Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. Hedging: A Swedish firm based in the Swedish krone (SEK) seeks your advice in managing the exchange rate exposure on its US dollar (USD)

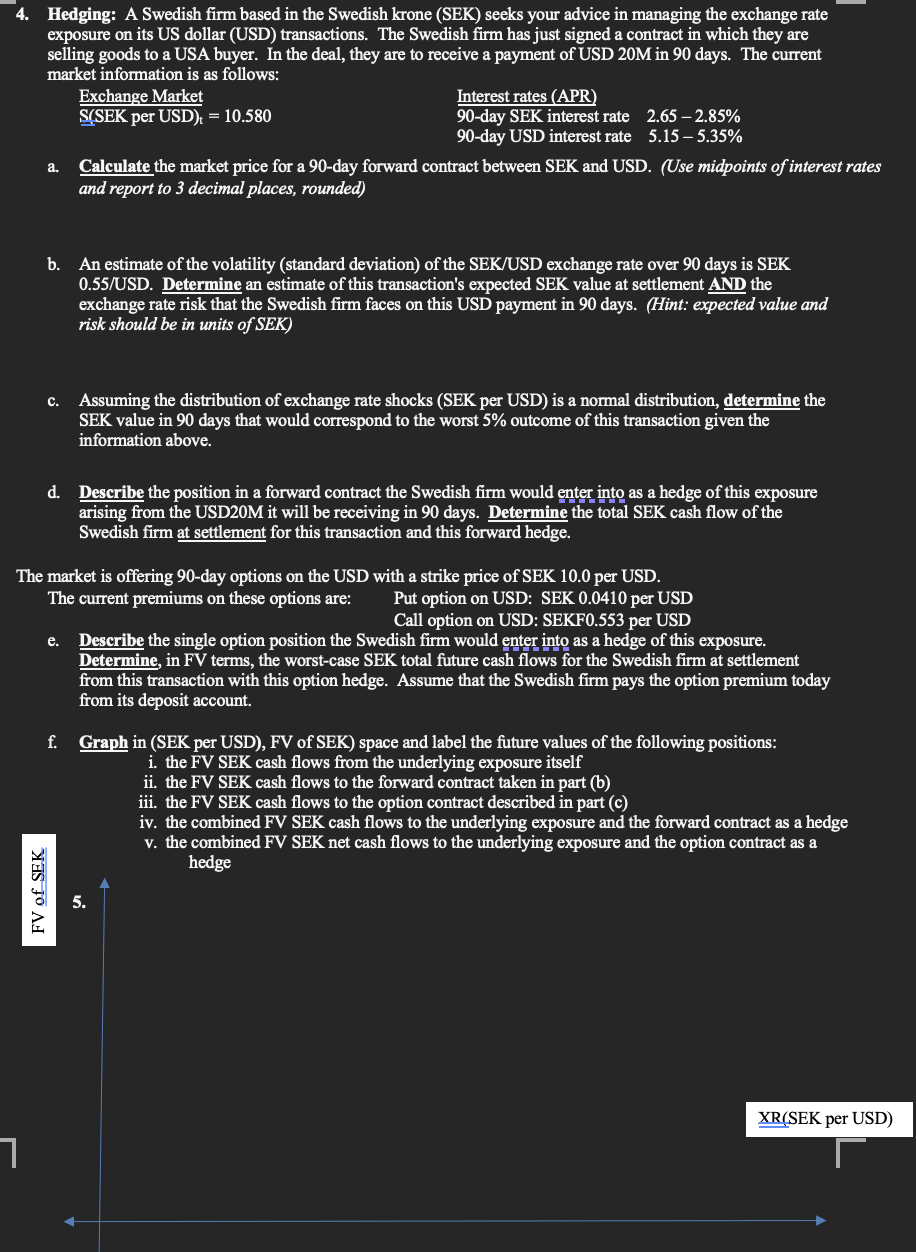

4. Hedging: A Swedish firm based in the Swedish krone (SEK) seeks your advice in managing the exchange rate exposure on its US dollar (USD) transactions. The Swedish firm has just signed a contract in which they are selling goods to a USA buyer. In the deal, they are to receive a payment of USD 20M in 90 days. The current market information is as follows: Exchange Market \\( \\underline{\\underline{\\text { S(SEK }} \\text { per USD) }} \\mathrm{t}=10.580 \\) Interest rates (APR) 90-day SEK interest rate \2.652.85 90-day USD interest rate \5.155.35 a. Calculate the market price for a 90-day forward contract between SEK and USD. (Use midpoints of interest rates and report to 3 decimal places, rounded) b. An estimate of the volatility (standard deviation) of the SEK/USD exchange rate over 90 days is SEK 0.55/USD. Determine an estimate of this transaction's expected SEK value at settlement \\( \\mathbf{A N D} \\) the exchange rate risk that the Swedish firm faces on this USD payment in 90 days. (Hint: expected value and risk should be in units of SEK) c. Assuming the distribution of exchange rate shocks (SEK per USD) is a normal distribution, determine the SEK value in 90 days that would correspond to the worst \5 outcome of this transaction given the information above. d. Describe the position in a forward contract the Swedish firm would enter into as a hedge of this exposure arising from the USD20M it will be receiving in 90 days. Determine the total SEK cash flow of the Swedish firm at settlement for this transaction and this forward hedge. The market is offering 90-day options on the USD with a strike price of SEK 10.0 per USD. The current premiums on these options are: Put option on USD: SEK 0.0410 per USD Call option on USD: SEKF 0.553 per USD e. Describe the single option position the Swedish firm would enter into as a hedge of this exposure. Determine, in FV terms, the worst-case SEK total future cash flows for the Swedish firm at settlement from this transaction with this option hedge. Assume that the Swedish firm pays the option premium today from its deposit account. f. Graph in (SEK per USD), FV of SEK) space and label the future values of the following positions: i. the FV SEK cash flows from the underlying exposure itself ii. the FV SEK cash flows to the forward contract taken in part (b) iii. the FV SEK cash flows to the option contract described in part (c) iv. the combined FV SEK cash flows to the underlying exposure and the forward contract as a hedge v. the combined FV SEK net cash flows to the underlying exposure and the option contract as a hedge 5. 4. Hedging: A Swedish firm based in the Swedish krone (SEK) seeks your advice in managing the exchange rate exposure on its US dollar (USD) transactions. The Swedish firm has just signed a contract in which they are selling goods to a USA buyer. In the deal, they are to receive a payment of USD 20M in 90 days. The current market information is as follows: Exchange Market \\( \\underline{\\underline{\\text { S(SEK }} \\text { per USD) }} \\mathrm{t}=10.580 \\) Interest rates (APR) 90-day SEK interest rate \2.652.85 90-day USD interest rate \5.155.35 a. Calculate the market price for a 90-day forward contract between SEK and USD. (Use midpoints of interest rates and report to 3 decimal places, rounded) b. An estimate of the volatility (standard deviation) of the SEK/USD exchange rate over 90 days is SEK 0.55/USD. Determine an estimate of this transaction's expected SEK value at settlement \\( \\mathbf{A N D} \\) the exchange rate risk that the Swedish firm faces on this USD payment in 90 days. (Hint: expected value and risk should be in units of SEK) c. Assuming the distribution of exchange rate shocks (SEK per USD) is a normal distribution, determine the SEK value in 90 days that would correspond to the worst \5 outcome of this transaction given the information above. d. Describe the position in a forward contract the Swedish firm would enter into as a hedge of this exposure arising from the USD20M it will be receiving in 90 days. Determine the total SEK cash flow of the Swedish firm at settlement for this transaction and this forward hedge. The market is offering 90-day options on the USD with a strike price of SEK 10.0 per USD. The current premiums on these options are: Put option on USD: SEK 0.0410 per USD Call option on USD: SEKF 0.553 per USD e. Describe the single option position the Swedish firm would enter into as a hedge of this exposure. Determine, in FV terms, the worst-case SEK total future cash flows for the Swedish firm at settlement from this transaction with this option hedge. Assume that the Swedish firm pays the option premium today from its deposit account. f. Graph in (SEK per USD), FV of SEK) space and label the future values of the following positions: i. the FV SEK cash flows from the underlying exposure itself ii. the FV SEK cash flows to the forward contract taken in part (b) iii. the FV SEK cash flows to the option contract described in part (c) iv. the combined FV SEK cash flows to the underlying exposure and the forward contract as a hedge v. the combined FV SEK net cash flows to the underlying exposure and the option contract as a hedge 5

4. Hedging: A Swedish firm based in the Swedish krone (SEK) seeks your advice in managing the exchange rate exposure on its US dollar (USD) transactions. The Swedish firm has just signed a contract in which they are selling goods to a USA buyer. In the deal, they are to receive a payment of USD 20M in 90 days. The current market information is as follows: Exchange Market \\( \\underline{\\underline{\\text { S(SEK }} \\text { per USD) }} \\mathrm{t}=10.580 \\) Interest rates (APR) 90-day SEK interest rate \2.652.85 90-day USD interest rate \5.155.35 a. Calculate the market price for a 90-day forward contract between SEK and USD. (Use midpoints of interest rates and report to 3 decimal places, rounded) b. An estimate of the volatility (standard deviation) of the SEK/USD exchange rate over 90 days is SEK 0.55/USD. Determine an estimate of this transaction's expected SEK value at settlement \\( \\mathbf{A N D} \\) the exchange rate risk that the Swedish firm faces on this USD payment in 90 days. (Hint: expected value and risk should be in units of SEK) c. Assuming the distribution of exchange rate shocks (SEK per USD) is a normal distribution, determine the SEK value in 90 days that would correspond to the worst \5 outcome of this transaction given the information above. d. Describe the position in a forward contract the Swedish firm would enter into as a hedge of this exposure arising from the USD20M it will be receiving in 90 days. Determine the total SEK cash flow of the Swedish firm at settlement for this transaction and this forward hedge. The market is offering 90-day options on the USD with a strike price of SEK 10.0 per USD. The current premiums on these options are: Put option on USD: SEK 0.0410 per USD Call option on USD: SEKF 0.553 per USD e. Describe the single option position the Swedish firm would enter into as a hedge of this exposure. Determine, in FV terms, the worst-case SEK total future cash flows for the Swedish firm at settlement from this transaction with this option hedge. Assume that the Swedish firm pays the option premium today from its deposit account. f. Graph in (SEK per USD), FV of SEK) space and label the future values of the following positions: i. the FV SEK cash flows from the underlying exposure itself ii. the FV SEK cash flows to the forward contract taken in part (b) iii. the FV SEK cash flows to the option contract described in part (c) iv. the combined FV SEK cash flows to the underlying exposure and the forward contract as a hedge v. the combined FV SEK net cash flows to the underlying exposure and the option contract as a hedge 5. 4. Hedging: A Swedish firm based in the Swedish krone (SEK) seeks your advice in managing the exchange rate exposure on its US dollar (USD) transactions. The Swedish firm has just signed a contract in which they are selling goods to a USA buyer. In the deal, they are to receive a payment of USD 20M in 90 days. The current market information is as follows: Exchange Market \\( \\underline{\\underline{\\text { S(SEK }} \\text { per USD) }} \\mathrm{t}=10.580 \\) Interest rates (APR) 90-day SEK interest rate \2.652.85 90-day USD interest rate \5.155.35 a. Calculate the market price for a 90-day forward contract between SEK and USD. (Use midpoints of interest rates and report to 3 decimal places, rounded) b. An estimate of the volatility (standard deviation) of the SEK/USD exchange rate over 90 days is SEK 0.55/USD. Determine an estimate of this transaction's expected SEK value at settlement \\( \\mathbf{A N D} \\) the exchange rate risk that the Swedish firm faces on this USD payment in 90 days. (Hint: expected value and risk should be in units of SEK) c. Assuming the distribution of exchange rate shocks (SEK per USD) is a normal distribution, determine the SEK value in 90 days that would correspond to the worst \5 outcome of this transaction given the information above. d. Describe the position in a forward contract the Swedish firm would enter into as a hedge of this exposure arising from the USD20M it will be receiving in 90 days. Determine the total SEK cash flow of the Swedish firm at settlement for this transaction and this forward hedge. The market is offering 90-day options on the USD with a strike price of SEK 10.0 per USD. The current premiums on these options are: Put option on USD: SEK 0.0410 per USD Call option on USD: SEKF 0.553 per USD e. Describe the single option position the Swedish firm would enter into as a hedge of this exposure. Determine, in FV terms, the worst-case SEK total future cash flows for the Swedish firm at settlement from this transaction with this option hedge. Assume that the Swedish firm pays the option premium today from its deposit account. f. Graph in (SEK per USD), FV of SEK) space and label the future values of the following positions: i. the FV SEK cash flows from the underlying exposure itself ii. the FV SEK cash flows to the forward contract taken in part (b) iii. the FV SEK cash flows to the option contract described in part (c) iv. the combined FV SEK cash flows to the underlying exposure and the forward contract as a hedge v. the combined FV SEK net cash flows to the underlying exposure and the option contract as a hedge 5 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started