2018 in addition to offering paving services. In 2018 5 the company incorporated. Then in 2019, the company also started to offer landscaping services. Currently, the 6 owner (John) owns all the shares in the corporation. To raise the needed cash, John decides to offer common and 7 preferred stock for sale to investors starting in 2019. Below is the balance sheet at the end of 2018 Grindstone Paving Inc. Balance Sheet As at December 31, 2018 0 2 Assets 3 Cash 4 Accounts Receivable 5 Prepaid Insurance 6 Inventory 7 Property, Plant & Equipment 8 Accumulated Depreciation Liabilities Accounts Payable Unearned Revenue Bank Loan Total Liabilities Stockholders' Equity Common Stock - 60,000 issued Retained Earnings Total Stockholders' Equity Liabilities & Stockholders' Equity $121,000 25,500 7,200 5,000 55,000 32,000 $21,000 9,000 17.700 47,700 60,000 74,000 134,000 $181,700 0 1 Total Assets $181,700 4 John has authorized 100,000 common shares and 25,000 preferred shares. The preferred stock will be cumulative 5 and pay $9 dividends. John wants to keep control of his business, so he will keep his 60,000 common shares and 6 will sit on the board of directors 8 John has located a few private investors that wish to purchase stock in the corporation. Some want common 9 stock, while other are interested in preferred stock. On January 20, 2019, John issues 30,000 common shares for 0 $75,000 cash and issues 7,000 preferred shares for $28,000 cash. 3 On March 1, 2019, Grindstone Paving issued and sold $200,000, 6 year bonds with an interest rate of 7%. The 4 market rate at the time of issue was 8%. Any premium or discount on the bond is amortized using the straight line 5 method. Interest will be paid annually on February 28. Use a 4 decimal factor for the bond calculation 7 During 2019, the company has performed well, so the board of directors decided to pay dividends. On November 8 30, 2019, the company declared cash dividends of $90,000, which will be paid out on December 15, 2019. Use the 9 cash dividends method and close cash dividends at the end of the year. 0 1 Prepare the journal entries for the issue of stock, issue of the bonds and the dividends. Also prepare adjustments 2 at year end to accrue interest on the bond