Answered step by step

Verified Expert Solution

Question

1 Approved Answer

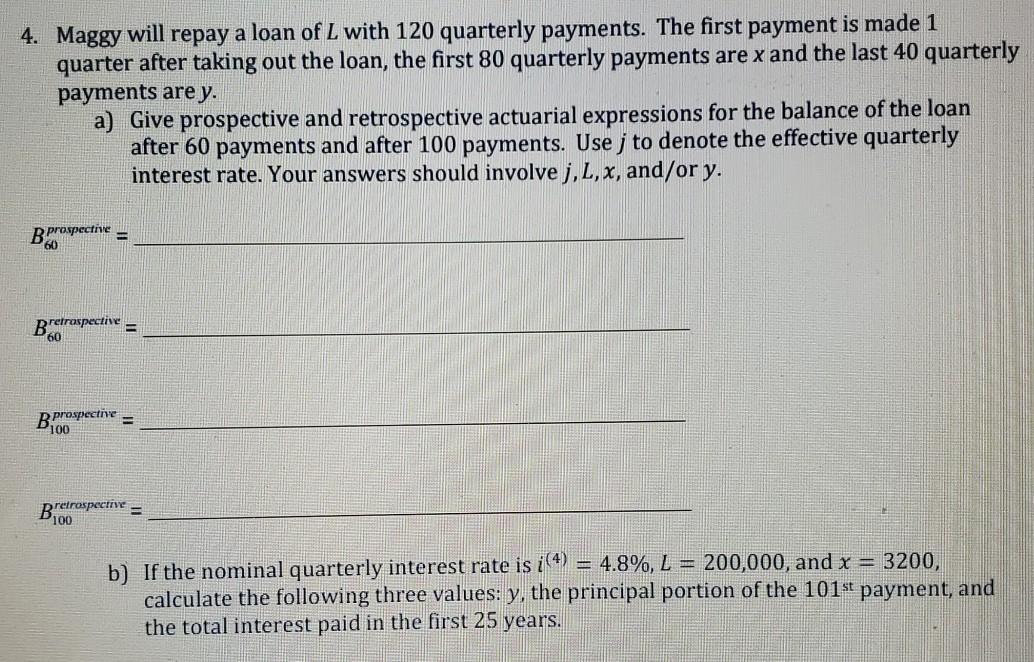

4. Maggy will repay a loan of L with 120 quarterly payments. The first payment is made 1 quarter after taking out the loan, the

4. Maggy will repay a loan of L with 120 quarterly payments. The first payment is made 1 quarter after taking out the loan, the first 80 quarterly payments are x and the last 40 quarterly payments are y. a) Give prospective and retrospective actuarial expressions for the balance of the loan after 60 payments and after 100 payments. Usej to denote the effective quarterly interest rate. Your answers should involve j,L,x, and/or y. B prospective 60 Bretrospective = B prospective Bretrospective = 100 b) If the nominal quarterly interest rate is i(4) = 4.8%, L = 200,000, and x = 3200, calculate the following three values: y, the principal portion of the 101st payment, and the total interest paid in the first 25 years. 4. Maggy will repay a loan of L with 120 quarterly payments. The first payment is made 1 quarter after taking out the loan, the first 80 quarterly payments are x and the last 40 quarterly payments are y. a) Give prospective and retrospective actuarial expressions for the balance of the loan after 60 payments and after 100 payments. Usej to denote the effective quarterly interest rate. Your answers should involve j,L,x, and/or y. B prospective 60 Bretrospective = B prospective Bretrospective = 100 b) If the nominal quarterly interest rate is i(4) = 4.8%, L = 200,000, and x = 3200, calculate the following three values: y, the principal portion of the 101st payment, and the total interest paid in the first 25 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started