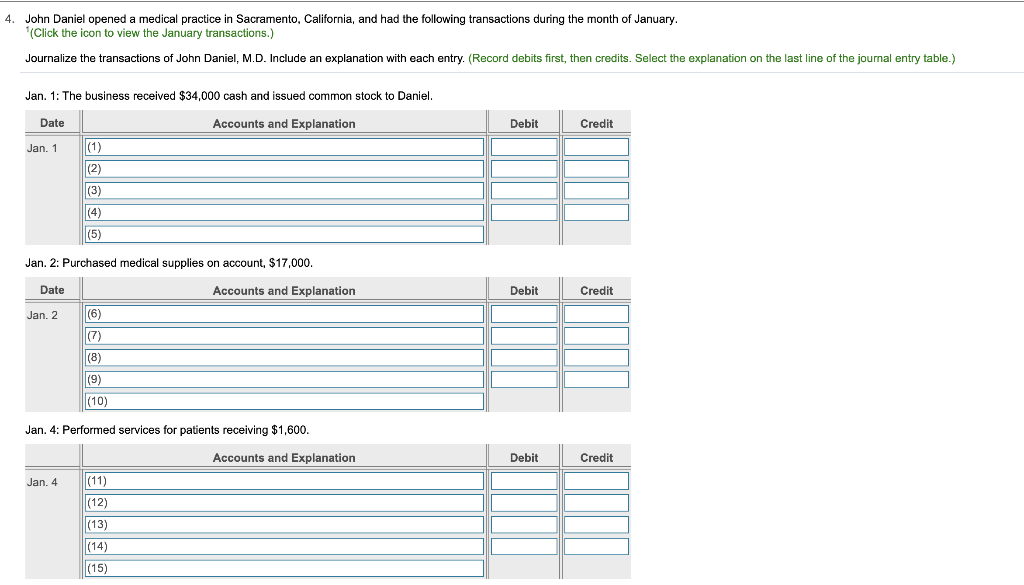

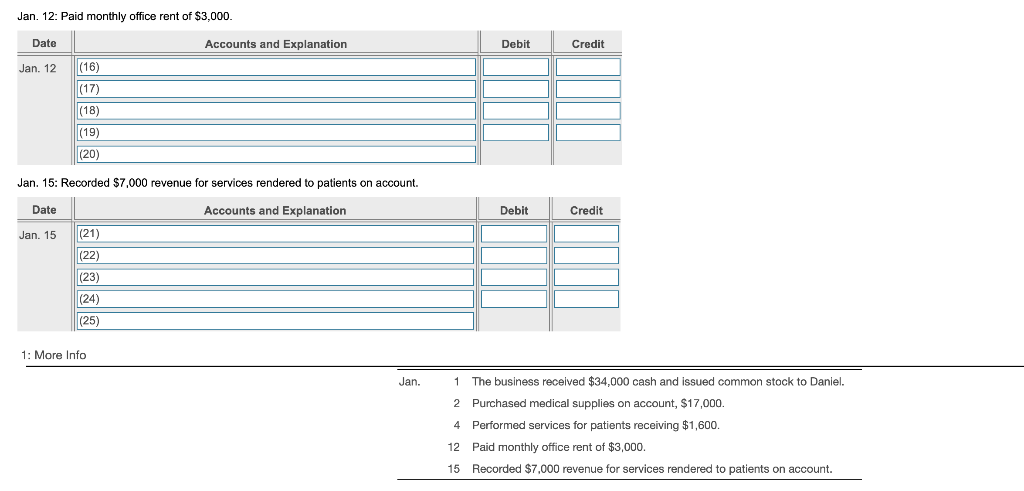

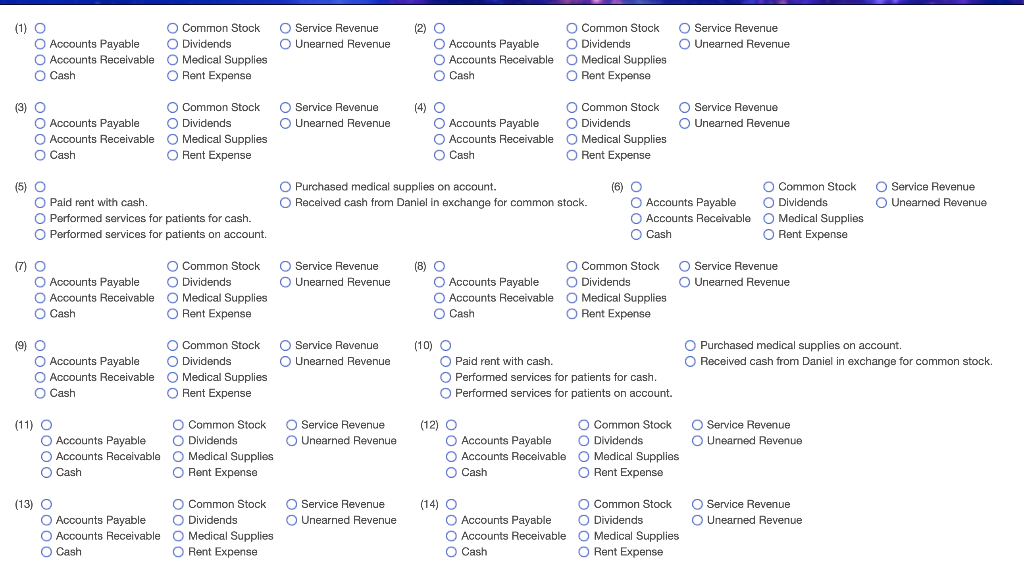

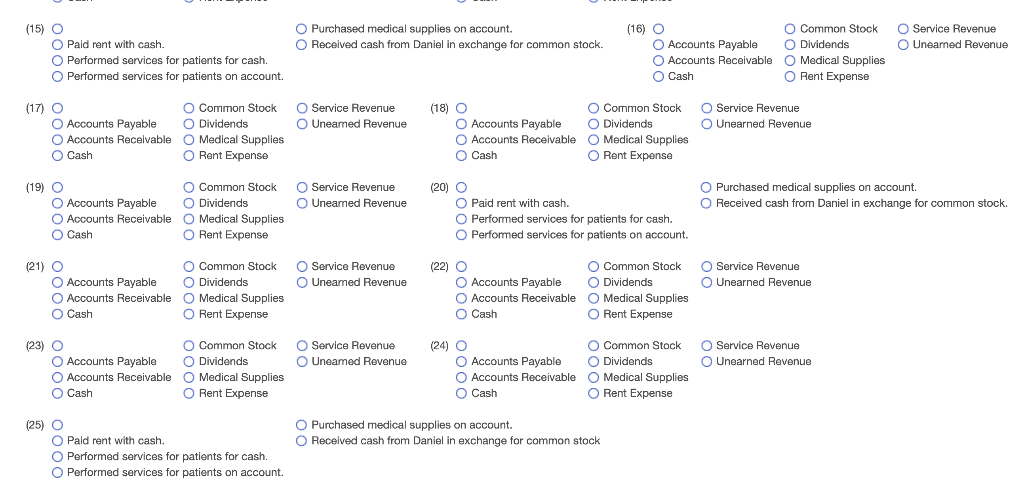

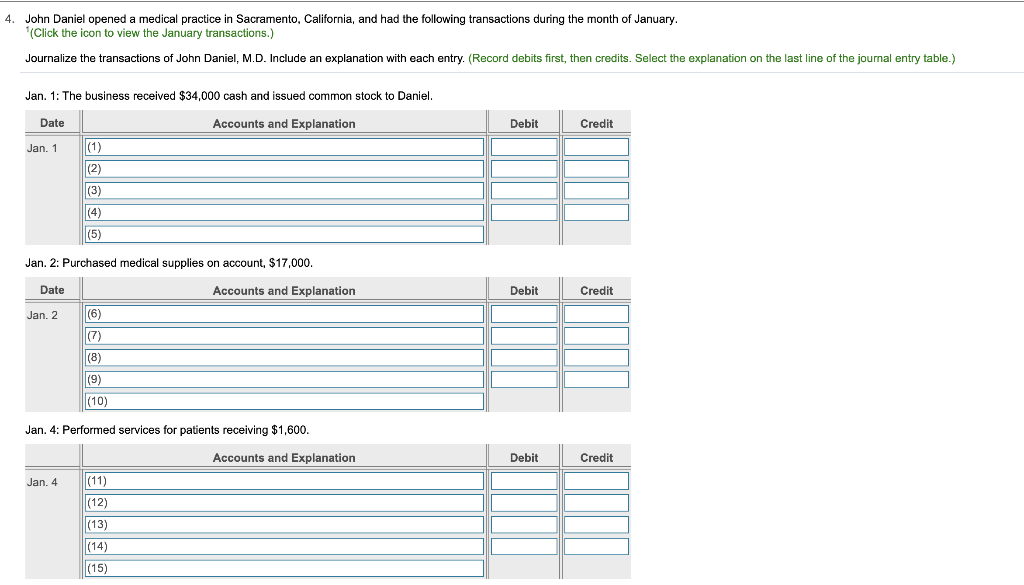

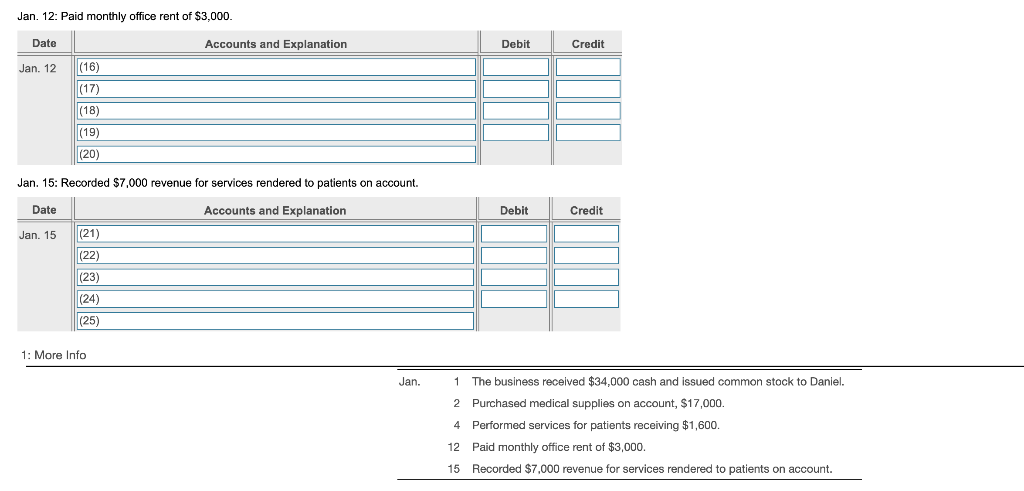

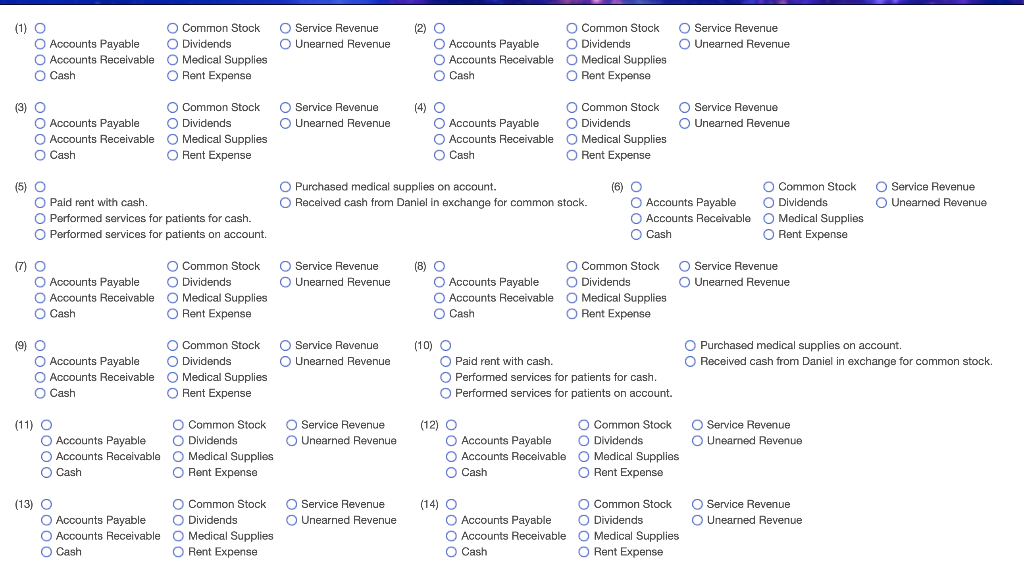

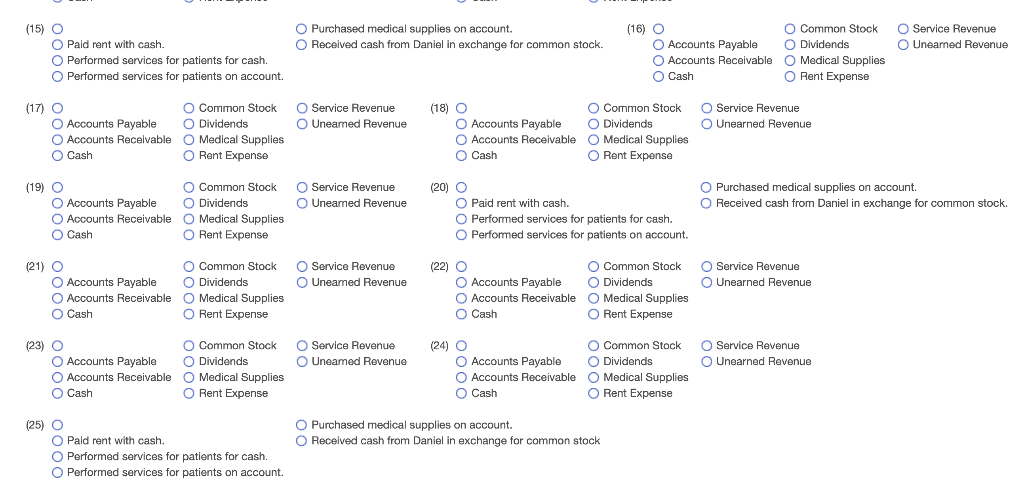

4. John Daniel opened a medical practice in Sacramento, California, and had the following transactions during the month of January (Click the icon to view the January transactions.) Journalize the transactions of John Daniel, M.D. Include an explanation with each entry. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Jan. 1: The business received $34,000 cash and issued common stock to Daniel. Date Accounts and Explanation Debit Credit Jan. 1 a a Jan. 2: Purchased medical supplies on account, $17,000. Date Accounts and Explanation Debit Credit Jan. 2 (9) Jan. 4: Performed services for patients receiving $1,600. Accounts and Explanation Debit Credit Jan. 4 (11) Jan. 12: Paid monthly office rent of $3,000. Date Accounts and Explanation Debit Credit Jan. 12 (16) 18) (20) Jan. 15: Recorded $7,000 revenue for services rendered to patients on account. Date Accounts and Explanation Debit Credit Jan. 15 (21) 1: More Info Jan. 1 The business received $34,000 cash and issued common stock to Daniel. 2 Purchased medical supplies on account, $17,000. 4 Performed services for patients receiving $1,600. 12 Paid monthly office rent of $3,000 15 Recorded $7.000 revenue for services rendered to patients on account. Service Revenue Unearned Revenue Service Revenue Unearned Revenue (1) O Accounts Payable O Accounts Receivable O Cash Common Stock Dividends O Medical Supplies O Rent Expense (2) O Accounts Payable O Accounts Receivable O Cash O Common Stock Dividends O Medical Supplies Rent Expense Service Revenue Unearned Revenue Service Revenue Unearned Revenue (3) O O Accounts Payable Accounts Receivable O Cash Common Stock Dividends Medical Supplies Rent Expense (4) O O Accounts Payable O Accounts Receivable O Cash Common Stock Dividends Medical Supplies Rent Expense (5) O Purchased medical supplies on account. Received cash from Daniel in exchange for common stock. Service Revenue Unearned Revenue O O Pald rent with cash. Performed services for patients for cash. O Performed services for patients on account. (6) O Accounts Payable Accounts Receivable O Cash O Common Stock Dividends Medical Supplies Rent Expense (7) Service Revenue Unearned Revenue Service Revenue Unearned Revenue O O Accounts Payable O Accounts Receivable O Cash Common Stock Dividends O Medical Supplies O Rent Expense (8) O Accounts Payable Accounts Receivable O Cash Common Stock Dividends Medical Supplies Rent Expense (9) Service Revenue Unearned Revenue O O Accounts Payable O Accounts Receivable O Cash O Purchased medical supplies on account. Received cash from Daniel in exchange for common stock Common Stock Dividends Medical Supplies Rent Expense (10) O O Paid rent with cash. O Performed services for patients for cash. O Performed services for patients on account. (12) O Service Revenue Unearned Revenue Service Revenue Unearned Revenue (11) O Accounts Payable O Accounts Receivable O Cash O Common Stock Dividends Medical Supplies Rent Expense Accounts Payable Accounts Receivable Cash Common Stock Dividends Medical Supplies Rent Expense Service Revenue Unearned Revenue Service Revenue Unearned Revenue (13) O Accounts Payable O Accounts Receivable O Cash O Common Stock Dividends O Medical Supplies O Rent Expense (14) O Accounts Payable Accounts Receivable O Cash Common Stock Dividends Medical Supplies O Rent Expense (16) O Purchased medical supplies on account. Received cash from Daniel in exchange for common stock. Service Revenue Unearned Revenue (15) O O Paid rent with cash. O Performed services for patients for cash. O Performed services for patients on account. Accounts Payable Accounts Receivable Cash O Common Stock Dividends Medical Supplies O Rent Expense (17) (18) O Common Stock O O Accounts Payable O Accounts Receivable O Cash Service Revenue Unearned Revenue Service Revenue Unearned Revenue O Common Stock Dividends O Medical Supplies Rent Expense O Accounts Receivable O Cash Medical Supplies O Rent Expense (19) O Accounts Payable O Accounts Receivable O Cash Service Revenue Uneamed Revenue O Purchased medical supplies on account. Received cash from Daniel in exchange for common stock Common Stock Dividends Medical Supplies Rent Expense (20) O O Paid rent with cash. O Performed services for patients for cash. O Performed services for patients on account. (21) O O Accounts Payable O Accounts Receivable O Cash Service Revenue Uneamed Revenue Service Revenue Unearned Revenue Common Stock Dividends Medical Supplies Rent Expense (22) O Accounts Payable Accounts Receivable O Cash Common Stock Dividends Medical Supplies Rent Expense Service Revenue Uneamed Revenue Service Revenue Unearned Revenue (23) O Accounts Payable O Accounts Receivable Cash Common Stock Dividends Medical Supplies Rent Expense (24) O Accounts Payable O Accounts Receivable O Cash Common Stock Dividends Medical Supplies Rent Expense O Purchased medical supplies on account. Received cash from Daniel in exchange for common stock (25) O O Paid rent with cash. O Performed services for patients for cash. O Performed services for patients on account