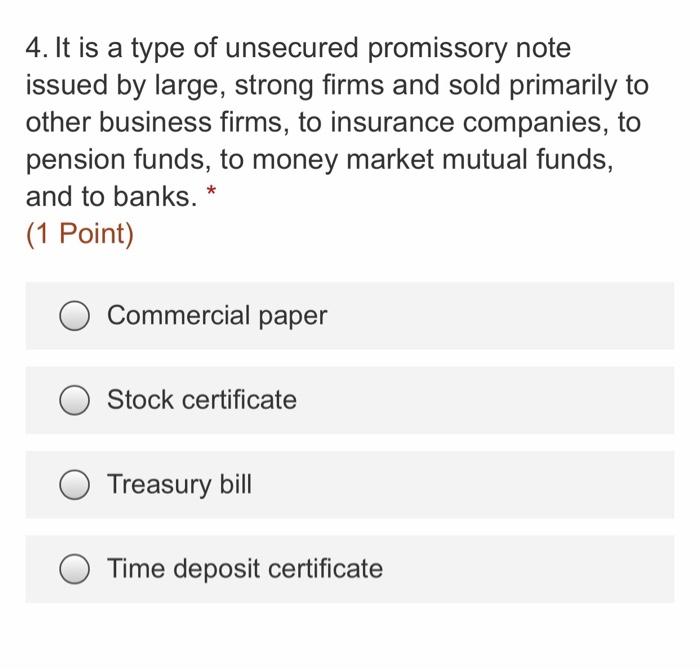

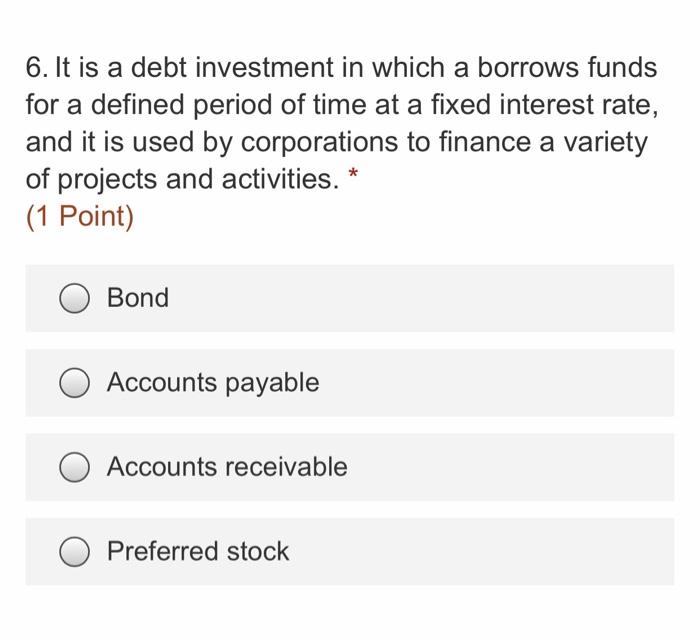

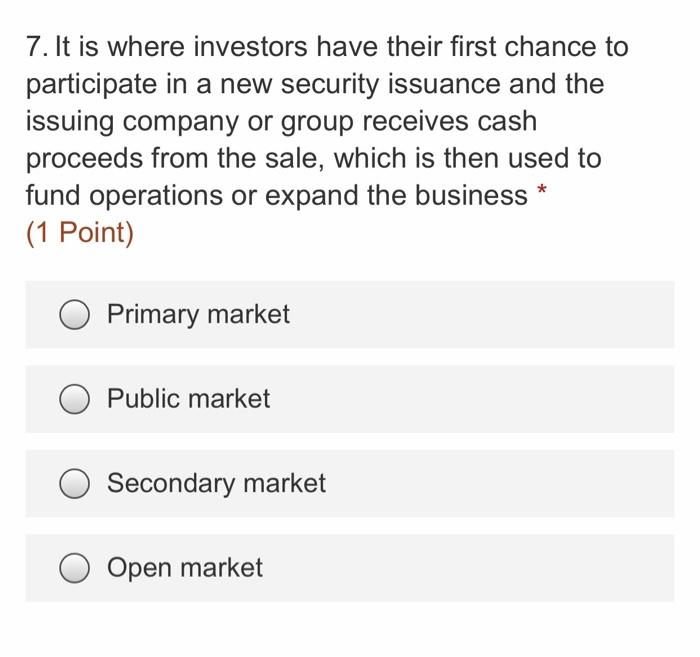

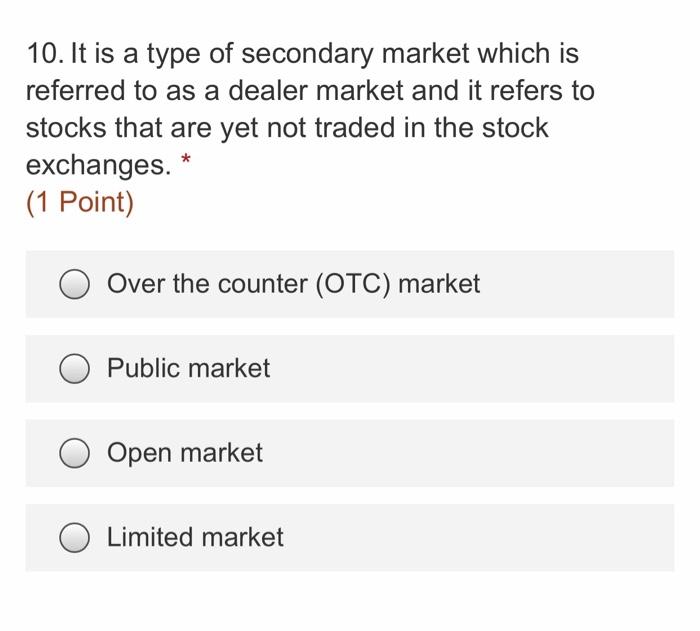

4. It is a type of unsecured promissory note issued by large, strong firms and sold primarily to other business firms, to insurance companies, to pension funds, to money market mutual funds, and to banks. (1 Point) Commercial paper Stock certificate Treasury bill Time deposit certificate 6. It is a debt investment in which a borrows funds for a defined period of time at a fixed interest rate, and it is used by corporations to finance a variety of projects and activities. (1 Point) Bond Accounts payable O Accounts receivable O Preferred stock 7. It is where investors have their first chance to participate in a new security issuance and the issuing company or group receives cash proceeds from the sale, which is then used to fund operations or expand the business (1 Point) Primary market Public market Secondary market Open market 10. It is a type of secondary market which is referred to as a dealer market and it refers to stocks that are yet not traded in the stock exchanges. (1 Point) Over the counter (OTC) market Public market Open market Limited market 11. The shares of ownership in a corporation that afford their holders voting rights. * (1 Point) Ordinary shares O Preference shares Cumulative preference shares Participating preferred stock 12. It is a financial market in which long-term debt (over a year) or equity-backed securities are bought and sold and it channels the wealth of savers to those who can put it to long-term productive use, such as companies or governments making long-term investments. (1 Point) Capital market Money market Primary market Secondary market 15. It is used by participants as a means for borrowing and lending in the short term, from several days to just under a year, it consists of negotiable certificates of deposit, Treasury bills, commercial paper, municipal notes, and repurchase agreements with short maturities. * (1 Point) Money market O Capital market O Secondary market Primary market 17. It is an organization created to provide and maintain a fair, efficient, transparent, and orderly market for the purchase and sale of stocks and other securities * (1 Point) Philippine Stock Exchange Securities and Exchange Commission O Bangko Sentral ng Pilipinas Insurance Commission 4. It is a type of unsecured promissory note issued by large, strong firms and sold primarily to other business firms, to insurance companies, to pension funds, to money market mutual funds, and to banks. (1 Point) Commercial paper Stock certificate Treasury bill Time deposit certificate 7. It is where investors have their first chance to participate in a new security issuance and the issuing company or group receives cash proceeds from the sale, which is then used to fund operations or expand the business (1 Point) Primary market Public market Secondary market Open market 6. It is a debt investment in which a borrows funds for a defined period of time at a fixed interest rate, and it is used by corporations to finance a variety of projects and activities. * (1 Point) Bond Accounts payable Accounts receivable Preferred stock