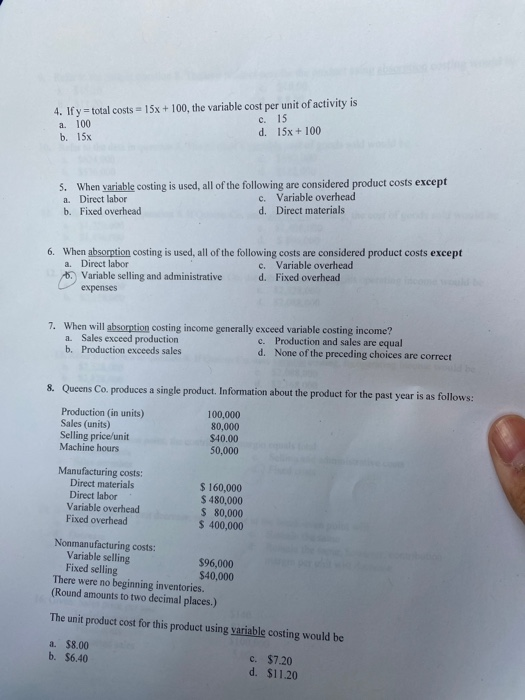

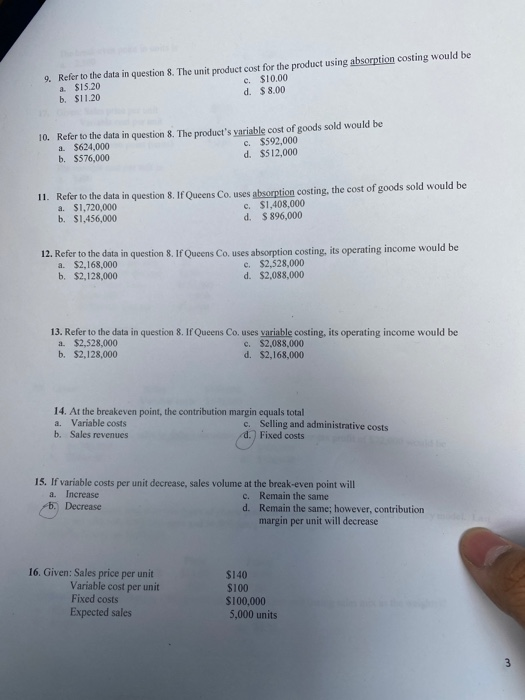

4. If y = total costs=15x + 100, the variable cost per unit of activity is a 100 c. 15 b. 15x d. 15x + 100 5. When variable costing is used, all of the following are considered product costs except a. Direct labor c. Variable overhead b. Fixed overhead d. Direct materials 6. When absorption costing is used, all of the following costs are considered product costs except a. Direct labor C. Variable overhead Variable selling and administrative d. Fixed overhead expenses 7. When will absorption costing income generally exceed variable costing income? a Sales exceed production c. Production and sales are equal b. Production exceeds sales d. None of the preceding choices are correct 8. Queens Co. produces a single product. Information about the product for the past year is as follows: Production (in units) Sales (units) Selling price/unit Machine hours 100,000 80,000 $40.00 50,000 Manufacturing costs: Direct materials Direct labor Variable overhead Fixed overhead $ 160,000 $ 480,000 $ 80,000 $ 400,000 Nonmanufacturing costs: Variable selling $96,000 Fixed selling $40,000 There were no beginning inventories. (Round amounts to two decimal places.) The unit product cost for this product using variable costing would be a. $8.00 b. $6.40 c. $7.20 d. $11.20 9. Refer to the data in question 8. The unit product cost for the product using absorption costing would be a $15.20 c. $10.00 b. $11.20 d. $8.00 10. Refer to the data in question 8. The product's variable cost of goods sold would be a $624,000 c. $592,000 b. $576,000 d. $512,000 11. Refer to the data in question 8. If Queens Co. uses absorption costing, the cost of goods sold would be a. $1,720,000 c. $1,408,000 b. $1,456,000 d. $ 896,000 12. Refer to the data in question 8. If Queens Couses absorption costing, its operating income would be a. $2,168,000 c. $2,528,000 b. $2,128,000 d. $2,088,000 13. Refer to the data in question 8. If Queens Co. uses variable costing, its operating income would be a $2,528,000 c. $2,088,000 b. $2,128,000 d. $2,168,000 14. At the breakeven point, the contribution margin equals total a. Variable costs c. Selling and administrative costs b. Sales revenues d. Fixed costs 15. If variable costs per unit decrease, sales volume at the break-even point will a. Increase c. Remain the same b. Decrease d. Remain the same; however, contribution margin per unit will decrease 16. Given: Sales price per unit Variable cost per unit Fixed costs Expected sales $140 $100 $100,000 5,000 units