Question

Eastern Broom Company manufactures, amongst other broom products, corn brooms. To make a corn broom, a worker begins the manufacturing process by selecting a bundle

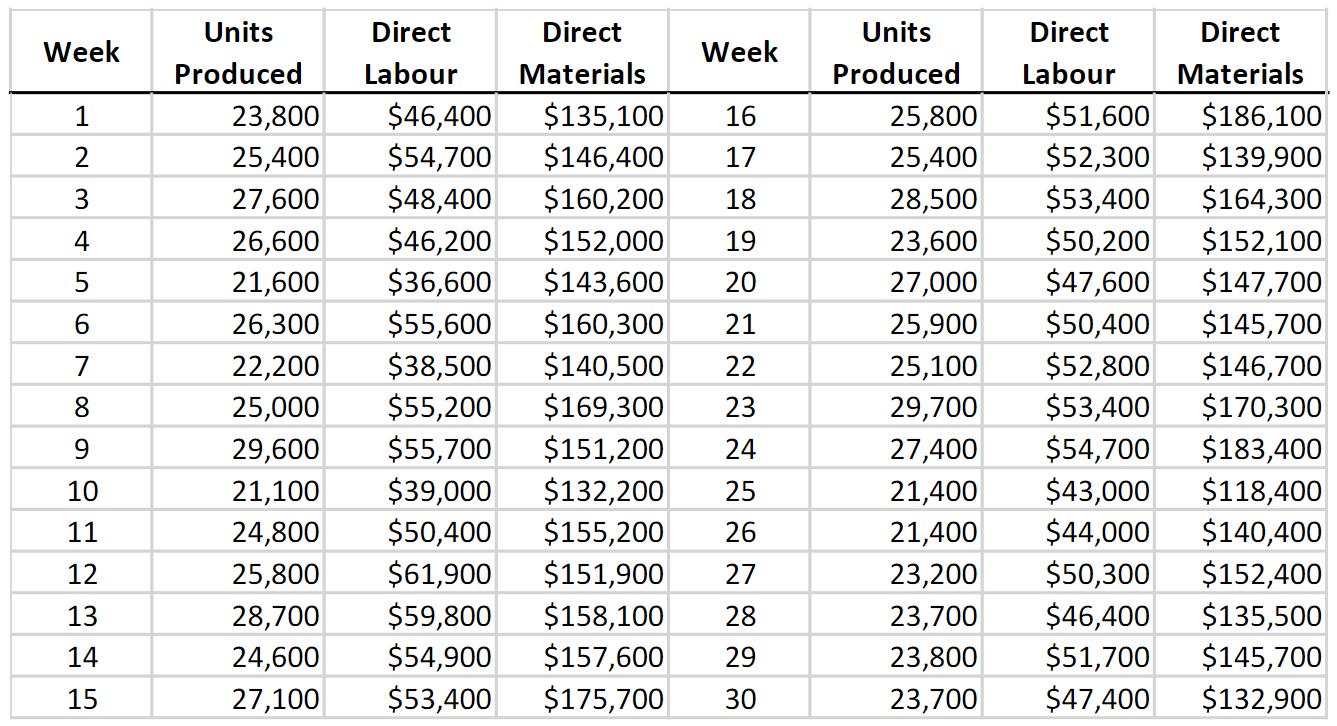

Eastern Broom Company manufactures, amongst other broom products, corn brooms. To make a corn broom, a worker begins the manufacturing process by selecting a bundle of straw, which is prepackaged by the supplier, and a broom handle. The worker puts both items into a machine and presses a button. The machine then binds the bundle of straw and the broom handle to complete production. A production worker, who is paid $40 per hour, can make 20 corn brooms each hour. Total production is limited by the number of labour hours available, which is 1,500. Eastern Broom Company sells its corn brooms for $28 each and is currently operating at capacity. Annual fixed costs assigned to the corn broom operation is $540,000. The production supervisor has provided data, which appears in the following chart, summarizing production volume, materials cost, and labour costs for the most recent 30 weeks of operations.

a. When operating at capacity, what after tax net income will Eastern Broom Company report?

b. The marketing manager believes that if the price per corn broom is increased to $30 demand will fall to 28,000 units. What is the effect on income of making this change?

c. A customer has approached Eastern Broom Company with a request to make and supply 1,000 units of a larger corn broom. This new product will require $8.40 of materials cost and 0.08 labour hours to produce. What is the floor (minimum) price Eastern Broom Company should be willing to accept for this new product?

Week 1 2 3 4 LO 5 6 7 8 10 11 12 13 14 15 Units Produced Direct Labour Direct Materials Week 23,800 $46,400 $135,100 16 25,400 $54,700 $146,400 17 27,600 $48,400 $160,200 18 26,600 $46,200 $152,000 19 21,600 $36,600 $143,600 20 26,300 $55,600 $160,300 21 22,200 $38,500 $140,500 22 25,000 $55,200 $169,300 23 29,600 $55,700 $151,200 24 21,100 $39,000 $132,200 25 24,800 $50,400 $155,200 26 25,800 $61,900 $151,900 27 28,700 $59,800 $158,100 28 24,600 $54,900 $157,600 29 27,100 $53,400 $175,700 30 Units Direct Produced Labour Direct Materials 25,800 $186,100 25,400 $139,900 28,500 $164,300 23,600 $50,200 $152,100 27,000 $47,600 25,900 $50,400 25,100 $52,800 29,700 $53,400 27,400 $54,700 21,400 $43,000 21,400 $44,000 23,200 $50,300 23,700 $46,400 23,800 $51,700 23,700 $47,400 $51,600 $52,300 $53,400 $147,700 $145,700 $146,700 $170,300 $183,400 $118,400 $140,400 $152,400 $135,500 $145,700 $132,900

Step by Step Solution

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started