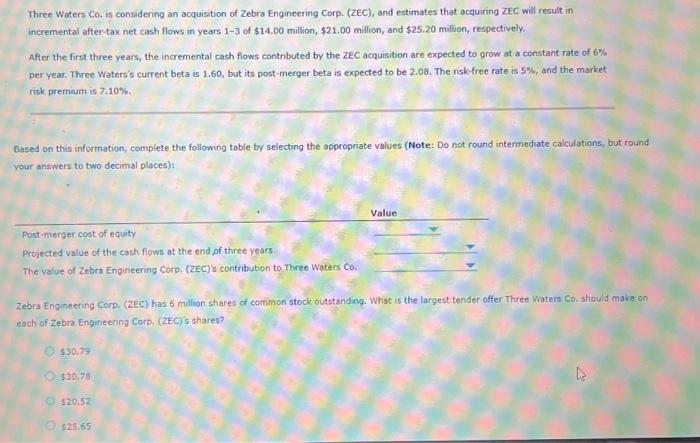

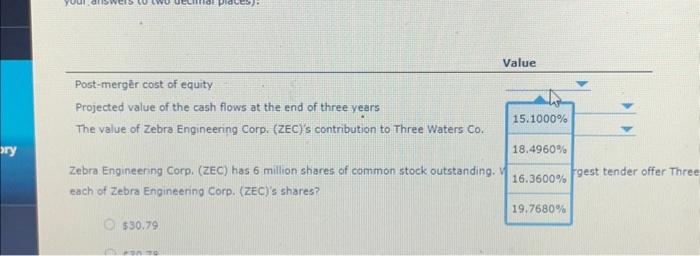

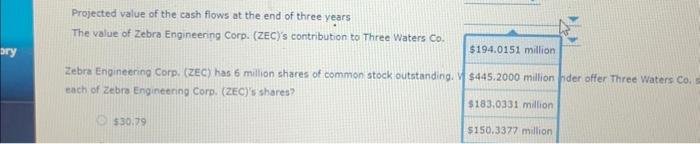

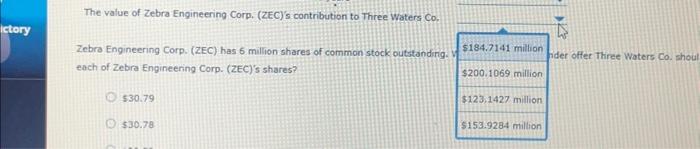

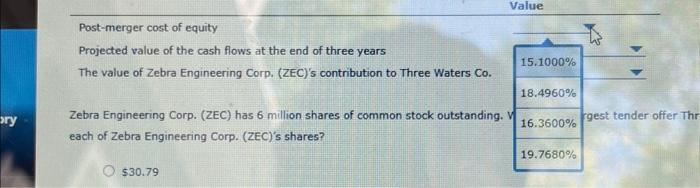

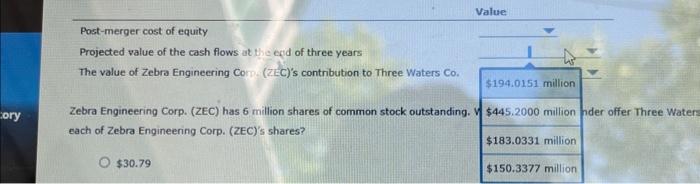

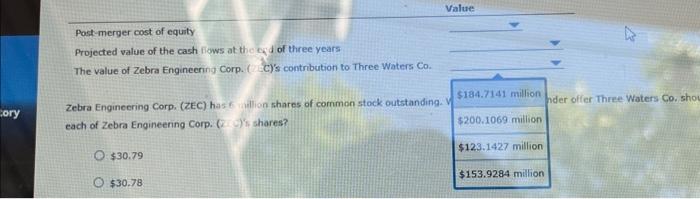

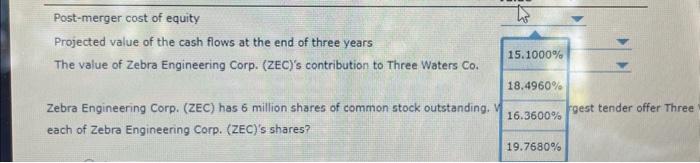

4. Merger valuation and discounted cash flows When an acquirer assesses a potential target, the price the acquirer is willing to pay should be based on the value of: The target firm's total corporate value (debt and equity) The target firm's debt The target firm's equty Consider the following scenario: Three Waters Co. is considering an acquisition of Zebra Engineering CorD. (ZEC). and estimates that acquining zEC will result in incremental after-tax.net cash flows in years 13 of $14.00 million, $21.00 million, and $25.20 million, respectively, After the first three years, the incremental cash flows contnbuted by the ZEC acquisition are expected to grow at a constant rate of 6% oer year. Three Waters's current beta is 1.60 , but its post-merger beta is expected to be 2.08 . The niskefree rate is 5%, and the market nisk premium is 7.10%. Three Waters Co. is considering an acquisition of Zebra Engineering Corp. (ZEC), and estimates that acquiring ZEC will result in incremental after-tax net cash flows in years 13 of $14.00 million, $21.00 million, and $25.20 million, respectively. After the first three years, the incremental cash flows contributed by the ZEC acquisition are expected to grow at a constant rate of 6% per year. Three Woters's current beta is 1.60 , but its post-merger beta is expected to be 2.08 . The risk-free rate is 5%, and the market risk premium is 7,10% Based on this information, complete the following table by selecting the appropriate values (Note: Do not round intermediate calculations, but round your answers to two decimal places): Zebra Engmeening Corp. (2EC) has 6 million shares of common stock outstanding. What is the largest tender offer Three waters Co. should make on esch of Zebra Engineering Corp. (ZEC)'s shares? 330.79 436.78 120.52 $25.65 n moniod Projected value of the cash flows at the end of three years The value of Zebra Engineering Corp. (ZEC)'s contribution to Three Waters Co. Zebra Engineering Corp. (ZEC) has 6 milion shares of common stock outstanding. each of Zebre Engineering Corp. (ZEC)'s shares? 530.79 The value of Zebra Engineering Corp. (ZEC)'s contribution to Three Waters Co. Zebra Engineering Corp. (ZEC) has 6 million shares of common stock outstanding. ider ofter Three Waters Co. shou each of Zebra Engineering Corp. (ZEC)'s shares? 530.79 $30.78 Value Post-merger cost of equity Projected value of the cash flows at the end of three years The value of Zebra Engineering Corp. (ZEC)'s contribution to Three Waters Co. Zebra Engineering Corp. (ZEC) has 6 million shares of common stock outstanding. each of Zebra Engineering Corp. (ZEC)'s shares? $30.79 Value Post-merger cost of equity Projected value of the cash flows at the ecid of three years The value of Zebra Engineering Corn (ZEC)'s contribution to Three Waters Co. Zebra Engineering Corp. (ZEC) has 6 million shares of common stock outstanding. each of Zebra Engineering Corp. (ZEC)'s shares? $30.79 Value Post-merger cost of equity Projected value of the cash fiows at the cyd of three years The value of Zebra Engineering Corp. ( CEC)'s contribution to Three Waters Co. Zebra Engineering Corp. (ZEC) has 6 willion shares of cornmon stock outstanding. each of Zebra Engineerng Corp. (iviv)s shares? $30.79 $30.78 Post-merger cost of equity Projected value of the cash flows at the end of three years The value of Zebra Engineering Corp. (ZEC)'s contribution to Three Waters Co. Zebra Engineering Corp. (ZEC) has 6 million shares of common stock outstanding. each of Zebra Engineering Corp. (ZEC)'s shares