Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. Maher joined Star Co. on April 21, 2019 for an annual salary of JD12,600. His work contract provides for 18 days paid vacation per

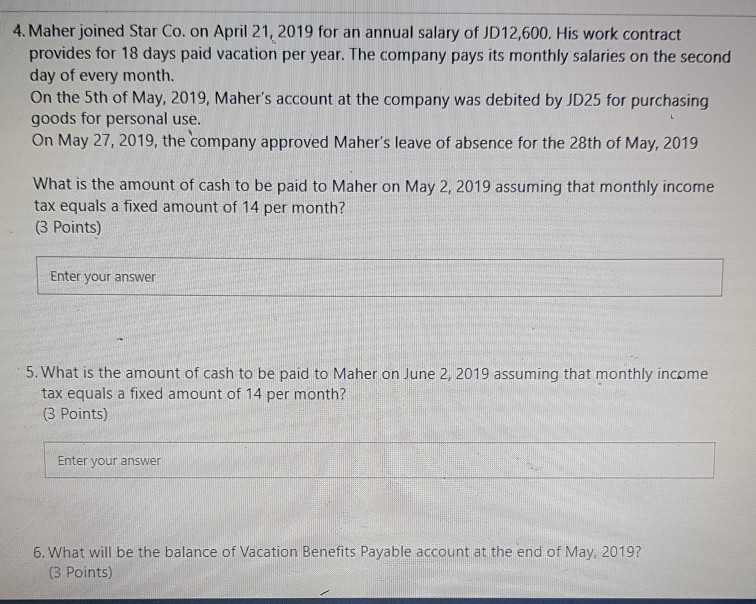

4. Maher joined Star Co. on April 21, 2019 for an annual salary of JD12,600. His work contract provides for 18 days paid vacation per year. The company pays its monthly salaries on the second day of every month. On the 5th of May, 2019, Maher's account at the company was debited by JD25 for purchasing goods for personal use. On May 27, 2019, the company approved Maher's leave of absence for the 28th of May, 2019 What is the amount of cash to be paid to Maher on May 2, 2019 assuming that monthly income tax equals a fixed amount of 14 per month? (3 Points) Enter your answer 5. What is the amount of cash to be paid to Maher on June 2, 2019 assuming that monthly income tax equals a fixed amount of 14 per month? (3 Points) Enter your answer 6. What will be the balance of Vacation Benefits Payable account at the end of May, 2019? (3 Points) 7. What is the salaries and wages expense balance for the month of May, 2019? (3 Points) Enter your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started