Answered step by step

Verified Expert Solution

Question

1 Approved Answer

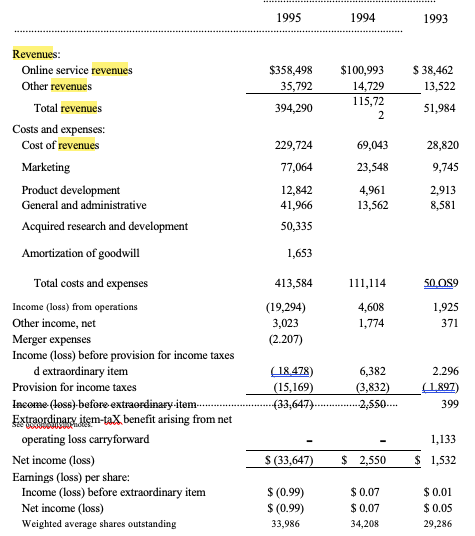

4. If all the SAC's which had been INCURRED during the year 1995 had been expensed, illustrate how the 1995 income statement would have

4. If all the SAC's which had been INCURRED during the year 1995 had been expensed, illustrate how the 1995 income statement would have been affected (using after-tax dollar amounts). In your explanation be sure to clearly reference your amounts. Revenues: Online service revenues Other revenues Total revenues Costs and expenses: Cost of revenues Marketing Product development General and administrative Acquired research and development Amortization of goodwill Total costs and expenses Income (loss) from operations Other income, net Merger expenses Income (loss) before provision for income taxes d extraordinary item Provision for income taxes Income (loss)-before-extraordinary-item Extraordinary item-tax benefit arising from net operating loss carryforward Net income (loss) Earnings (loss) per share: Income (loss) before extraordinary item Net income (loss) Weighted average shares outstanding 1995 $358,498 35,792 394,290 229,724 77,064 12,842 41,966 50,335 1,653 413,584 (19,294) 3,023 (2.207) (18.478) (15,169) --(33,647).. $ (33,647) $ (0.99) $ (0.99) 33,986 1994 $100,993 14,729 115,72 2 69,043 23,548 4,961 13,562 111,114 4,608 1,774 6,382 (3,832) -2,550.... $ 2,550 $ 0.07 $ 0.07 34,208 1993 $ 38,462 13,522 51,984 28,820 9,745 2,913 8,581 50.089 1,925 371 2.296 (1897) 399 1,133 $ 1,532 $ 0.01 $ 0.05 29,286

Step by Step Solution

★★★★★

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

all SAEs which had been Incurred during the your Spen expensed n lore would be affecte...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started