Answered step by step

Verified Expert Solution

Question

1 Approved Answer

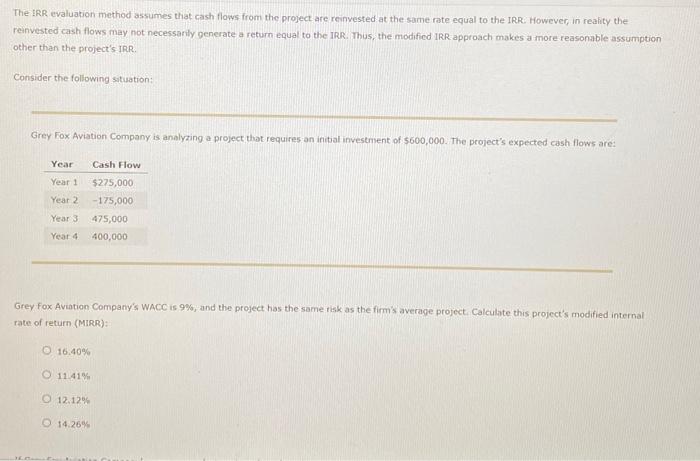

4. Modified internal rate of return (MIRR) The IRR evaluation method assumes that cash flows from the project are reinvested at the same rate equal

4. Modified internal rate of return (MIRR)

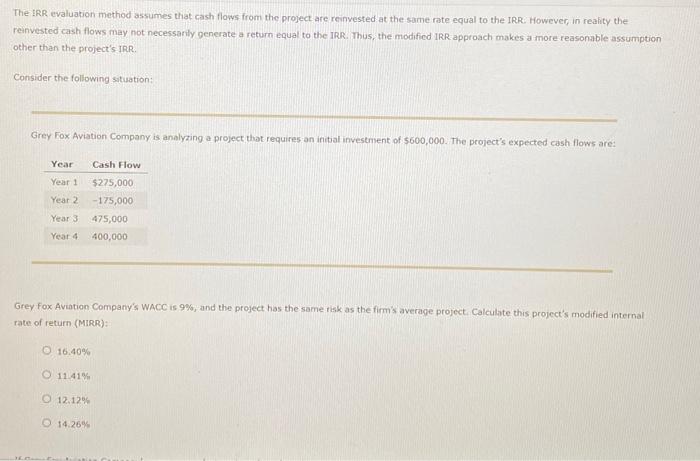

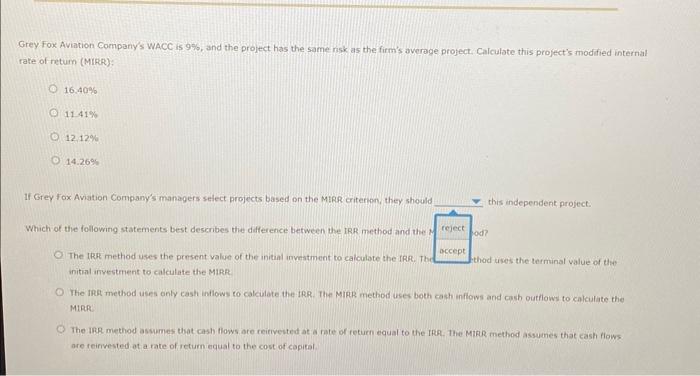

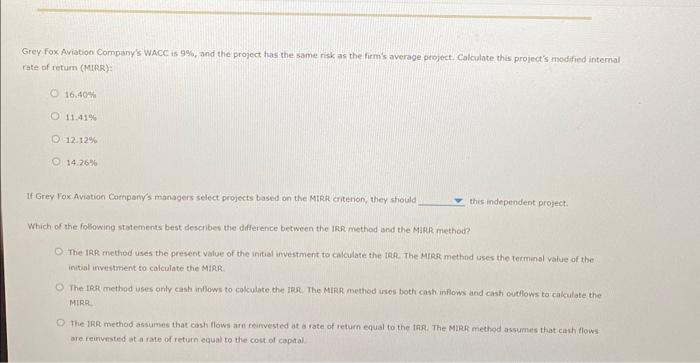

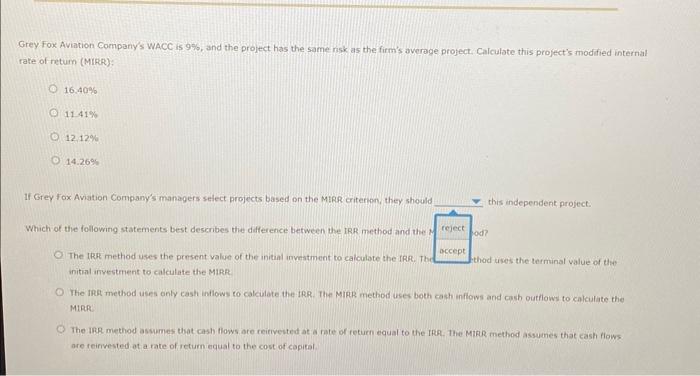

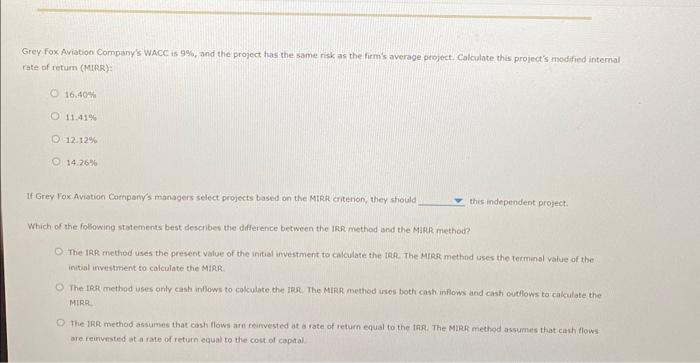

The IRR evaluation method assumes that cash flows from the project are reinvested at the same rate equal to the IRR. However, in reality the reinvested cash flows may not necessarily generate a return equal to the IRR. Thus, the modified IRR approach makes a more reasonable assumption other than the project's IRR. Consider the following situation: Grey Fox Aviation Company is analyzing a project that requires an initial investment of 5600,000 . The project's expected cash flows are: Grey fox Aviation Company's WACC is 9%, and the project has the same risk as the firm's average project. Calculate this project's modified internal rate of return (MIRR): 16.40% 11.41% 12,12% 14.26% Grey Fox Aviation Gompany's WACC is 9 bo, and the project has the same risk as the firm's averoge project, Calculate this project's modified internal rate of retum (MIRR). 16.40% 11.414 12,12% 14.266 If Grey fox Aviation Company's managers select projects based on the MtaR criterhon, they should this independent project. Which of the following statements best describes the ddference between the IRR method and the ? The IRR method uses the present value of the initial investment to calculate the IRR. Tbe thad ures the terminal value of the initial investment to calculate the MIRA The tRat method uses anly cash inilows co calculate the tRR. The MIRR method uses both cach inflows and cash outflows to calculate the Mint The IDR. method aswumes that cash flows are ceirivested at a rate of returm equal to the IRA. The MItR method assumes that cash flows are reirivested at a rate of return equal to the cost of capital Grey fox Aviation Cornpany's WACC is 9%, and the project thas the same risk as the lirm's average project Calculate this project's modried internal rate of returis (MIRR): 16.40%11.41%12.12%14.26% If Grey Fox Avation Companys managers select projects based on the MtRt critenon, they should this independent project. Which of the fogowing statements best describes the difference between the ImR method and the Mark miethod? The IRR method uses the present value of the initial inyestment to calculate the tab. The MiRs method uses the terminal value of the initial investinent to colculate the Miak The IRR methgd uses only cash inllows to cokculate the IRS. The MiRR method ises both cash inflows and cash outllows to calkulate the MIRP. The IRR method assumes that cosh llows arn reirvested at a rate of return equal to the tra. The MaPs method assumes that cash flows: are reinvested ot a rame of return equal to the cost of coptal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started