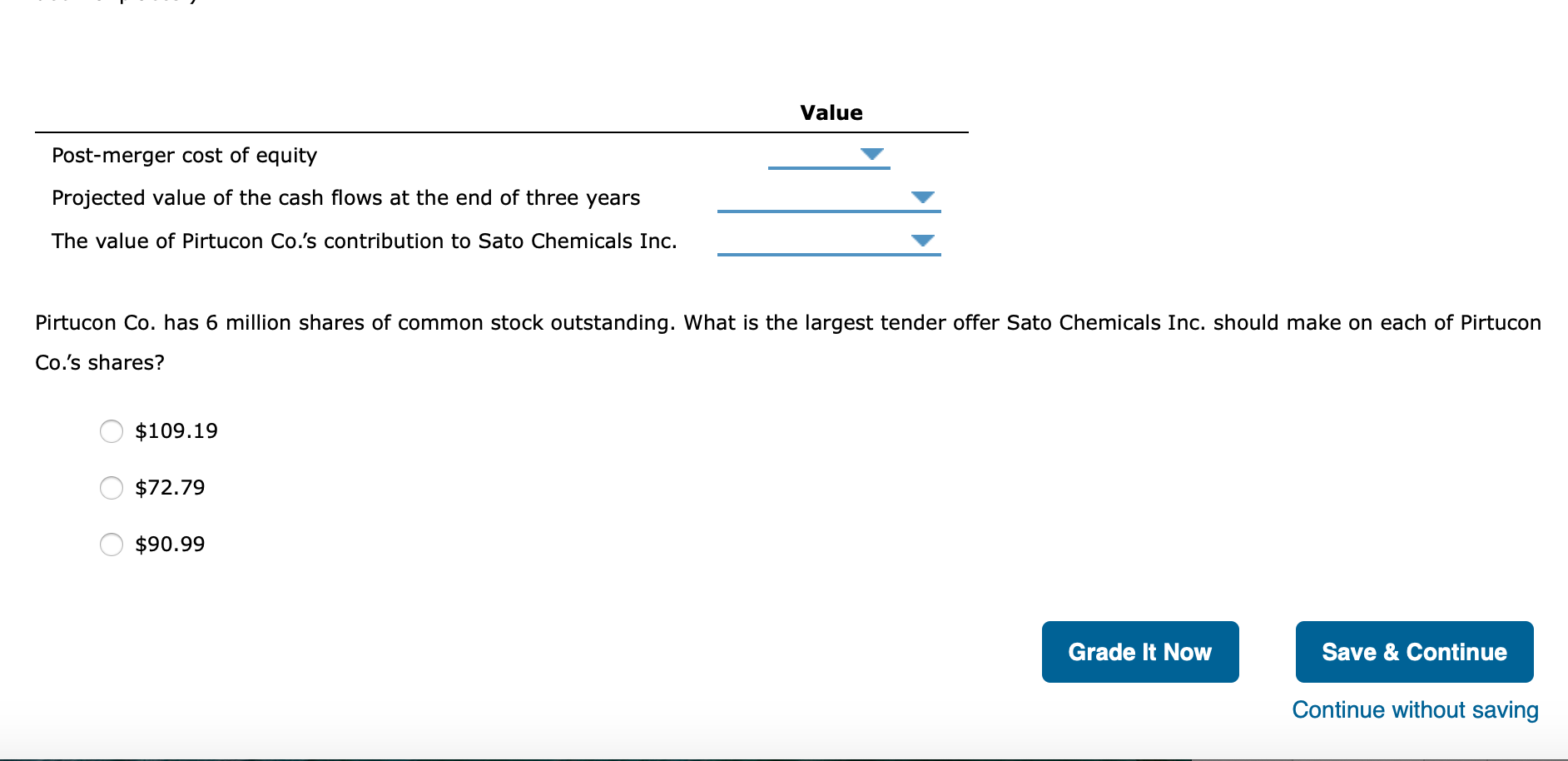

4. Merger valuation and discounted cash flows When an acquirer assesses a potential target, the price the acquirer is willing to pay should be based on the value of: The target firm's total corporate value (debt and equity) The target firm's debt The target firm's equity Consider the following scenario: Sato Chemicals Inc. is considering an acquisition of Pirtucon Co., and estimates that acquiring Pirtucon will result in incremental aftertax net cash flows in years 13 of $8 million, $12 million, and $14.4 million, respectively. After the first three years, the incremental cash flows contributed by the Pirtucon acquisition are expected to grow at a constant rate of 4% per year. Sato's current beta is 0.40 , but its post-merger beta is expected to be 0.52 . The risk-free rate is 3.5%, and the market risk premium is 5.60%. Based on this information, complete the following table by selecting the appropriate values. (Note: Round your intermediate calculations to two decimal places.) Pirtucon Co. has 6 million shares of common stock outstanding. What is the largest tender offer Sato Chemicals Inc. should make on each of Pirtucon Co.'s shares? $109.19$72.79$90.99 Continue without saving 4. Merger valuation and discounted cash flows When an acquirer assesses a potential target, the price the acquirer is willing to pay should be based on the value of: The target firm's total corporate value (debt and equity) The target firm's debt The target firm's equity Consider the following scenario: Sato Chemicals Inc. is considering an acquisition of Pirtucon Co., and estimates that acquiring Pirtucon will result in incremental aftertax net cash flows in years 13 of $8 million, $12 million, and $14.4 million, respectively. After the first three years, the incremental cash flows contributed by the Pirtucon acquisition are expected to grow at a constant rate of 4% per year. Sato's current beta is 0.40 , but its post-merger beta is expected to be 0.52 . The risk-free rate is 3.5%, and the market risk premium is 5.60%. Based on this information, complete the following table by selecting the appropriate values. (Note: Round your intermediate calculations to two decimal places.) Pirtucon Co. has 6 million shares of common stock outstanding. What is the largest tender offer Sato Chemicals Inc. should make on each of Pirtucon Co.'s shares? $109.19$72.79$90.99 Continue without saving