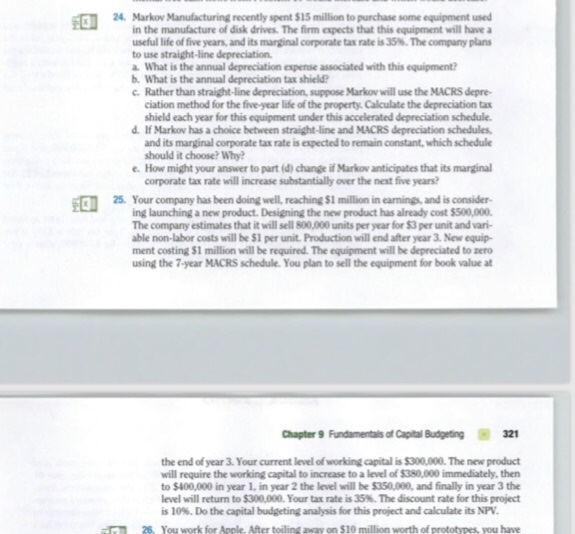

4. Markov Manufacturing recently spent $15 million to purchase some equipment used in the manufacture of disk drives. The firm expects that this equipment will have a useful life of five years, and its marginal corporate tax rate is 35%. The company plans to use straight-line depreciation a. What is the annual depreciation expense associated with this equipment? b. What is the annual depreciation tax shield c. Rather than straight-line depreciation, suppose Markov will use the MACRS depre ciation method for the five-year life of the property. Calculate the depreciation tax shield each year for this equipment under this accelerated depreciation schedule d. If Markov has a choice between straight-line and MACRS depreciation schedules and its marginal corporate tax rate is expected to remain constant, which schedule should it choose? Why e. How might your answer to part (d) change if Markov anticipates that its marginal corporate tax rate will increase substantially over the next five years 25. Your company has been doing well, reaching $1 million in earnings, and is consider ng launching a new product. Desagning the new product has already cost $500,000. The company estimates that it will sell 800,000 units per year for $3 per unit and vari- able non-labor costs will be $1 per unit. Production will end after year 3. New equip- ment costing $1 million will be required. The equipment will be depreciated to zero using the 7-year MACRS schedule. You plan to sell the equipment for book value at Chapter 9 Fundamentals of Capital Budgeting 321 the end of year 3. Your current level of working capital is $300,000.The new product will require the working capital to increase to a level of $380,000 immediately, then to $400,000 in year 1, in year 2 the level will be $350,000, and finally in year 3 the level will return to $300,000. Your tax rate is 35%. The discount rate for this project is10%. Do the capital budgeting analysis for this project and alculate its NPV. You work for Apple. After toiling away on $10 million worth ofprototypes, you have 26, 4. Markov Manufacturing recently spent $15 million to purchase some equipment used in the manufacture of disk drives. The firm expects that this equipment will have a useful life of five years, and its marginal corporate tax rate is 35%. The company plans to use straight-line depreciation a. What is the annual depreciation expense associated with this equipment? b. What is the annual depreciation tax shield c. Rather than straight-line depreciation, suppose Markov will use the MACRS depre ciation method for the five-year life of the property. Calculate the depreciation tax shield each year for this equipment under this accelerated depreciation schedule d. If Markov has a choice between straight-line and MACRS depreciation schedules and its marginal corporate tax rate is expected to remain constant, which schedule should it choose? Why e. How might your answer to part (d) change if Markov anticipates that its marginal corporate tax rate will increase substantially over the next five years 25. Your company has been doing well, reaching $1 million in earnings, and is consider ng launching a new product. Desagning the new product has already cost $500,000. The company estimates that it will sell 800,000 units per year for $3 per unit and vari- able non-labor costs will be $1 per unit. Production will end after year 3. New equip- ment costing $1 million will be required. The equipment will be depreciated to zero using the 7-year MACRS schedule. You plan to sell the equipment for book value at Chapter 9 Fundamentals of Capital Budgeting 321 the end of year 3. Your current level of working capital is $300,000.The new product will require the working capital to increase to a level of $380,000 immediately, then to $400,000 in year 1, in year 2 the level will be $350,000, and finally in year 3 the level will return to $300,000. Your tax rate is 35%. The discount rate for this project is10%. Do the capital budgeting analysis for this project and alculate its NPV. You work for Apple. After toiling away on $10 million worth ofprototypes, you have 26