Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. J Corp produces 200 units of A and 100 units of B products. Final sales amount of A is 9,000. Joint cost is

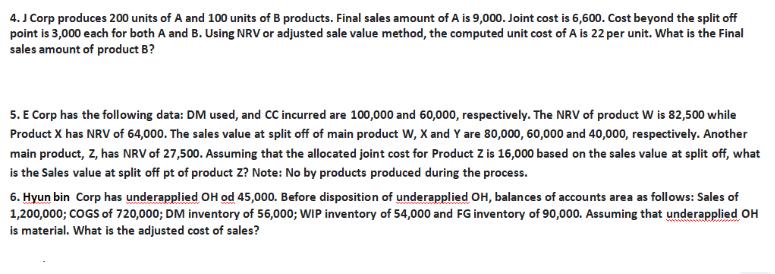

4. J Corp produces 200 units of A and 100 units of B products. Final sales amount of A is 9,000. Joint cost is 6,600. Cost beyond the split off point is 3,000 each for both A and B. Using NRV or adjusted sale value method, the computed unit cost of A is 22 per unit. What is the Final sales amount of product B? 5. E Corp has the following data: DM used, and CC incurred are 100,000 and 60,000, respectively. The NRV of product W is 82,500 while Product X has NRV of 64,000. The sales value at split off of main product W, X and Y are 80,000, 60,000 and 40,000, respectively. Another main product, z, has NRV of 27,500. Assuming that the allocated joint cost for Product Z is 16,000 based on the sales value at split off, what is the sales value at split off pt of product Z? Note: No by products produced during the process. 6. Hyun bin Corp has underapplied OH od 45,000. Before disposition of underapplied OH, balances of accounts area as follows: Sales of 1,200,000; COGS of 720,000; DM inventory of 56,000; WIP inventory of 54,000 and FG inventory of 90,000. Assuming that underapplied OH is material. What is the adjusted cost of sales?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Question 4 Given that the computed unit cost of Product A using the NRV or adjusted sale value metho...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started