Answered step by step

Verified Expert Solution

Question

1 Approved Answer

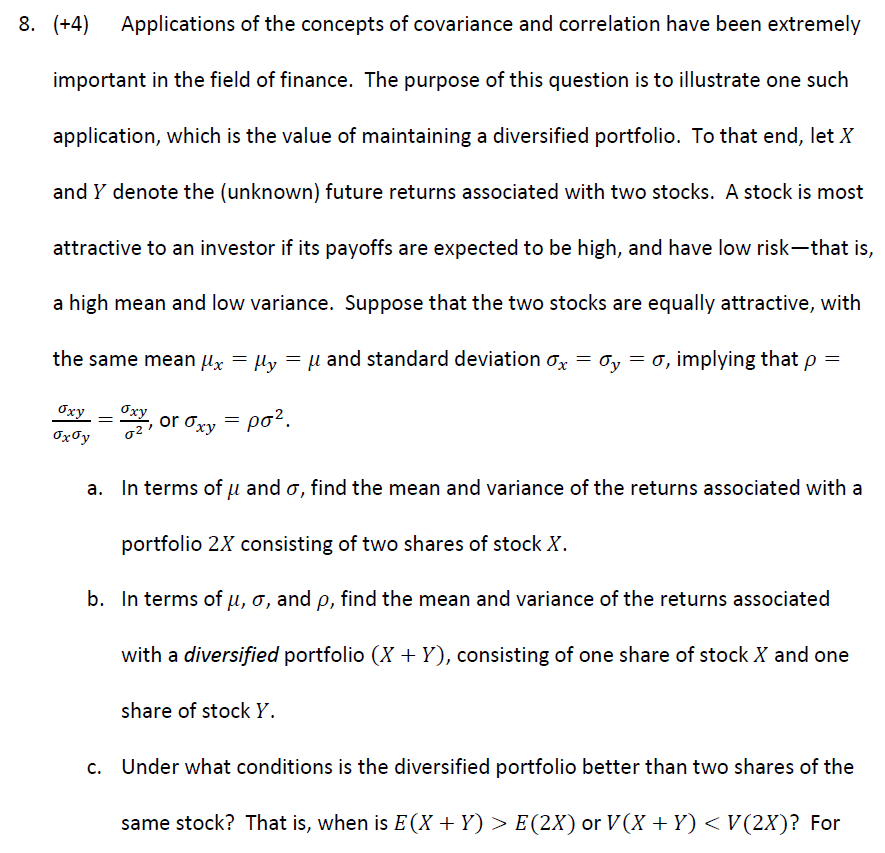

(+4) irmportani in the ficeld of finan. Th purpose of his question is ioillusra one such application, which is the value of maintaining a diversified

(+4) irmportani in the ficeld of finan. Th purpose of his question is ioillusra one such application, which is the value of maintaining a diversified portfolio. To that end, let X and Y denote the (unknown) future returns associated with two stocks. A stock is most attractive to an investor if its payoffs are expected to be high, and have low risk-that is, a high mean and low variance. Suppose that the two stocks are equally attractive, with the same mean Ax-ly- and standard deviation &-Oy, implying that 8. Applications of the concepts of covariance and correlation have been extremely In terms of and , find the mean and variance of the returns associated with a portfolio 2X consisting of two shares of stock X In terms of , , and p, find the mean and variance of the returns associated with a diversified portfolio (X Y), consisting of one share of stock X and one share of stock Y Under what conditions is the diversified portfolio better than two shares of the same stock? That is, when is E(X +Y) > E(2X) or V(X Y)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started