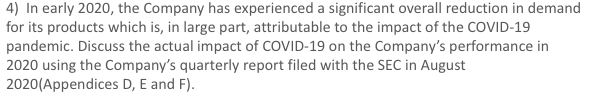

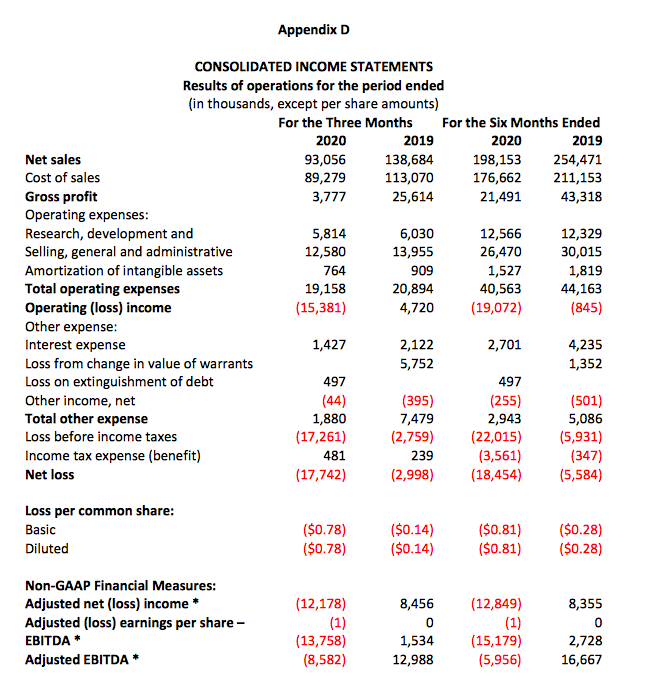

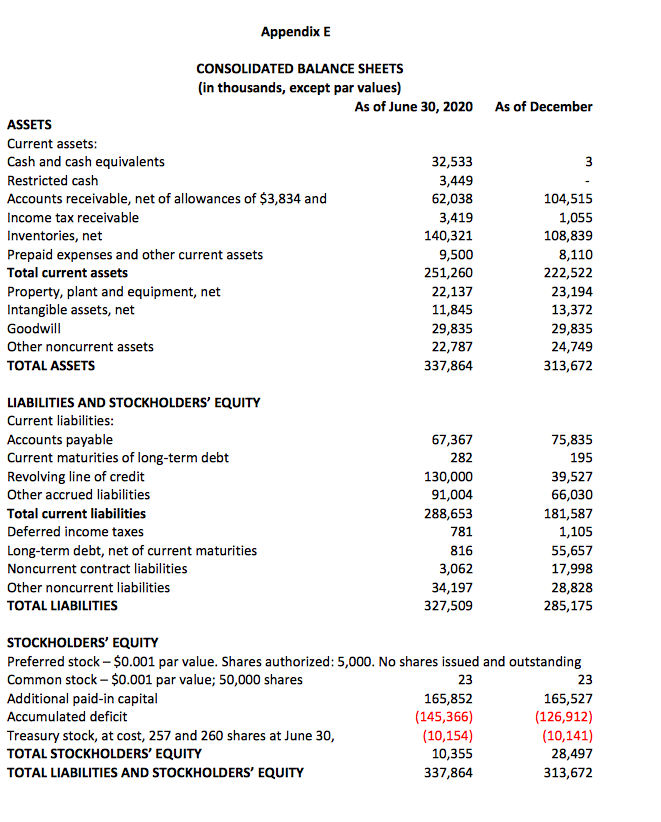

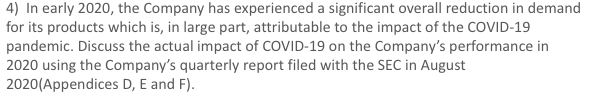

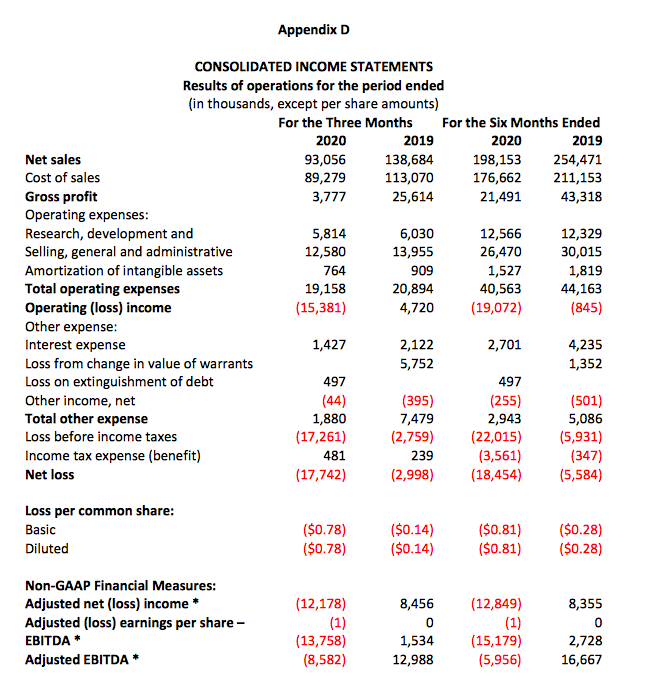

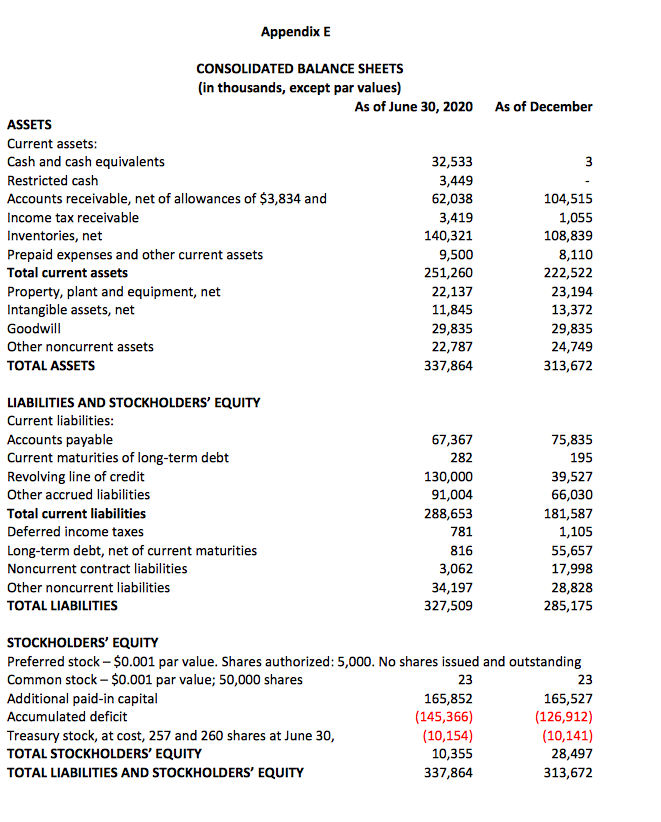

4) In early 2020, the Company has experienced a significant overall reduction in demand for its products which is, in large part, attributable to the impact of the COVID-19 pandemic. Discuss the actual impact of COVID-19 on the Company's performance in 2020 using the Company's quarterly report filed with the SEC in August 2020(Appendices D, E and F). Appendix D CONSOLIDATED INCOME STATEMENTS Results of operations for the period ended (in thousands, except per share amounts) For the Three Months For the Six Months Ended 2020 2019 2020 2019 Net sales 93,056 138,684 198,153 254,471 Cost of sales 89,279 113,070 176,662 211,153 Gross profit 3,777 25,614 21,491 43,318 Operating expenses: Research, development and 5,814 6,030 12,566 12,329 Selling, general and administrative 12,580 13,955 26,470 30,015 Amortization of intangible assets 764 909 1,527 1,819 Total operating expenses 19,158 20,894 40,563 44,163 Operating (loss) income (15,381) 4,720 (19,072) (845) Other expense: Interest expense 1,427 2,122 2,701 4,235 Loss from change in value of warrants 5,752 1,352 Loss on extinguishment of debt 497 497 Other income, net (44) (395) (255) (501) Total other expense 1,880 7,479 2,943 5,086 Loss before income taxes (17,261) (2, (22,015) Income tax expense (benefit) 481 239 (3,561) (347) Net loss (17,742) (2,998) (18,454) (5,584) Loss per common share: Basic Diluted ($0.78) ($0.78) ($0.14) ($0.14) ($0.81) ($0.81) ($0.28) ($0.28) Non-GAAP Financial Measures: Adjusted net (Loss) income * Adjusted (loss) earnings per share - EBITDA* Adjusted EBITDA* (12,178) (1) (13,758) (8,582) 8,456 0 1,534 12,988 (12,849) (1) (15,179) (5,956) 8,355 0 2,728 16,667 Appendix E As of December 3 CONSOLIDATED BALANCE SHEETS (in thousands, except par values) As of June 30, 2020 ASSETS Current assets: Cash and cash equivalents 32,533 Restricted cash 3,449 Accounts receivable, net of allowances of $3,834 and 62,038 Income tax receivable 3,419 Inventories, net 140,321 Prepaid expenses and other current assets 9,500 Total current assets 251,260 Property, plant and equipment, net 22,137 Intangible assets, net 11,845 Goodwill 29,835 Other noncurrent assets 22,787 TOTAL ASSETS 337,864 104,515 1,055 108,839 8,110 222,522 23,194 13,372 29,835 24,749 313,672 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Current maturities of long-term debt Revolving line of credit Other accrued liabilities Total current liabilities Deferred income taxes Long-term debt, net of current maturities Noncurrent contract liabilities Other noncurrent liabilities TOTAL LIABILITIES 67,367 282 130,000 91,004 288,653 781 816 3,062 34,197 327,509 75,835 195 39,527 66,030 181,587 1,105 55,657 17,998 28,828 285,175 STOCKHOLDERS' EQUITY Preferred stock - $0.001 par value. Shares authorized: 5,000. No shares issued and outstanding Common stock - $0.001 par value; 50,000 shares 23 23 Additional paid-in capital 165,852 165,527 Accumulated deficit (145,366) (126,912) Treasury stock, at cost, 257 and 260 shares at June 30, (10,154) (10,141) TOTAL STOCKHOLDERS' EQUITY 10,355 28,497 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY 337,864 313,672 Appendix F CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) For the Six Months Ended June 30, 2020 2019 (18,454) (5,584) 1,527 2,608 1,819 2,605 1,352 928 361 (458) 317 609 (323) 497 253 (68) Cash provided by operating activities Net loss Adjustments to reconcile net loss to net cash provided by operating activities: Amortization of intangible assets Depreciation Change in value of warrants Stock-based compensation expense Amortization of financing fees Deferred income taxes Loss on extinguishment of debt Other non-cash adjustments, net Changes in operating assets and liabilities: Accounts receivable, net Inventory, net Prepaid expenses and other assets Accounts payable Accrued expenses Other noncurrent liabilities Net cash provided by operating activities Cash used in investing activities Capital expenditures Other investing activities, net Net cash used in investing activities Cash provided by (used in) financing activities Repayments of long-term debt and lease liabilities Proceeds from revolving line of credit Repayments of revolving line of credit Payments of deferred financing costs Proceeds from warrant exercise Other financing activities, net Net cash provided by (used in) financing activities Net increase (decrease) in cash, cash equivalents, and restricted cash Cash, cash equivalents, and restricted cash at beginning of the period Cash, cash equivalents, and restricted cash at end of the period 42,492 (31,980) 22 (8,634) 24,692 (9,616) 4,010 10,292 (4,393) 4,902 (1,201) (5,354) (3,230) 1,971 (1,536) (1,416) 7 (1,409) (1,536) (55,200) (78) 180,298 267,584 (89,826) (268,743) (1,970) (375) 1,616 76 (443) 33,378 (439) 35,979 (4) 3 54 35,982 50