Question

4. If the retrofit project is financed with a bank loan, what should be the loan interest rate so that the annual energy savings are

4. If the retrofit project is financed with a bank loan, what should be the loan interest rate so that the annual energy savings are able to pay back the annual loan payments?

Assume an increase on the natural gas unit price and electricity of 3% annually; assume an inflation rate of 0%. (Hint: use an IRR analysis (or RATE), once you transform your inflows (savings) to annualized payments).

5. Carbon emissions reductions through energy retrofitting measures (optional question/ additional grading points): Due to the low cost of energy in Canada, energy retrofitting measures are (usually) not financially profitable. A carbon emissions reduction financial incentive could provide additional motivation to homeowners to undertake such energy savings measures.

a. Evaluate the proposed energy retrofitting measures based on a Life Cycle Costing (LCC) analysis, if an incentive of 50$/ton CO2,red is available ($50 for every ton CO2 that was reduced through the energy retrofitting measures) for the carbon emissions savings (in tonnes CO2) that were achieved through your energy retrofitting measures. The financial incentive is subject to a 2% increase every year. An increase on the natural gas unit price and electricity of 3% annually and an inflation rate of 2% is expected. (Hint: add the carbon emissions incentive value to the inflows of case 3 previously and find the new NPV, or PW).

b. It is argued that if the value of the carbon emissions reductions incentive is increased, more homeowners will be willing to undertake energy retrofitting measures. In the case that your NPV under a) previously is negative, what should be the value of the carbon incentive (in $/ton CO2,red) so that the NPV of your cash flow is zero? (Hint: let x= value of the incentive in $/ton CO2,red, set the NPV to zero and solve for x). Use the following information for your calculations: ?

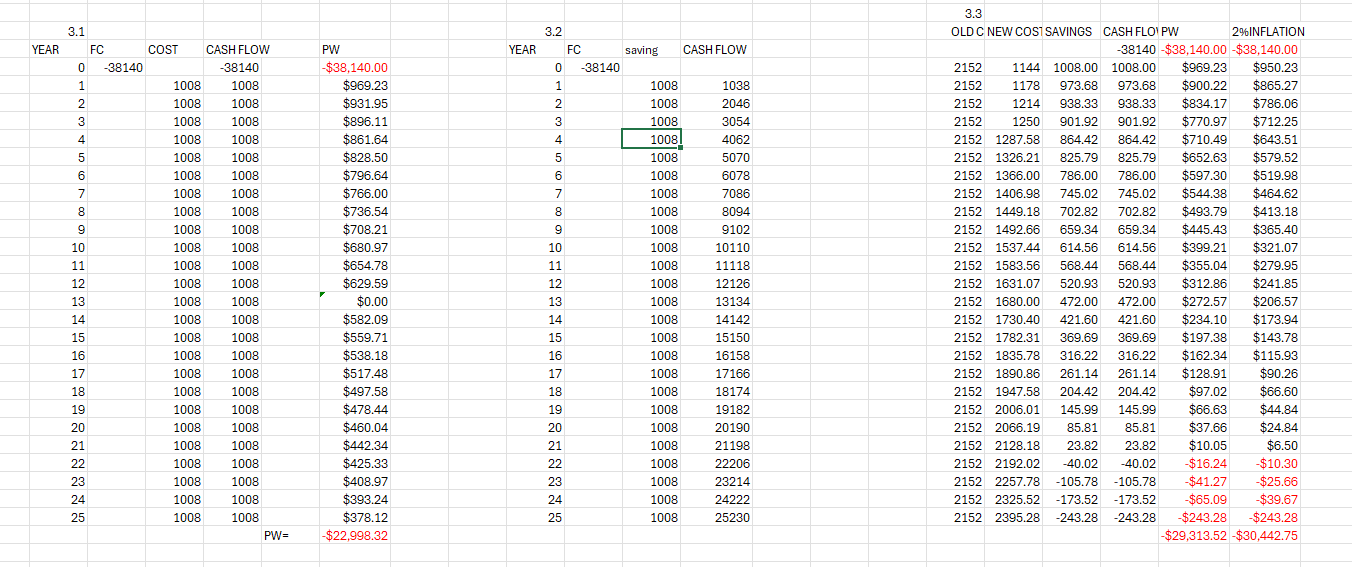

Assume 25 years for the lifetime of the retrofitting measures. ? Use an interest rate of 4% for your calculations. You may use your personal MARR (e.g., an interest rate that you use for your investments). ? You may (or may not) want to add a salvage value to the insulation (e.g., 10% of the initial value), since insulation upgrades may last up to 40 years. the photo shows the reulte of quotations 1,2,3. you just need to answer 4 and 5

YEAR 3.1 3.2 3.3 OLD C NEW COST SAVINGS CASH FLO! PW FC COST CASH FLOW PW YEAR FC saving CASH FLOW 0 -38140 -38140 -$38,140.00 0 -38140 2152 1 1008 1008 $969.23 1 1008 1038 2152 2 1008 1008 $931.95 2 1008 2046 2152 3 1008 1008 $896.11 3 1008 3054 2152 4 1008 1008 $861.64 4 1008 4062 5 1008 1008 $828.50 5 1008 5070 6 1008 1008 $796.64 6 1008 6078 7 1008 1008 $766.00 7 1008 7086 8 1008 1008 $736.54 8 1008 8094 9 1008 1008 $708.21 9 1008 9102 10 1008 1008 $680.97 10 1008 10110 11 1008 1008 $654.78 11 1008 11118 12 1008 1008 $629.59 12 1008 12126 13 1008 1008 $0.00 13 1008 13134 14 1008 1008 $582.09 14 1008 14142 15 1008 1008 $559.71 15 1008 15150 16 1008 1008 $538.18 16 1008 16158 17 1008 1008 $517.48 17 1008 17166 18 1008 1008 $497.58 19 1008 1008 $478.44 19 20 1008 1008 $460.04 20 21 1008 1008 $442.34 22 1008 1008 $425.33 23 1008 1008 $408.97 24 1008 1008 $393.24 25 1008 1008 $378.12 25 22222222 18 1008 18174 261.14 261.14 204.42 204.42 1008 19182 145.99 145.99 2%INFLATION -38140 -$38,140.00 -$38,140.00 1144 1008.00 1008.00 $969.23 $950.23 1178 973.68 973.68 $900.22 $865.27 1214 938.33 938.33 $834.17 $786.06 1250 901.92 901.92 $770.97 $712.25 2152 1287.58 864.42 864.42 $710.49 $643.51 2152 1326.21 825.79 825.79 $652.63 $579.52 2152 1366.00 786.00 786.00 $597.30 $519.98 2152 1406.98 745.02 745.02 $544.38 $464.62 2152 1449.18 702.82 702.82 $493.79 $413.18 2152 1492.66 659.34 659.34 $445.43 $365.40 2152 1537.44 614.56 614.56 $399.21 $321.07 2152 1583.56 568.44 568.44 $355.04 $279.95 2152 1631.07 520.93 520.93 $312.86 $241.85 2152 1680.00 472.00 472.00 $272.57 $206.57 2152 1730.40 421.60 421.60 $234.10 $173.94 2152 1782.31 369.69 369.69 $197.38 2152 1835.78 316.22 316.22 2152 1890.86 2152 1947.58 2152 2006.01 $143.78 $162.34 $115.93 $128.91 $90.26 $97.02 $66.60 $66.63 $44.84 1008 20190 21 1008 21198 1008 22206 23 1008 23214 24 1008 24222 1008 25230 2152 2066.19 2152 2128.18 23.82 23.82 2152 2192.02 -40.02 -40.02 2152 2257.78 -105.78 -105.78 2152 2325.52 -173.52 -173.52 2152 2395.28 -243.28 -243.28 85.81 85.81 $37.66 $24.84 $10.05 $6.50 PW= -$22,998.32 -$16.24 -$10.30 -$41.27 -$25.66 -$65.09 -$39.67 -$243.28 -$243.28 -$29,313.52 -$30,442.75

Step by Step Solution

There are 3 Steps involved in it

Step: 1

4 Loan Interest Rate for Annual Energy Savings to Pay Back Loan To determine the loan interest rate needed for annual energy savings to pay back the l...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started