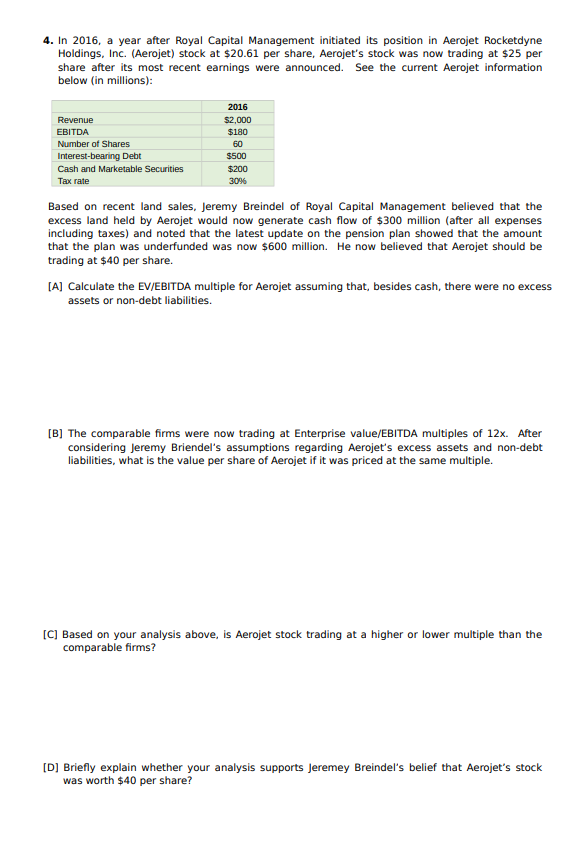

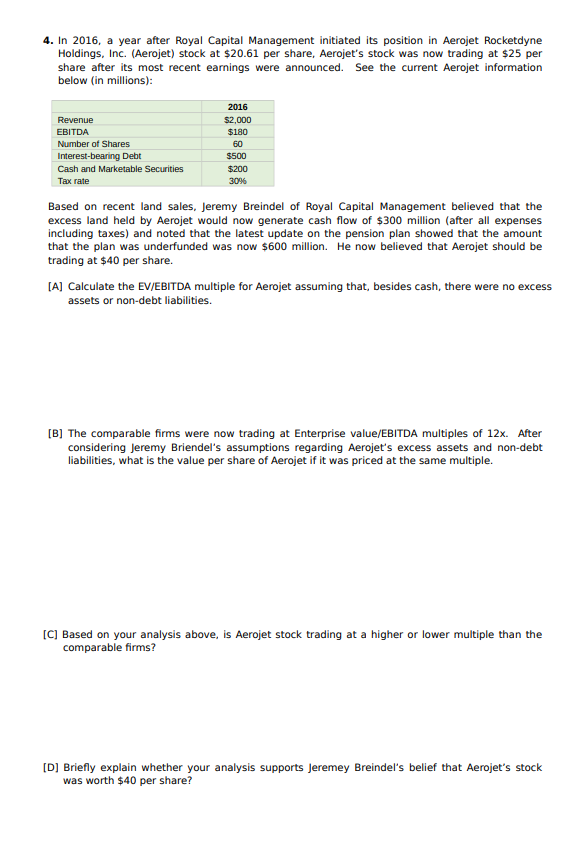

4. In 2016, a year after Royal Capital Management initiated its position in Aerojet Rocketdyne Holdings, Inc. (Aerojet) stock at $20.61 per share, Aerojet's stock was now trading at $25 per share after its most recent earnings were announced. See the current Aerojet information below (in millions): Revenue EBITDA Number of Shares Interest-bearing Debt Cash and Marketable Securities Tax rate 2016 $2,000 $180 60 $500 $200 3096 Based on recent land sales, Jeremy Breindel of Royal Capital Management believed that the excess land held by Aerojet would now generate cash flow of $300 million (after all expenses including taxes) and noted that the latest update on the pension plan showed that the amount that the plan was underfunded was now $600 million. He now believed that Aerojet should be trading at $40 per share. [A] Calculate the EV/EBITDA multiple for Aerojet assuming that, besides cash, there were no excess assets or non-debt liabilities. [B] The comparable firms were now trading at Enterprise value/EBITDA multiples of 12x. After considering Jeremy Briendel's assumptions regarding Aerojet's excess assets and non-debt liabilities, what is the value per share of Aerojet if it was priced at the same multiple. [C] Based on your analysis above, is Aerojet stock trading at a higher or lower multiple than the comparable firms? [D] Briefly explain whether your analysis supports Jeremey Breindel's belief that Aerojet's stock was worth $40 per share? 4. In 2016, a year after Royal Capital Management initiated its position in Aerojet Rocketdyne Holdings, Inc. (Aerojet) stock at $20.61 per share, Aerojet's stock was now trading at $25 per share after its most recent earnings were announced. See the current Aerojet information below (in millions): Revenue EBITDA Number of Shares Interest-bearing Debt Cash and Marketable Securities Tax rate 2016 $2,000 $180 60 $500 $200 3096 Based on recent land sales, Jeremy Breindel of Royal Capital Management believed that the excess land held by Aerojet would now generate cash flow of $300 million (after all expenses including taxes) and noted that the latest update on the pension plan showed that the amount that the plan was underfunded was now $600 million. He now believed that Aerojet should be trading at $40 per share. [A] Calculate the EV/EBITDA multiple for Aerojet assuming that, besides cash, there were no excess assets or non-debt liabilities. [B] The comparable firms were now trading at Enterprise value/EBITDA multiples of 12x. After considering Jeremy Briendel's assumptions regarding Aerojet's excess assets and non-debt liabilities, what is the value per share of Aerojet if it was priced at the same multiple. [C] Based on your analysis above, is Aerojet stock trading at a higher or lower multiple than the comparable firms? [D] Briefly explain whether your analysis supports Jeremey Breindel's belief that Aerojet's stock was worth $40 per share