Answered step by step

Verified Expert Solution

Question

1 Approved Answer

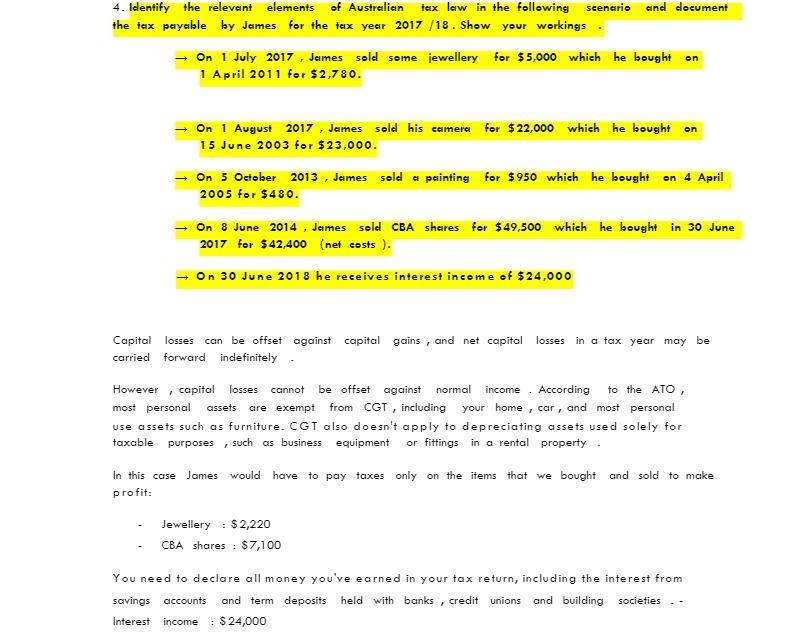

4. Identify the relevant elements of Australian tax law in the following scenario and document the tax payable by James for the tax year

4. Identify the relevant elements of Australian tax law in the following scenario and document the tax payable by James for the tax year 2017 /18. Show your workings. On 1 July 2017, James sold some jewellery for $5,000 which he bought on 1 April 2011 for $2,780. On 1 August 2017, James sold his camera for $22,000 which he bought on 15 June 2003 for $23,000. On 5 October 2013, James sold a painting for $950 which he bought on 4 April 2005 for $480. On 8 June 2014, James sold CBA shares for $49,500 which he bought in 30 June 2017 for $42,400 (net costs). On 30 June 2018 he receives interest income of $24,000 Capital losses can be offset against capital gains, and net capital losses in a tax year may be carried forward indefinitely However , capital losses cannot be offset against normal income According to the ATO, most personal assets are exempt from CGT, including your home, car, and most personal use assets such as furniture. CGT also doesn't apply to depreciating assets used solely for taxable purposes such as business equipment or fittings in a rental property. I In this case James would have to pay taxes only on the items that we bought and sold to make profit: Jewellery : $2,220 CBA shares $7,100 You need to declare all money you've earned in your tax return, including the interest from savings accounts and term deposits held with banks credit unions and building societies. Interest income : $ 24,000 7

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Tax on Jewellery Capital gain 5000 2780 2220 James Capital Gain for this transaction is not eligible ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started