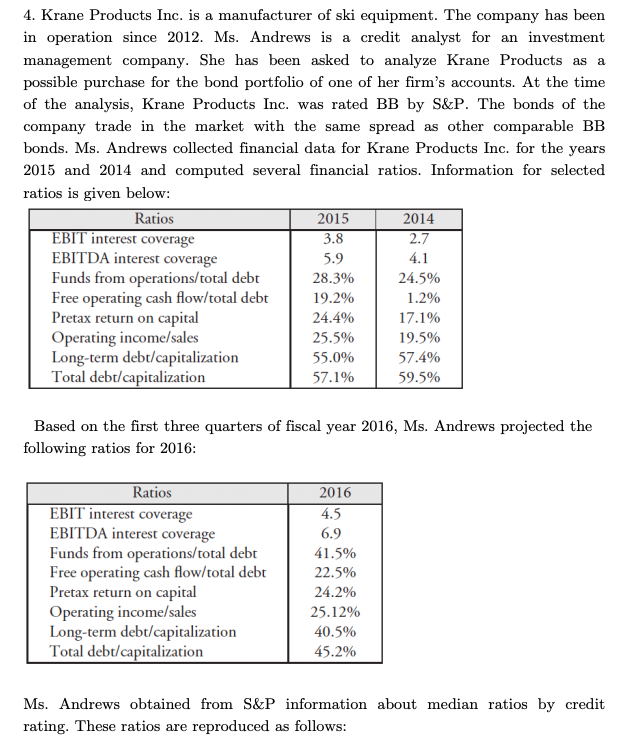

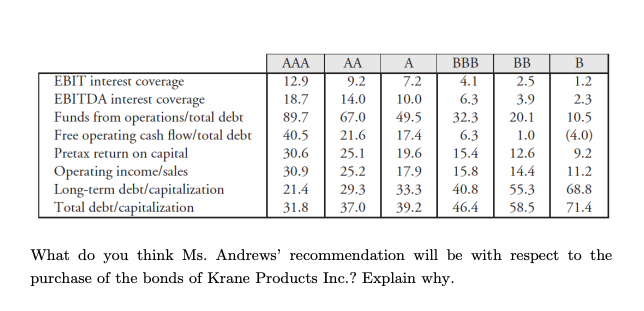

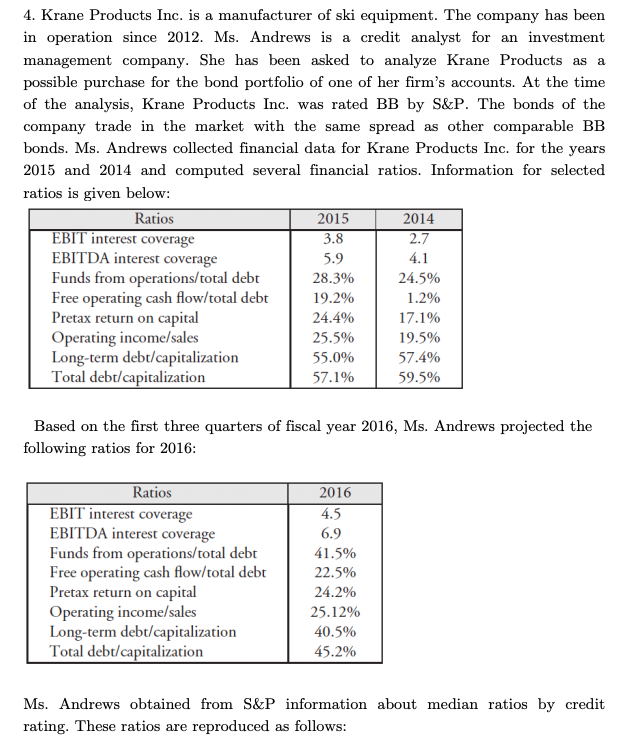

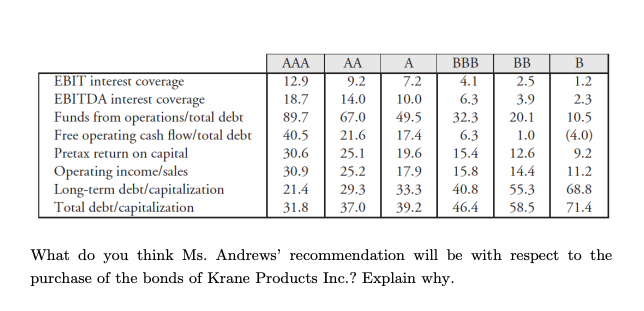

4. Krane Products Inc. is a manufacturer of ski equipment. Th in operation since 2012. Ms. Andrews is a credit analyst for an investment man possible purchase for the bond portfolio of one of her firm's accounts. At the time of the analysis, Krane Products Inc. was rated BB by S&P. The bonds of the company trade in the market with the same spread as other comparable BB bonds. Ms. Andrews collected financial data for Krane Products Inc. for the years 2015 and 2014 and computed several financial ratios. Information for selected ratios is given below e company has been agement company. She has been asked to analyze Krane Products as a 2014 2.7 Ratios 2015 EBIT interest coverage EBITDA interest coverage 5.9 28.3% 19.2% 24.4% 25.5% 55.0% 57.1% Funds from operations/total debt 24.5% 1.2% Free operating cash flow/total debt Pretax return on capital Operating income/sales Long-term debt/capitalization Total debt/capitalization 19.5% 57.4% 59.5% Based on the first three quarters of fiscal year 2016, Ms. Andrews projected the following ratios for 2016 2016 4.5 6.9 41.5% 225% 24.2% 25. 12% 40.5% 45.2% Ratios EBII interest coverage EBITDA interest coverage Funds from operations/total debt Free operating cash flow/total debt Pretax return on capital Operating income/sales Long-term debt/capitalization Total debt/capitalization Ms. Andrews obtained from S&P information about median ratios by credit rating. T hese ratios are reproduced as follows EBIT interest coverage EBITDA interest coverage Funds from operations/total debt Free operating cash flow/total debt40.521617.4 Pretax return on capital Operating income/sales Long-term debt/capitalization Total debt/capitalization 12.9 18.7 14.010.0 89.7 67.0 49.532.3 20.110.5 2.5 3.9 1.2 2.3 9.2 7.2 6.3 1.0 (4.0) 9.2 6.3 30.6 25. 19.6 15.4 12.6 30.9 25.217.9 15.814.4 11.2 21.4 29.3 33.340.8 55.3 68.8 31.8 37.0 39.2 46.458.5 71.4 What do you think Ms. Andrews' recommendation will be with respect to the purchase of the bonds of Krane Products Inc.? Explain why 4. Krane Products Inc. is a manufacturer of ski equipment. Th in operation since 2012. Ms. Andrews is a credit analyst for an investment man possible purchase for the bond portfolio of one of her firm's accounts. At the time of the analysis, Krane Products Inc. was rated BB by S&P. The bonds of the company trade in the market with the same spread as other comparable BB bonds. Ms. Andrews collected financial data for Krane Products Inc. for the years 2015 and 2014 and computed several financial ratios. Information for selected ratios is given below e company has been agement company. She has been asked to analyze Krane Products as a 2014 2.7 Ratios 2015 EBIT interest coverage EBITDA interest coverage 5.9 28.3% 19.2% 24.4% 25.5% 55.0% 57.1% Funds from operations/total debt 24.5% 1.2% Free operating cash flow/total debt Pretax return on capital Operating income/sales Long-term debt/capitalization Total debt/capitalization 19.5% 57.4% 59.5% Based on the first three quarters of fiscal year 2016, Ms. Andrews projected the following ratios for 2016 2016 4.5 6.9 41.5% 225% 24.2% 25. 12% 40.5% 45.2% Ratios EBII interest coverage EBITDA interest coverage Funds from operations/total debt Free operating cash flow/total debt Pretax return on capital Operating income/sales Long-term debt/capitalization Total debt/capitalization Ms. Andrews obtained from S&P information about median ratios by credit rating. T hese ratios are reproduced as follows EBIT interest coverage EBITDA interest coverage Funds from operations/total debt Free operating cash flow/total debt40.521617.4 Pretax return on capital Operating income/sales Long-term debt/capitalization Total debt/capitalization 12.9 18.7 14.010.0 89.7 67.0 49.532.3 20.110.5 2.5 3.9 1.2 2.3 9.2 7.2 6.3 1.0 (4.0) 9.2 6.3 30.6 25. 19.6 15.4 12.6 30.9 25.217.9 15.814.4 11.2 21.4 29.3 33.340.8 55.3 68.8 31.8 37.0 39.2 46.458.5 71.4 What do you think Ms. Andrews' recommendation will be with respect to the purchase of the bonds of Krane Products Inc.? Explain why