Answered step by step

Verified Expert Solution

Question

1 Approved Answer

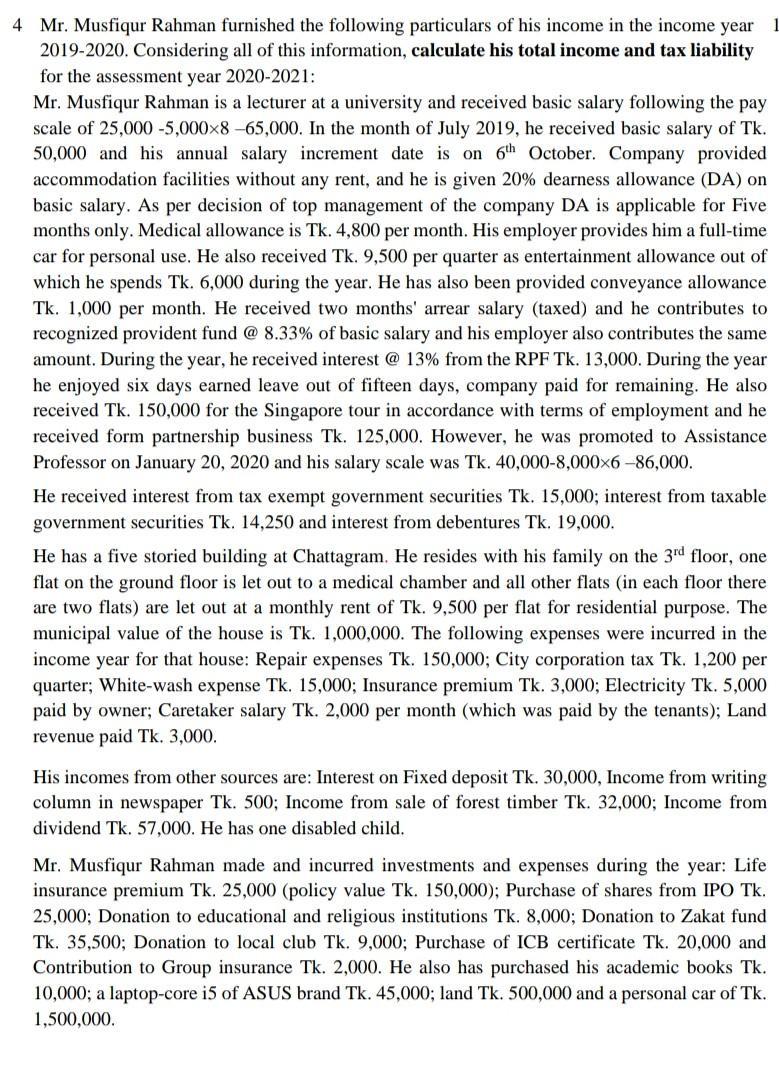

4 Mr. Musfiqur Rahman furnished the following particulars of his income in the income year 2019-2020. Considering all of this information, calculate his total

4 Mr. Musfiqur Rahman furnished the following particulars of his income in the income year 2019-2020. Considering all of this information, calculate his total income and tax liability for the assessment year 2020-2021: Mr. Musfiqur Rahman is a lecturer at a university and received basic salary following the pay scale of 25,000 -5,0008-65,000. In the month of July 2019, he received basic salary of Tk. 50,000 and his annual salary increment date is on 6th October. Company provided accommodation facilities without any rent, and he is given 20% dearness allowance (DA) on basic salary. As per decision of top management of the company DA is applicable for Five months only. Medical allowance is Tk. 4,800 per month. His employer provides him a full-time car for personal use. He also received Tk. 9,500 per quarter as entertainment allowance out of which he spends Tk. 6,000 during the year. He has also been provided conveyance allowance Tk. 1,000 per month. He received two months' arrear salary (taxed) and he contributes to recognized provident fund @ 8.33% of basic salary and his employer also contributes the same amount. During the year, he received interest @ 13% from the RPF Tk. 13,000. During the year he enjoyed six days earned leave out of fifteen days, company paid for remaining. He also received Tk. 150,000 for the Singapore tour in accordance with terms of employment and he received form partnership business Tk. 125,000. However, he was promoted to Assistance Professor on January 20, 2020 and his salary was Tk. 40,000-8,000x6-86,000. He received interest from tax exempt government securities Tk. 15,000; interest from taxable government securities Tk. 14,250 and interest from debentures Tk. 19,000. He has a five storied building at Chattagram. He resides with his family on the 3rd floor, one flat on the ground floor is let out to a medical chamber and all other flats (in each floor there are two flats) are let out at a monthly rent of Tk. 9,500 per flat for residential purpose. The municipal value of the house is Tk. 1,000,000. The following expenses were incurred in the income year for that house: Repair expenses Tk. 150,000; City corporation tax Tk. 1,200 per quarter; White-wash expense Tk. 15,000; Insurance premium Tk. 3,000; Electricity Tk. 5,000 paid by owner; Caretaker salary Tk. 2,000 per month (which was paid by the tenants); Land revenue paid Tk. 3,000. His incomes from other sources are: Interest on Fixed deposit Tk. 30,000, Income from writing column in newspaper Tk. 500; Income from sale of forest timber Tk. 32,000; Income from dividend Tk. 57,000. He has one disabled child. Mr. Musfiqur Rahman made and incurred investments and expenses during the year: Life insurance premium Tk. 25,000 (policy value Tk. 150,000); Purchase of shares from IPO Tk. 25,000; Donation to educational and religious institutions Tk. 8,000; Donation to Zakat fund Tk. 35,500; Donation to local club Tk. 9,000; Purchase of ICB certificate Tk. 20,000 and Contribution to Group insurance Tk. 2,000. He also has purchased his academic books Tk. 10,000; a laptop-core i5 of ASUS brand Tk. 45,000; land Tk. 500,000 and a personal car of Tk. 1,500,000.

Step by Step Solution

★★★★★

3.32 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Total income Basic salary Arrear salary Interest from RPF Interest from tax exempt g...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started